In a press release today, Cardiome CEO Doug Janzen said “The decision was based on Merck’s assessment of the regulatory environment and projected development timeline.” The news sent shares of the Vancouver biotech tumbling, closing today down 54% to $.88 cents.

Byron Capital Healthcare Analyst Douglas Loe says Cardiome is now subject to “Sizable risk to entire oral program until Merck either returns development rights to Cardiome or financially reimburses Cardiome in some contractually-specified way, or until new co-development partners can be identified.” In a research update today, Loe slashed his twelve month target price on Cardiome to $1.25 from $8.50 and reduced the company from a Buy rating to a Hold.

___________________________________________________________________________________________________________________

This story is brought to you by Verisante (TSX:VRS). The Canadian Cancer Society named Verisante Core a Top 10 Cancer Breakthrough of 2011. Click here for more information.

____________________________________________________________________________________________________________________

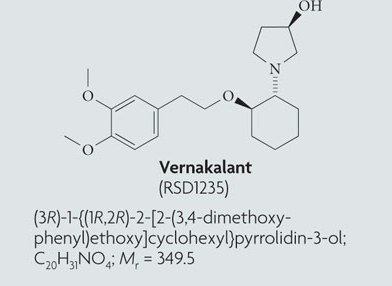

Cardiome, which was founded in 1986, came to public attention in April 2009, when it signed a deal with the US pharmaceutical giant and, soon after, reached an important phase 3 end point, which triggered a milestone payment of $50-million. But investors got jittery when, on October 21st 2010, a patient enrolled in the vernakalant trial experienced cardiogenic shock and the trial was suspended. Cardiome shares plunged but later recovered when Merck said it would move forward with clinical development.

Loe says there may be a small silver lining to the news as Merck’s pace on oral vernakalant has been “sluggish” and the move could pave the way for other specialty pharmaceutical partners. The clinical data on vernakalant, he notes, has been overwhelmingly positive. Loe suspects Merck may be passing due to regulatory and financial risk, perhaps believing that the required investment to get the drug through Phase 3 may not be worth it, something the Byron analyst disagrees with.

______________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment