Analyst Byron Berry: Poynt and Yelp aren’t so Different

In the public markets, the social media frenzy that will no doubt reach its pinnacle with the IPO of Facebook, rumoured to happen in May, hasn’t really spilled over to Canada.

The high profile IPOs of Zynga (NASD:ZNGA), the San Francisco-based creator of social network games like Farmville, as well as deal giant Groupon (NASD:GRPN), not to mention Pandora (NASD:P), and Linkedin (NASD:LNKD), have few Canuck peers. But Byron Capital tech analyst Byron Berry says there is one notable exception.

In reviewing the IPO paperwork for popular user review site Yelp, Berry says he is struck by the similarities between Poynt’s (TSXV:PYN) revenue growth profile today compared to Yelp’s in 2008, when the San Francisco based company raised $15 million at a rumored $200 million pre-money valuation.

_

This story is brought to you by Intertainment Media (TSXV:INT). Intertainment’s recently launched mobile platform, Ortsbo 2 Go, (O2Go), for the iPhone platform reached the position of the 3rd in the free Social Networking category just behind Facebook in the US Apple iTunes store. Click here for more information.

____

Berry says that while there is “substantial risk to investing in companies at this early stage” he also believes that if Poynt can continue its current rate of growth investors will own a company in an “…industry with very strong investment returns and valuations.”

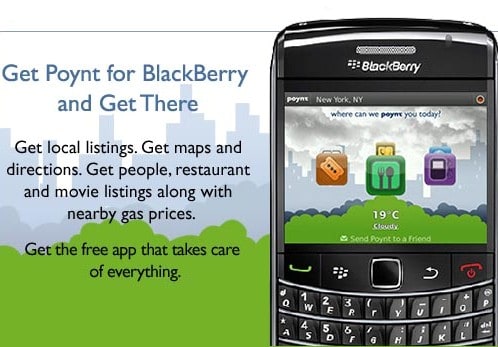

Poynt, a GPS enabled location-based search application has nearly twelve-million users, and has grown 158% in the past year alone. Shareholders would no doubt love to see a resurgence in the fortunes of the company which slipped to as low as a dime after trading as high as $.85 cents before the 2008 meltdown.

Poynt, the eponymous app, has been growing for years. CEO Andrew Osis, however, thinks several recent moves signal the beginning of a new era in the company’s history, one that will more closely align the fortunes of the stock with the fortunes of the app.

In November, Poynt brought on former Intuit Canada executive Yves Millette in the role of President. The company also added David Lucatch, CEO of Canada’s most heavily traded stock, Intertainment Media, to its board. Then, on December 1st, the company announced what Osis thinks is its seminal deal; Poynt will come preloaded on all Samsung Galaxy devices.

Berry has a $1.15 target on Poynt, which he rates as a Speculative Buy. Shares of the company closed today at $.13 cents.

_______________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.