Can Sprylogics and Intertainment Media revive and reinvent Poynt?

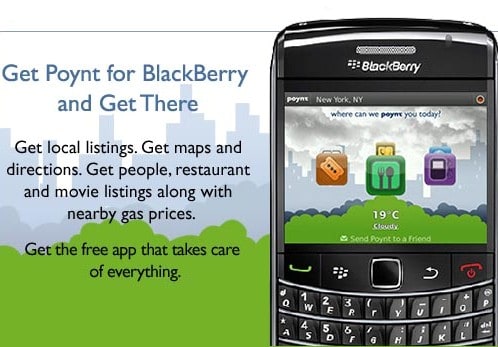

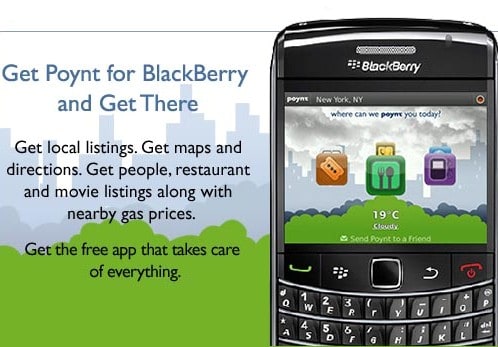

There it is, on your mobile phone, same as always. But since the Poynt went bankrupt last November it was an unsupported app; a zombie.

Now a small venture company, Sprylogics (Sprylogics Stock Quote, Chart, News: TSXV:SPY), is looking to revive the once wildly popular location-based search platform.

Sprylogics this morning announced it had signed a Letter of Intent to acquire Poynt by issuing issue a two year note for $2.5 Million and up to $500,000 in Sprylogics shares. The note comes with an annual interest rate of 6.5%.

Oh, and there’s another twist here too; Poynt is currently 50% owned by one-time high flier Intertainment Media (Intertainment Media Stock Quote, Chart, News: TSXV:INT), owing to the fact that Poynt owed that company money. Before bad became worse Poynt, it borrowed $1.5-million at an 8% interest rate and issued six million non-transferable bonus warrants to that company at a price of $.115 cents per share.

So can the two struggling juniors breathe some life into one of their fallen comrades? Sprylogics CEO Marvin Igelman thinks so.

“The current ownership group at Poynt has done an excellent job ensuring the continuous operations of the application through re-establishing key relationships and stability of the technology platform”, he said. “This provides us with an excellent foundation to exploit the explosive growth of mobile local search and mobile advertising that is happening. The market timing could not be better and the Sprylogics management and engineering team has the deep product and technical experience in mobile advertising and search to make it happen.”

After a brief time as a TSXV market darling, the fortunes of Poynt the company diverged from the fortunes of its eponymous app, which was a runaway success. Around the time the app was passing the sixteen million user mark, the company was reporting it had lost $20.47-million in fiscal 2011 on revenues of just $2.4-million.

Sprylogic’s tools, says the company, use proprietary algorithms and methodology to mine data in a way that hasn’t been done before. Through a reverse merger, the company went public midway through 2007 and, while things looked promising out of the gate, the largest recession in a generation effectively clipped the company’s chances. Shares of Sprylogics, which had traded as high as $.28 cents, fell to less than a penny and have since rebounded to the six cent mark.

Two years ago, Sprylogics set up a mobile team to be led by ex-BlackBerry mobile advertising exec Brad Marks and Bhavuk Kaul , who led product management for BlackBerry’s search and push service initiatives.

There’s no word on exactly the route Sprylogics will take with Poynt, but management believes its core technology can offer an improvement in mobile space by using machine learning and semantic technologies to “aggregate and rank opinions and sentiment on places, businesses and products using social signals, traditional on-line media and on-line.”

This, of course, sounds a lot like Yelp, which IPO’d on the NASDAQ last year at $15, and has doubled in the time since.

Today’s development is interesting because A simple mashup of Poynt’s, Sprylogic’s and Intertainment Media’s technologies does sound at least promising: take a popular location-based search platform, add opinion ranking and social signals, and make it available in any language, instantly, as INT’s Ortsbo does. Venture investors from the struggling but hyper-liquid stocks are hoping three’s a charm.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.