The Richmond, BC based aerospace giant’s Canadarm, a robotic space arm developed in the 1970′s to repair and service NASA space shuttles, is iconic.

With the Canadarm literally set to become history in the Canada Aviation and Space Museum in Ottawa, however, MDA has, in more recent times, been forced on the rocky road of reinvention. 2010’s revenue of $688 million was barely half of 2007’s.

But things are looking up for MDA, says analyst Byron Berry of Byron Capital Markets, who initiated coverage today on the company with a Strong Buy rating and a target price of $58.

Berry says that although MDA trades at what he calls a “slight premium” to industry peers such as Boeing, Lockheed Martin and Raytheon, it deserves this mark-up because its margins are improving, the company has a diversified customer base that depends less on government, and it has stable management that has a proven ability to execute. (For Cantech Letter’s recent chat with CFO Anil Wirasekara click here).

This year began with MDA getting back to its aerospace roots. The company sold its real-estate information business, which sold property information to insurance companies, lenders, and legal professionals to US private equity firm TGP Capital. The sale of the unit, which was once thought to be a key to the company’s growth gave MDA an $819 million shot in the arm it quickly put to use with dividends and share buybacks.

_________________________________________________________________________________________________________________

This story is brought to you by Cantech Letter sponsor Serenic (TSXV:SER). Serenic Corporation develops, markets and supports mission-critical fund accounting software solutions for not-for-profit organizations and government agencies. Click here for more information.

_________________________________________________________________________________________________________________

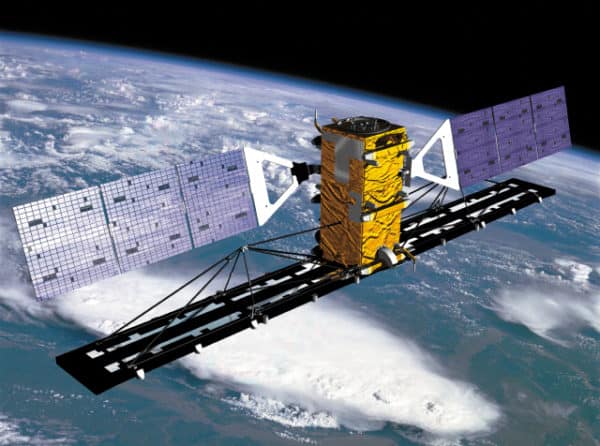

Today, MDA derives revenue from three business segments. Ground-Based Information Systems that receive and process signals from earth observation satellites account for approximately 40% of the company’s revenue. Berry points out that MDA has built the majority of the non-classified ground stations in the world, and that servicing and maintaining this large installed base generates revenue, as does building new units. Space-Based Information Systems, like RadarSat-2, have historically accounted for 30% of the company’s revenues, says Berry, but now make up approximately as much as Ground-Based Systems. The company’s smallest revenue source, Geospatial Services, generates about $35 million per quarter.

If we are to peg what MDA does into an umbrella category, says Berry, the company is squarely in the satellite information industry and that is , increasingly, a good place to be.

The Satellite Industry Association’s 2011 State of the Satellite Industry Report showed that Global 2010 revenues for the satellite industry totaled $168.1 billion, an 11.2 percent average annual industry growth rate over the past 5 years. The report noted that satellite services revenues passed the $100-billion for the first time, and that satellite ground equipment has doubled its revenues since 2006.

Shares of Macdonald Dettwiler closed Wednesday up $.32 cents to $48.27.

________________________________________________________________________________________________________________

About Byron Berry

Byron Berry focuses on generating unique investment strategy themes and ideas across a variety of investment sectors. Prior to joining Byron Capital, Berry had over 15 years of experience in securities analysis and investment banking. In 2004, he was a #1 ranked analyst in the “Software and Services” sector and he has also been successful as both a technology analyst and a business trust analyst. Byron was most recently at an advisory firm, creating proprietary investment and trading models and advising several technology companies on capital raising, M&A and corporate strategy. Prior to joining Byron Capital Markets, he worked for several investment dealers, both independent and bank-owned.

______________________________________________________________________________________________________

________________________________________________________________________________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment