Anil, shares of MDA have had a very strong run over the past couple years. It seems that shareholders increasingly embraced the changes going on at MDA. Can you tell us how MDA’s business has transitioned over the past several years?

MDA has been in the business of providing essential information solutions for over 40 years. Over the past 5 years we have greatly expanded our Surveillance business by expanding into UAV services as well as expanding our Geospatial business both to Defence and Civilian Agencies. We have also grown our services in the Communications business over the past 3 years with several large turnkey programs in Russia and the old Soviet Union. MDA also expanded into the Products Information Business between 2000 to 2010 until it was sold to TPG on January 4th 2010 for $850 million.

What kinds of businesses is MDA now involved in, or looking to get involved in that are new?

We’re still involved with all of the historical businesses that I just mentioned with the addition of our newly announced Orbit Satellite Services business.

What segments of MDA’s business is driving earnings growth?

MDA’s earning growth is driven by our very stable systems business and increasing our service business in UAVs, Geospatial and our expanding Communication business.

Why did MDA sell its property information business? Did you

consider this a “non-core” asset?

We believed it was an opportune time to divest ourselves of our Products business as we saw a prolonged recession in the Property Information market and felt it was time to crystallize on the opportunity and provide value for our shareholders.

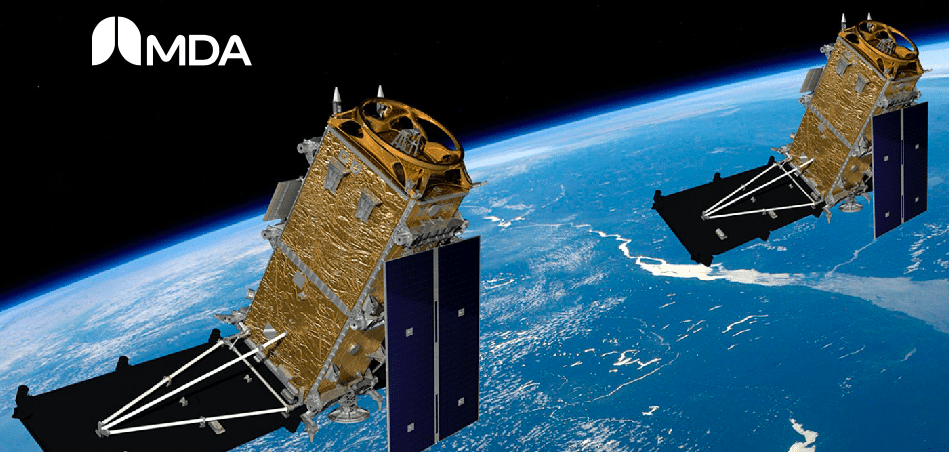

Can you tell us about MDA’s recent initiative with Intelsat to build a

space-based service vehicle?

MDA entered into an agreement with Intelsat as its anchor tenant for its Space Infrastructure Servicing (SIS) vehicle which could be in service by 2015. This would create a new commercial space segment for MDA.

MDA has a tremendous cash position. How does the company plan to employ this?

We plan to deploy the cash with M&A transactions or if unable to find an appropriate business we will return the cash to our shareholders. We plan to know this by the end of this summer.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment