MDA wins price target raise at BMO

Following the company’s third quarter results, BMO analyst Thanos Moschopoulos has raised his target on MDA (MDA Stock Quote, Chart, News, Analysts, Financials TSX:MDA), though the analyst doesn’t see much upside to the stock.

On November 8, MDA reported its Q3, 2023 results. The company posted EBITDA of $42.8-million on revenue of $204.7-million, a topline that was up 19 per cent over the same period a year prior.

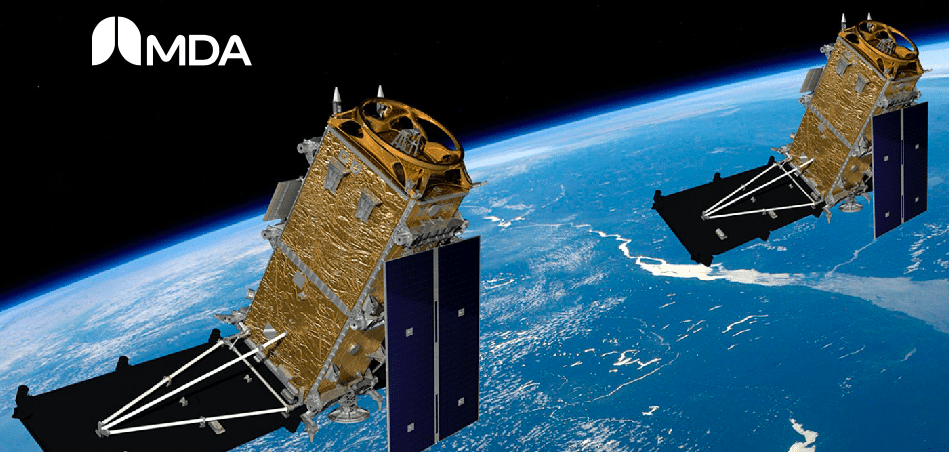

“MDA delivered another solid quarter in Q3 showcasing the team’s continued strong execution and the momentum we are seeing in our business and end markets,” said CEO Mike Greenley. “We continue to focus on our growth strategy and growing our book of business. In Q3, we announced that MDA was awarded a $2.1-billion contract from Telesat to act as the prime satellite contractor on the Telesat Lightspeed LEO constellation; this is our second prime satellite contract in 18 months and a testament to MDA’s innovative technology and advanced manufacturing capabilities in this market. We also recently closed our acquisition of the digital payload division of SatixFy Communications, announced in Q3, as we continue to invest in our digital satellite technology and talent to maximize our market opportunity. Additionally, we are on pace with the development of Chorus, our next-generation Earth observation constellation. Elements of Chorus are now in production at our Montreal facility and we recently announced the selection of SpaceX as our launch partner with a confirmed launch window of Q4 2025.”

As reported by the Globe and Mail, Moschopoulos has raised his twelve-month price target on MDA to $13 from $12, although the analyst stuck with his “Market Perform” rating on the stock.

“We remain Market Perform on MDA and have made minor changes to our FY2024 estimates following strong Q3/23 results,” he said. “MDA has been executing well in recent quarters, from both a project delivery and bookings perspective, and management continues to see a strong pipeline of opportunities. The capex cycle related to Chorus (slated for a Q4/25 launch) keeps us on the sidelines. However, we believe that MDA should be able to sustain strong revenue/EBITDA growth through the medium term given its backlog and pipeline, and view the stock’s valuation as undemanding.”

Shares of MDA closed November 8 up 3.39 per cent to $12.20.

Staff

Writer