Another year, and another year of mining stock successes on the Toronto Stock Exchange. It seems like decades since a technology stock really made a difference to the index, and 2010 was not the year to break that pattern. In fact, only one technology related issue cracked the top thirty five performing stocks on the Toronto Stock Exchange this past year. Amongst names like Spartan Exploration, Cline Mining, Intrepid Mines and South American Silver, Mississauga’s 01 Communique was a respectable 685% gainer in 2010. But it’s a long way down the list to the second best performing tech, Electrovaya. In all, there were fifteen stocks listed on the TSX Technology, Cleantech or Life Sciences sectors that doubled in 2010. We count them down here.

1. 01 Communique (TSX:ONE)

December 31st, 2009: $.21

December 31st, 2010: $1.65

Gain: 685.7%

It was a wild year for Mississauga’s 01 Communique. On July 5th, their thinly traded stock was mired in a two year slump, closing at $.175 cents. But on July 8th, the company, whose products, such as the I’m InTouch line, give you the ability to access and control your desktop personal computer from anywhere you are connected to the Internet, was declared the victor in patent litigation suit against giant Citrix Systems. On July 19th, shares of 01 Communique closed at $1.59, and over three million shares changed hands. Click here for Cantech Letter’s interview with Andrew Cheung, President and CEO of 01 Communique (TSX:ONE).

2. Electrovaya (TSX:EFL)

December 31st, 2009: $.83

December 31st, 2010: $2.78

Gain 234.9%

What was behind Electrovaya’s rise in 2010? The long answer is a more than a decade’s worth of pioneering work and 150 patents on its lithium ion battery technology. The short answer is Chrysler. On March 24, Electrovaya announced that it had been selected by Chrysler to supply the battery for a hybrid version of the Dodge Ram pickup. Click here for Cantech Letter’s interview with Electrovaya President and CEO, Sankar Das Gupta.

3. Tembec (TSX:TMB)

December 31st, 2009: $1.28

December 31st, 2010: $4.28

Gain 234.4%

Tembec, a Quebec based forestry company that is part of the TSX’s Cleantech index, improved its balance sheet with the sale of two of its French pulp mills and benefited from rising global pulp prices.

4. Bioniche Life Sciences (TSX:BNC)

December 31st, 2009: $.56

December 31st, 2010: $1.50

Gain 167.9%

For years, Belleville, Ontario’s Bioniche Life Sciences (TSX:BNC) was better known to your veterinarian than your doctor. Bioniche, which formed in 1979 to develop veterinary bio pharmaceutical products, received worldwide attention two year ago when it received a Canadian license for Econiche, the world’s first cattle vaccine against E. coli. Bioniche’s animal health products sales have been slipping of late, but many investors aren’t too worried. As it turns out the company’s move into human health may be much more lucrative.

In the early 90’s Bioniche established a human health division, and the results of this venture are now, finally, paying off. Since late 2009 shares of Bioniche have rallied from just over $.40 cents to a recent high of $1.80 on October 15th. The reason? Urocidin. Urocidin is a product Bioniche is developing to treat non-muscle-invasive bladder cancer that doesn’t respond to current first-line therapy.

5. Mad Catz Interactive (TSX:MCZ)

December 31st, 2009: $.37

December 31st, 2010: $.98

Gain 164.8%

If you don’t know Mad Catz, ask your kids. The Company designs and markets accessories for video game systems. Mad Catz has teamed up with Fender to make a wooden replica of the Fender Stratocaster for Harmonix’s Rock Band series of games, has made a special themed controller for Call of Duty: Modern Warfare 2 on the XBox and Playstation 3, and worked with Capcom to produce FightSticks and FightPads for Street Fighter IV. In early November, after the company generated record second quarter net sales of $37.4-million, a 73.2-per-cent increase from $21.6-million in the prior-year, shares of Mad Catz took off.

6. McCoy Corporation (TSX:MCB)

December 31st, 2009: $1.44

December 31st, 2010: $3.70

Gain 156.9%

Shares of Edmonton’s McCoy, which provides technologies for the oil and gas sector, rose sharply after the company reported Q2 revenue of $30.4-million, an increase of 30 per cent compared with revenues of $23.3-million for the second quarter of 2009.

7. Craig Wireless (TSX:CWG)

December 31st, 2009: $.21

December 31st, 2010: $.52

Gain 147.6%

Craig took off in March after it was announced that The Company was selling one quarter of its wireless spectrum licenses for $80-million to Inukshuk Wireless Partnership, a joint venture owned by Rogers Communications and BCE.

8. Oncolytics Biotech (TSE:ONC)

December 31st, 2009: $2.75

December 31st, 2010: $6.73

Gain 144.7%

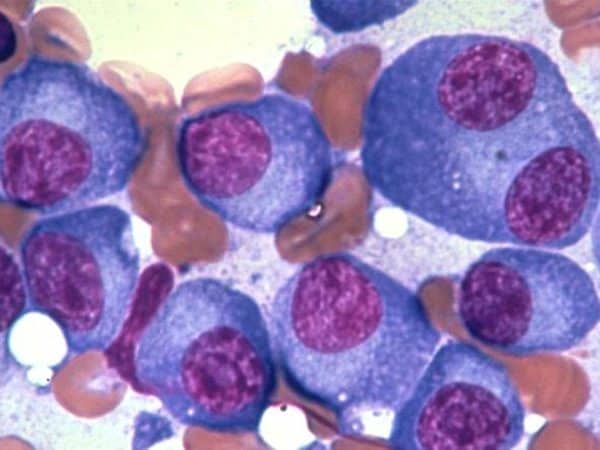

Calgary’s Oncolytics Biotech grew out of discoveries made in the 1990’s in the Department of Microbiology and Infectious Diseases at the University of Calgary. The Company’s Reolysin, a formulation of reovirus, a family of viruses that can affect the gastrointestinal system and have shown to have oncolytic, or cancer killing properties, is about to enter Phase 3 trials. Recently Cantech Letter talked to Brad Thompson, the company’s President and CEO.

9. Wi-LAN (TSX:WIN)

December 31st, 2009: $2.63

December 31st, 2010: $6.40

Gain 143.3%

“Introducing inventions with mass appeal to the world.” That slogan is the way that Ottawa’s Wi-LAN, which holds a roster of patents covering everything from Bluetooth technology to WiMAX base stations to routers, sees itself. If certain people, and by certain people we mean people like Judge T. John Ward of the U.S. District Court for the Eastern District of Texas, who is presiding over Wi-LAN’s patent infringement litigations against giants such as Apple, Dell, Intel, Hewlett-Packard, LG and Broadcom, see things the same way, then the eighteen year old Wi-LAN will almost certainly earn mass appeal with investors. While success in the courtroom will mean a major splash for Wi-LAN, the company has had increasing success deriving revenue from licensing deals; more than 200 worldwide. It’s unlikely however, we have seen the last of Wi-LAN lawyers in US courtrooms as the Canadian junior has a impressive portfolio of more than eight hundred patents to defend. Shares of Wi-LAN finished 2010 in particularly strong fashion, after settling a patent claim with LG Electronics.

10. DALSA (TSX:DSA)

December 31st, 2009: $7.62

December 31st, 2010: $18.18

Gain 139%

Shareholders of Waterloo’s DALSA, a tech triangle mainstay that had manufactured specialized digital cameras and semiconductors since 1980, unwrapped an early Christmas gift on December 22nd, when the company announced it would be acquired for Teledyne Technologies for $18.25 a share, nearly four dollars more than it had traded for the day before.

11. Cipher Pharmaceuticals (TSX:DND)

December 31st, 2009: $.54

December 31st, 2010: $1.20

Gain 122.2%

Mississauga’s Cipher, which is focused on drug delivery technologies, rose in the first few days of 2010 and held onto the gain throughout the year. On January 4th, Cipher receive a favorable result in a patent lawsuit for its extended-release Tramadol product, which is designed to treat moderate to moderately severe chronic pain in adults.

12. Sandvine Corporation (TSE:SVC)

December 31st, 2009: $.1.29

December 31st, 2010: $2.81

Gain 117.8%

When Sandvine President and CEO Dave Caputo picks up a newspaper these days it must be hard to stop smiling. Two contentious, consumer-related technology issues keep landing on editorial pages, and his company is in the sweet spot for both.

The first has to do with what the FCC calls “Bill Shock”. It’s estimated that thirty million Americans have experienced a bill more than $50 larger than what they anticipated, but were not alerted to beforehand. Under new rules the FCC is proposing, consumers would have access to simple alerts and easy to find tools to manage their accounts better. It would also “…require wireless phone companies to obtain customer consent before charging for services that are not covered by their regular monthly service plan.”

Northern Securities analyst Sameet Kanada believes these measures are good news for Sandvine, because tools the Waterloo based company has been building for years address these very issues.

The other issue can be described with a host of technical terms like buffer overflow, stateful packet inspection or deep-packet inspection. Or it could be described with just one: Netflix. The growth of Netflix is bringing debate about bandwidth management to a head. The issue? Netflix uses a ton of bandwidth, and that supply is not unlimited. And since Netflix has transitioned from a mail order business model to a primarily online one, it has had a staggering impact on bandwidth usage. One report estimates that Netflix now accounts for twenty per cent of peak bandwidth use.

13. Pareto (TSE:PTO)

December 31st, 2009: $1.10

December 31st, 2010: $2.35

Gain 113.7%

Toronto’s Pareto, which provides marketing solutions to major retailers continued its 2009 momentum into 2010. In Cantech Letter’s September survey of dividend paying Canadian tech stocks, Pareto finished on top, with a 5.45% yield.

14. Zarlink Semiconductor (TSE:ZL)

December 31st, 2009: $.89

December 31st, 2010: $1.83

Gain 105.6%

Ottawa’s Zarlink has been around for quite some time, but has subtly shifted focus of late, entering more specialized markets that leverage expertise the company has gained over three decades. Like most Ottawa based telecom companies, you don’t have to go looking too far for Terry Matthews fingerprints on The Company. Zarlink was born out of the telecommunications division of Mitel, its name derived from the phrase “tsar of links” reflected its early history in networking equipment.

Recent acquisitions and joint ventures illustrate Zarlink’s move away from general chip business and into more specialized business, in particular businesses that leverage the company’s leadership position in low-voltage technology. Situations where low power requirements are important is Zarlink’s wheelhouse, and those seem to be everywhere now, including specialized items to medical devices, devices used in smart phones and in the companys’ most recent venture -a deal with CADEKA Microcircuits to tackle the CCTV and video surveillance market. Zarlink posted its gains early in 2010, as Q1 and Q2 numbers exceeded expectations.

15. AEterna Zentaris (TSX:AEZ)

December 31st, 2009: $.85

December 31st, 2010: $1.72

Gain 102.4%

Early this year, things weren’t looking that great for Quebec City’s AEterna Zentaris (TSX:AEZ). On January 21st, the company received notification from the NASDAQ that they didn’t comply with the exchange’s minimum bid price requirements. Shares of AEterna, an oncology and endocrine therapy drug development company with a Phase 3 cancer therapy candidate, Perifosine, had been slipping for years. Despite the fact that AEterna is also listed on the TSX, a delisting of its shares from NASDAQ might have seriously affected the company’s ability to raise capital at a critical time. To the great relief of it’s shareholders, management, led by President and CEO Jürgen Engel, steered AEZ out of its storm. The Company has raised $25 million in the nine months ended September 30th, mostly through two registered direct offerings in April and June. With $40 million in Cash and Short Term Investments, AEZ management anticipates it now has the working capital to make it to commercialization with Perifosine.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment