The editors of Cantech Letter don’t have access to a time machine. And, as far as we know neither do the editors of Computerworld, The Gartner Group, CNET, or Duncan Stewart from Deloitte and Touche, who just hosted that company’s 10th annual “Predictions” event on a cross Canada tour. We do, however, put some faith in the power of the collective. The aforementioned organizations, together with the commonalities in the countless lists we perused for this story might at least give us a sense of what kind of year 2011 might be, technology wise. The five predictions we review below weren’t on every list, but they did pop up across a variety of publications. Cantech Letter reviews Five Hot Tech Trends for 2011 and, because it’s kind of what we do, we check in on the Canadian technology stocks that stand to benefit from these trends.

1. Mobile Security

Canadian Tech Stocks to Watch: RIM, Open Text, Diversinet

WikiLeaks. Julian Assange’s guerrilla style news corps had its proverbial fifteen minutes of fame in 2010. Some are no doubt hoping that the organization’s profile fades with the vuvuzela and other 2010 annoyances, but the issues it brought up may have staying power in 2011. Wikileaks has a whole lot of people with a whole lot to lose paranoid about their data. Move that data around on various networks, through various countries and various devices and the paranoia rises. Is your iPhone secure? Would you bet your company on it? Many are betting that 2011 may be the year you hear less about Angry Birds and hear more about encryption.

This past year, Waterloo’s Open Text released social networking tools that offer what the company calls “enterprise-strength security controls.” If Open Text is beta testing their enterprise security tools, they aren’t messing around. For the first time ever, the company recently announced, “social media tools had been used at a G-20 to help participants work together during the forum. ” According to Open Text “G-20 organizers avoided use of consumer-grade social media tools, which lack enterprise-strength security controls. At the same time, social media offers better ways for people to connect, share and collaborate, than email, so a solution that combined the benefits while reducing the risks was needed.” Research in Motion‘s history of making secure devices is part of the Waterloo tech giant’s legacy. The company would presumably benefit from heightened awareness of security. A recent poll showed that 9140 out of USA House of Representatives 9226 staff use Blackberrys, and only 86 use iPhones. Of course, everyday citizens also have data that needs to be protected. Toronto’s Diversinet provides authentication solutions to protect personal health information, supporting all major mobile platforms.

2. Cloud Computing

Canadian Stocks to Watch: CGI Group, Peer 1 Enterprises

Cloud computing? Wait, wasn’t that last year? Or the year before? As 2010 closed Cloud Computing seemed to be controversial, misunderstood, or both. It was the only tech trend that was listed as both important and as overhyped in ComputerWorld’s 2011 forecast. So what is cloud computing? Some say the concept may be as hard to pin down as the ubiquitous Web 2.0 was, but essentially it means that software and hardware services are hosted on the internet, rather than hosted physically. The “cloud” is the internet. Many feel 2011 is the year cloud computing moves mainstream, which is basically code for adopted by more Fortune 500 companies. Sure Facebook and YouTube are in the cloud, but more scalable storage and vastly improved security mean its adoption is ready for its corporate closeup. Canada’s largest IT stock, CGI Group launched a cloud based initiative in October of 2010 and immediately won a contract with the U.S. General Services Administration. Regarding that contract, George Schindler, President, CGI Federal, a US based subsidiary of CGI said “It is no longer a question of whether a federal agency will use cloud computing, it is a question of how they can maximize its promise and integrate it into their current environment.” Vancouver’s Peer 1 Enterprises had had recent success with the launch of its Managed Private Cloud services, a sub sector that is starting to gain traction quickly in the US.

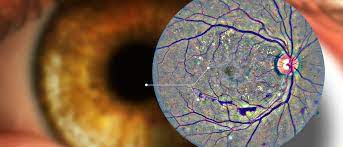

3. Context-Aware Computing

Canadian Stocks to Watch: Angoss Software, Diagnos, Cyberplex

Perhaps the most controversial of all the up and coming trends, Context-aware computing centers on the concept of using information about an consumer’s activities and preferences to improve the quality of interaction with that end user. Sound like spying? Well some believe the extreme ends of this practice are exactly that. Last year Apple was sued over the privacy of its apps, including the Weather Channel and Dictionary.com apps because it was alleged they allowed ad networks to track a user’s activity. Wasn’t Big Brother on the other guy’s side? Lawsuits aside, these practices probably aren’t going away, Gartner predicts that by 2013, more than half of Fortune 500 companies will have context-aware computing initiatives and by 2016, one-third of worldwide mobile consumer marketing will be context-awareness-based. Companies in this space will no doubt have to become increasingly more transparent and innovative with the mountains of data available to them. Toronto’s Angoss Software makes powerful predictive analytics software the company says helps “clients discover the patterns in their own data, predict the impacts of their marketing, sales and risk strategies, and act on this insight by helping them create actionable, predictive rules..” None of the the messy spying business, all of the results. Similarly Brossard, Québec based DIAGNOS has developed MCubiX, a data mining software suite capable of extracting knowledge from historical data. The company has won business in the health care and mining business. Toronto’s Cyberplex uses its more than 300 web properties to deliver targeted traffic to customers such as Jaguar, who saw an increase in the number of test drives after a Cyberplex campaign.

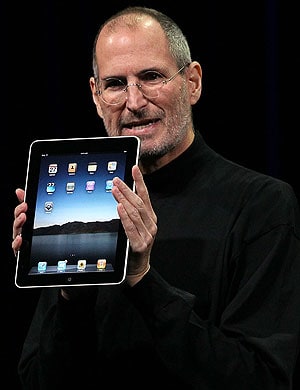

4. Tablet Wars

Canadian Stocks to Watch: Research in Motion, Intrinsyc Software

Apple didn’t invent the tablet, but they did, practically, invent the space. The iPad was a success straight out of the gate; Apple sold three million of them in the eighty days after it was released. In November, according to research firm Strategy Analytics, it was estimated that Apple owned 95% of the tablet market.

Attendees of this year’s CES in Vegas, where dozens of tablets were debuted, know the space will fragment at least somewhat. Motorola’s Xoom and BlackBerry’s Playbook were big hits at the show. But how large is the tablet space? This year Deloitte predicts that more than half the computing devices sold this year won’t be personal computers.

Some analysts think the new tablets are too late to the game. Steven Fox, of Crédit Agricole Securities, for instance, notes that Apple will have sold some 17 million iPads by the time RIM’s PlayBook hits the market. Others believe there is still time. Jon Chase of Switched thinks the idea that Apple will continue to dominate because of its first mover advantage is ridiculous. He points out that “Samsung’s Galaxy Tab has already sold over a million units worldwide in just a few months, – despite predictions to the contrary from naysayers all over.” Many believe the space will fragment and specialize. The UK rollout of BlackBerry’s Playbook in April will be targeted at business users. Vancouver’s Intrinsyc Software, which has designed mobile handsets and embedded devices, recently signed a deal with ASRT Corp. to develop a tablet device for the education market in Asia.

5. 4G

Canadian Stocks to Watch: Dragonwave, Bridgewater Systems, Sandvine

If 4G, which stands for the fourth generation of cellular wireless standards, seems like it is coming straight on the heels of 3G there’s a reason. And that reason is you live in Canada. The first 3G network in the world was established in Japan in 2001. But 3G didn’t come to Canada until late 2005. 1G cellular standards were established in the early 1980’s and a new generation of has replaced the old every decade or so. 4G will, like 3G did, offer better data rates and security. But in their Analysis of Top Telecommunications Themes and Trends for 2011, Deloitte speculate that “(3G) networks will continue to be the dominant wireless networking platform of choice throughout 2011 even as fourth-generation (4G) networks begin to proliferate in the market and demand for faster mobile data upload and download speeds continues to increase.”

So the day when it doesn’t take an hour to download a movie is already here in South Korea, around the bend in the United States, as most major carrier roll out 4G networks, and in Canada, we’ll have to be patient as usual. In the meantime, there is a cluster of Ontario companies benefiting from the buildout elsewhere. Ottawa’s DragonWave provides wireless microwave transmission systems for internet protocol networks. These products that enable the rollout of broadband voice, video and data. Bridgewater Systems and Sandvine make software that help large carriers manage increased network traffic.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment