Max Resource Appoints Technical Member

Vancouver, British Columbia–(Newsfile Corp. – February 4, 2026) – MAX RESOURCE CORP. (TSXV: MAX) (OTC Pink: MXROF) (FSE: M1D2) (“Max” or the “Company”) is pleased to announce that Scott Franko has joined the Advisory Board as a technical member.

Mr. Franko is an Ontario registered Professional Geoscientist with almost 40 years of domestic and international experience in base and precious metals and critical metals, both in exploration and mine settings. Most importantly, is the 4 years in managing projects in Colombia in particular, Max’s current Mora Gold Silver Property (KK6-08031).

Highlight channel cuts from 2012 exploration conducted by Mr. Franko and 2025 exploration (refer to Figure 1 and Table 2):

- 45.0 g/t gold and 7,110 g/t silver over 1.0m (1) – 2012

- 27.0 g/t gold and 732 g/t silver over 1.0m (2) – 2012

- 43.0 g/t gold and 187 g/t silver over 1.0m (3) -2012

- 36.7 g/t gold (silver N/A) over 2.0m (4) – 2012

- 8.9 g/t gold and 75 g/t silver over 1.5m (5) – 2012

- 21.0 g/t gold and 156 g/t silver over 1.0m (6) – 2025

“I’m honoured to be appointed to the Advisory Board. The exploration my team conducted in 2012 led me to the conclusion the Marmato deposit is part of a much larger mineralized system that undoubtably continues across the Mora property (KK6-08031). At the time, Gran Colombia stated that the Marmato deposit is open and continues at depth and to the southwest and to the south, both areas cross the Mora Property,” comments Max Technical Adviser, Scott Franco.

“We are extremely pleased to welcome Mr. Scott Franko to the Max Advisory Board. His experience exploring the Mora property will be of significant benefit as the Company advances exploration and the PTO (Mines Operations Plan) with the prime objective of drilling,” commented Max CEO, Brett Matich.

“Collective Mining’s Guayabales continues to move closer with the first drill hole at the X Target, located adjacent to the northern border, intersecting 12.85m at 503 g/t silver equivalent. Adjoining along the eastern border, Aris Mining reports Marmato upgrade target of 200,000 ounces p/year starting Q4, 2026, highlighting the prospectivity of Mora,” he concluded.

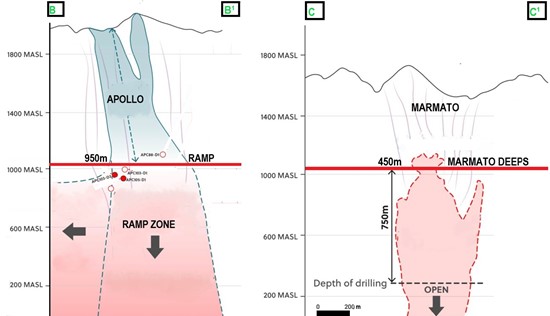

Figure 1: NAN : Section B B¹ “Apollo-Ramp” and Section C C¹ “Marmato Deeps” refer to Figure 3 and 4. Source: https://aris-mining.com/operation/reserves-and-resources/ Source: www.collectivemining.com

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/282632_26140964a45228ce_001full.jpg

Figure 2: Section B B¹ Ramp Zone (950m below surface) compared to Section C C¹ Marmato Deeps (450m below surface) Important Notation: Surface level of BX and BQ similar to Marmato and NAN approximately 500m lower

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/282632_max%20figure%202.jpg

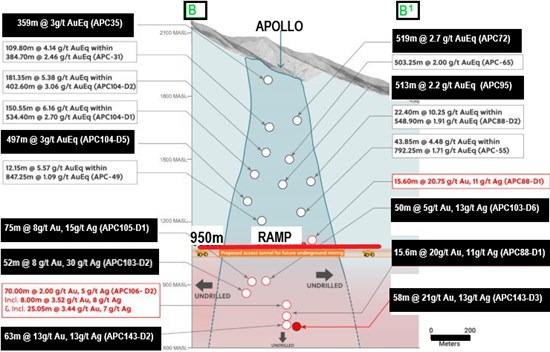

Figure 3: Ramp high-grade intersections and similar for Marmato Deeps

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/282632_26140964a45228ce_004full.jpg

Max advises investors that the gold mineralization at Marmato or Guayabales may not necessarily by indicative of similar mineralization at the Mora. Max further advises the QP has been unable to verify the information on Marmato that the information is not necessarily indicative to the mineralization on the Mora.

Figure 4: Mora Property is located along the productive Middle Cauca Gold Belt

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/282632_26140964a45228ce_005full.jpg

| Name | Highlights | Reference |

| La Mina | Resource: 33.77Mt at 1.06 g/t AuEq. For 1.15MozsEq. | https://goldmining.com/projects/colombia/la-mina-project/ |

| Titiribi | M. Resource: 85Mt at 1.06g/t AuEq. For 1.69MozEq. | https://www.goldmining.com/projects/colombia/titiribi-project/ |

| I. Resource: 349Mt at 0.55g/t AuEq. For 6.2MozEq. | ||

| Miraflora | M & I Resource: 6.1Mt at 2.62g/t Au For 0.51Moz | https://tigergoldco.com/quinchia-project/ |

| Gramalote | I. Resource: 192.7Mt at 0.68g/t Au For 4.2Moz | https://www.b2gold.com/operations-projects/overview/default.aspx#probable |

| Sergovia | P&P Reserve: 4.367Mt at 10.7 g/t Au for 1.5Mozs | https://aris-mining.com/operation/reserves-and-resources/ |

| M&I Resources: 7.4Mt at 15.3g/t Au for 3.626Mozs | ||

| La Colosa | I. Resource: 821.67Mt at 0.85g/t Au for 22.5Mozs | https://portergeo.com.au/database/mineinfo.php?mineid=mn1441 |

| I. Resource: 242.51Mt at 0.78g/t Au for 6.09Mozs | ||

| Nuevo Chaquiro |

I. Resource: 604.5Mt at 0.65%Cu, 0.32 g/t Ag, 116ppm Mo and 0.32g/t Au for 6.1Mozs |

https://portergeo.com.au/database/mineinfo.php?mineid=mn1501 |

| Marmato Deposit |

P&P Reserve: 31.28Mt at 3.16 g/t Au for 3.178Mozs | https://aris-mining.com/operation/reserves-and-resources/ |

| M&I Resource: 61.50Mt at 3.03 g/t Au for 5.997Mozs | ||

| Inferred Resource: 35.60Mt at 2.43 g/t Au for 2.787Mozs | ||

| Buriticá | P&P Reserve: 3.8Mozs at 6.9g/t Au&13Mozs at 24g/t Ag in 15.61Mt |

https://www.zijinmining.com/global/program-detail-71741.htm |

| M&I Resource: 4.4Mozs at 8.9g/t Au&14.6Mozs at 29g/t in 14.02Mt | ||

| Inf. Resource: 5.1Mozs at 8.9g/t Au&18Mozs at 29g/t Ag in 16.2Mt |

Table 1: Breakdown of the +60M oz gold total from Figure 4

| Gold | Silver | Channel | UTM | ID |

| 45.0 g/t | 7,110 g/t | 1.0 metre | 432432E/604753N | (1) 2012 |

| 27.0 g/t | 732 g/t | 2.0 metre | 432445E/604726N | (2) 2012 |

| 43.0 g/t | 187 g/t | 1.0 metre | 430940E/604972N | (3) 2012 |

| 36.7g/t | 2.0 metre | 431876E/604452N | (4) 2012 | |

| 8.9 g/t | 75 g/t | 1.0 metre | 431090E/6027832N | (5) 2012 |

| 21.0 g/t | 156 g/t | 1.5 metre | 435336E/603379N | (6) 2025 |

Table 2: 2012 channel cuts (1 to 5) and 2025 chip channel at the NAN

Quality Assurance

Max adheres to a strict QA/QC program for sample handling, sampling, sample transportation and analyses. All 21 rock samples were taken by the Max consulting geologist, labelled, placed in sealed, securitized bags and shipped to ALS Lab’s sample preparation facility in Medellin, Columbia. ALS Medellin is an ISO 9001: 2008 certified facility and is independent of Max. All samples were analyzed using ALS procedure ME-ICP61, a four-acid digestion with inductively coupled plasma finished. Over-limit gold is determined by ALS procedure Au-GRA21 a 30 gram fire assay with a gravimetric finish. Over-limit silver, lead, arsenic and zinc were determined by ALS procedure OG-62, a four-acid digestion with an atomic absorption spectroscopy finish.

At this early stage of exploration, Max relied on the QA/QC protocol’s employed by ALS.

Qualified Person

The Company’s disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P.Geo (British Columbia), a member of the Max Resource advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

About Max Resource Corp.

Max Resource is a mineral exploration company focused on copper and precious metals assets in Colombia and exploration development of a high purity iron project in Brazil.

- Mora Gold Silver in Colombia, encompasses over 40 historic, 5 active mines, a series of exposed polymetallic structures over 2,500m by 1,000m surrounded by Collective Mining’s (TSX: CNL) (NYSE: CNL) Guayabales project and Aris Mining’s (TSX: ARIS) (NYSE: ARMN) Marmato gold operations.

- Sierra Azul Copper Silver in Colombia, sits along the Colombian portion of the world’s largest producing copper belt (Andean belt), with world-class infrastructure and the presence of global majors (Glencore and Chevron). Fully funded by global miner Freeport-McMoRan (NYSE: FCX) relating to rights to earn up to 80% by funding $50 million of accumulated expenditures. Backed by support of Freeport-McMoRan the team views as validation of the geological and mining potential of Serra Azul. The 2026 exploration season is well underway.

- Florália High Purity Iron Project in Brazil, lies adjacent to the largest iron ore mines in Minas Gerais, Brazil’s largest iron ore and steel producing State. Exploration Target of 50-70Mt at 55%-61% Fe. Fully funded through an option to purchase by Bolt Metals Corp (CSE: BOLT) issuing an aggregate of 32.3m shares. Bolt is in process of closing financing. The transaction is subject to satisfactory applicable regulatory approvals.

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the geological target being delineated as a mineral resource. Hematite mineralization tonnage potential estimation is based on in situ high-grade outcrops and interpreted and modelled magnetic anomalies. Density value used for the estimate is 2.8t/m³. Hematite sample grades range between 55-61% Fe. The 58 channel samples were collected for chemical analysis from in situ outcrops in previously mined slopes of industrial materials.

For more information, visit on Max Resource: https://www.maxresource.com/

For additional information, contact: Tim McNulty E: info@maxresource.com T: (604) 290-8100 Brett Matich T: (604) 484 1230

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company’s control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein.

The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which filings are available at www.sedarplus.ca.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282632