This Canadian smallcap should be on your radar, analyst says

Haywood Capital Markets analyst Gianluca Tucci said MineHub Technologies strengthened its balance sheet and clarified its growth narrative heading into 2026 after closing an upsized $7.2-million private placement.

The financing, priced at $0.95 per unit, consisted of one common share and one-half warrant exercisable at $1.35 for 24 months. Net proceeds of roughly $6.7-million provide additional runway and remove near-term liquidity concerns, Tucci said on Dec. 12, allowing the company to focus on execution without immediate dilution risk.

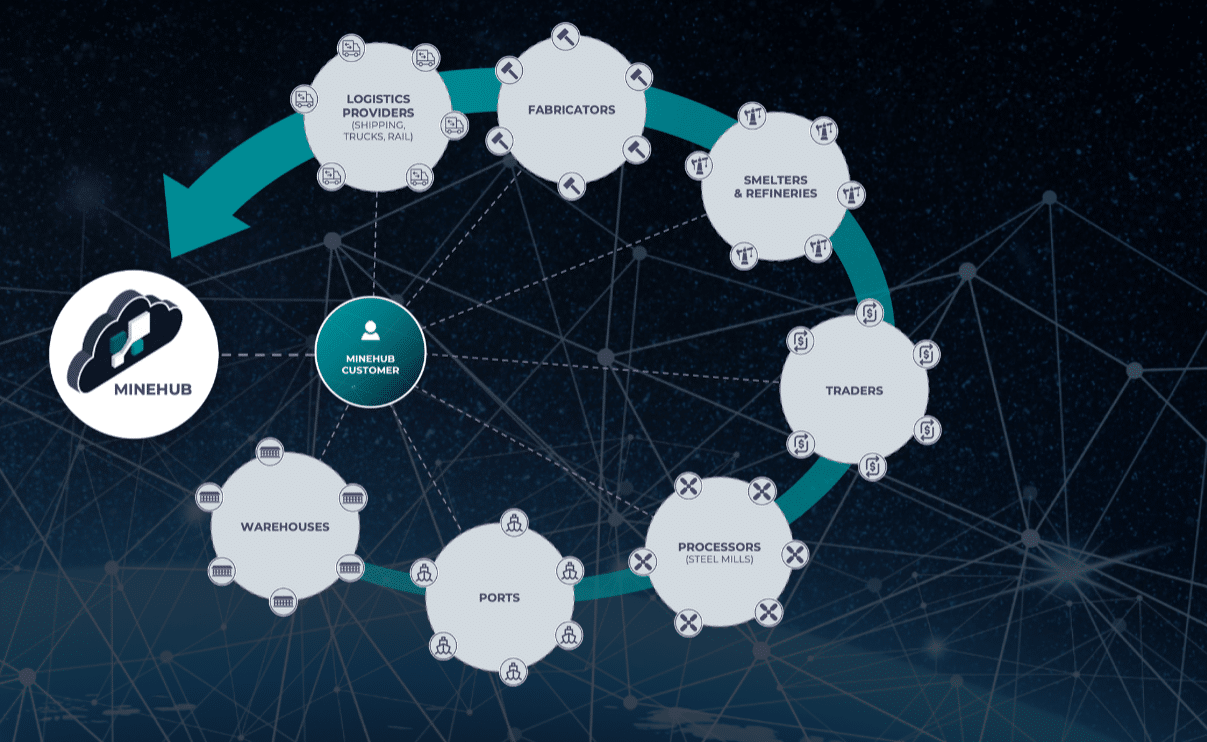

Tucci noted that MineHub’s investment thesis has evolved meaningfully, shifting from digitizing commodity paperwork to orchestrating liquidity, visibility and settlement across the roughly $11-trillion global commodities market. The platform now supports more than $14.7-billion in gross merchandise value, with recurring revenue replacing the lumpy professional-services model that characterized earlier stages of the business.

He said enterprise customers such as Sumitomo and Codelco validate MineHub’s position as a mission-critical system embedded in daily workflows.

A key catalyst, in Tucci’s view, is MineHub’s November 2025 acquisition of Jules AI, which expands the platform beyond primary metals into the fragmented and less-digitized scrap and circular-economy markets.

He described the transaction as “thesis-altering,” noting that Jules AI’s workflow automation complements MineHub’s recently launched Navigator product and creates an end-to-end solution for recyclers facing higher fraud risk and logistical complexity than traditional miners.

Tucci also highlighted growing fintech optionality. With Abaxx Technologies as both a roughly 20% shareholder and strategic partner, MineHub is integrating with the Abaxx Exchange to enable digital title transfer and trade-finance functionality, effectively linking physical logistics with financial settlement. Additional integrations, including Railinc for North American rail data and a recently announced MOU with contract-lifecycle platform Chinsay, further strengthen the company’s value proposition by compressing contract-to-cash cycles and improving working-capital efficiency.

Tucci said that MineHub enters 2026 with a reinforced balance sheet, demonstrated product-market fit in primary metals and a new growth engine in scrap and circular materials. With the financing completed, he said the company can now focus on converting its pipeline and integrating Jules AI, while strategic partner participation provides external validation of both the technology and compliance framework.

-30-

Rod Weatherbie

Writer

Rod Weatherbie is a journalist based in Prince Edward Island. Since 2004, he has written extensively about the Canadian property and casualty insurance landscape. He was also a founder and contributing editor for a Toronto-based arts website and a PEI-based food magazine. His fiction and poetry have been featured in The Fiddlehead, The Antigonish Review, and Juniper.