MineHub’s latest acquisition gets thumbs up at Haywood

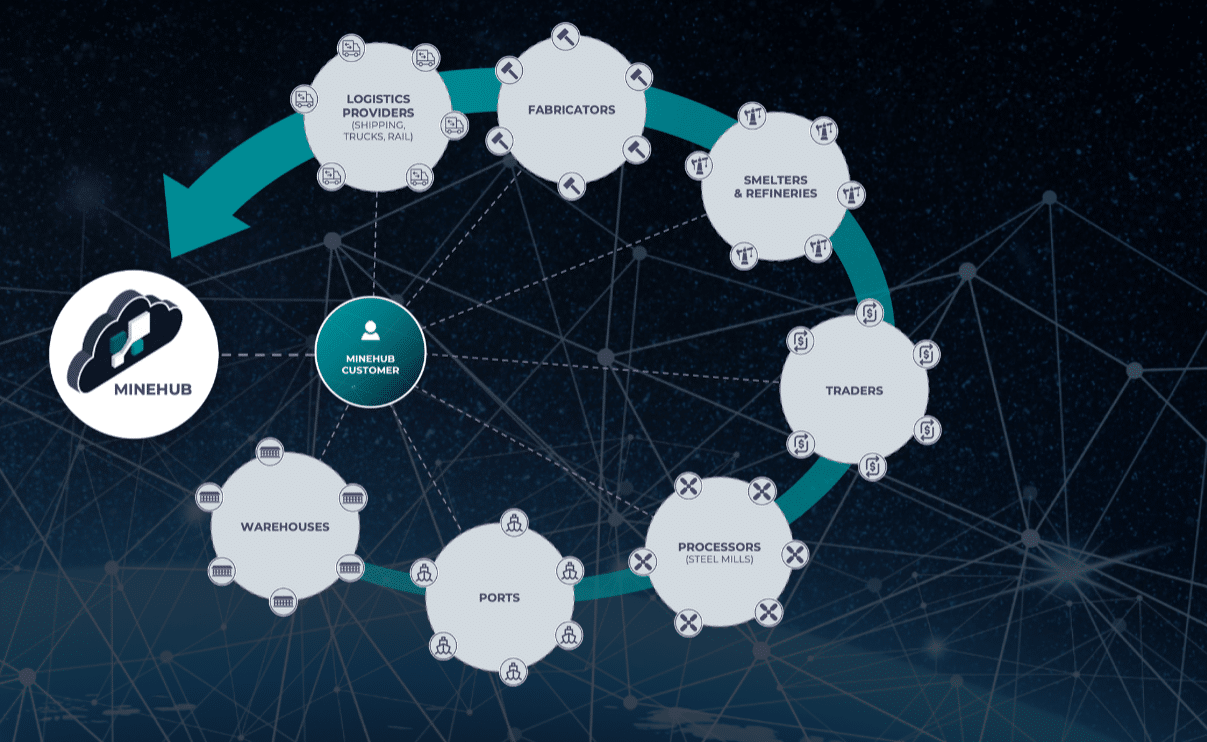

Haywood Capital Markets analyst Gianluca Tucci said in a Sept. 25 note that MineHub Technologies’ (MineHub Technologies Stock Quote, Chart, News, Analysts, Financials TSXV:MHUB) acquisition of Jules AI is a strategically sound move that expands its addressable market, strengthens its artificial intelligence capabilities, and positions the company as a digital infrastructure leader in metals supply chains.

While execution risk remains, he argued the deal enhances MineHub’s long-term growth profile and competitive positioning in the digitization of global commodity markets.

MineHub announced it has signed a definitive agreement to acquire Toronto-based Jules AI, an AI-enabled commodity trading and risk management platform focused on recycled and scrap metals. The transaction introduces MineHub to the US$1-trillion recycled materials sector, extending its reach across bulk, refined, and recycled metals. Terms include approximately US$1.9-million upfront, largely in equity, and up to US$18.1-million in a three-year, revenue-linked earn-out. Closing is expected within 90 days, subject to TSXV and regulatory approval.

Tucci noted the acquisition addresses two key growth vectors: sector expansion into recycled metals, a market projected to nearly double by 2035, and technology enhancement by embedding Jules AI’s agentic automation capabilities into MineHub’s workflows. With scrap metals central to decarbonization efforts, driven by policies such as the EU Carbon Border Adjustment Mechanism and automakers’ recycled-content mandates, the integration positions MineHub at the intersection of compliance, sustainability, and trade execution.

MineHub currently digitizes supply chain workflows and provides a “system of record” across commodity trades. Jules AI adds automation in areas such as document verification, letters of credit, and hedging workflows. The platform claims a seven-fold efficiency gain versus manual methods, with 2024 volumes of nearly two million tons of scrap processed for customers including Dhatu International, Schupan & Sons, and Star Group.

Tucci said this not only validates the technology but also creates cross-selling opportunities.

By entering the recycled materials market, MineHub significantly broadens its growth runway. Recycled metals, which can reduce carbon emissions by as much as 95% compared with virgin extraction, are expected to see demand surge across electric vehicles, low-carbon construction, aerospace, and electronics. MineHub’s exposure to customers in the U.S., Singapore, and India provides access to some of the most active markets for recycled trade.

The deal structure, Tucci added, reflects discipline, with a modest upfront cost and performance-based earn-outs contingent on Jules AI reaching US$5-million in cumulative revenues over three years. Jules AI is reportedly near breakeven, minimizing integration risk.

“Overall, we see the acquisition as accretive to MineHub’s strategic positioning,” Tucci said. “It creates a differentiated, end-to-end platform spanning from mine to recycling, a rare breadth in commodities digitalization. The market opportunity is supported by structural ESG and regulatory drivers, though execution on scaling Jules AI’s CTRM platform will be critical to sentiment moving forward.”

-30-

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.