Kraken Robotics acquisition gets thumbs up at Beacon

Following the company’s most recent acquisition, Beacon analyst Gabriel Leung has maintained his “Buy” rating on Kraken Robotics (Kraken Robotics Stock Quote, Chart, News, Analysts, Financials TSXV:PNG).

On March 13, PNG announced it had acquired 3D at Depth, which it described as a “a leading American subsea technology and services company”, for (US) $17.0-million.

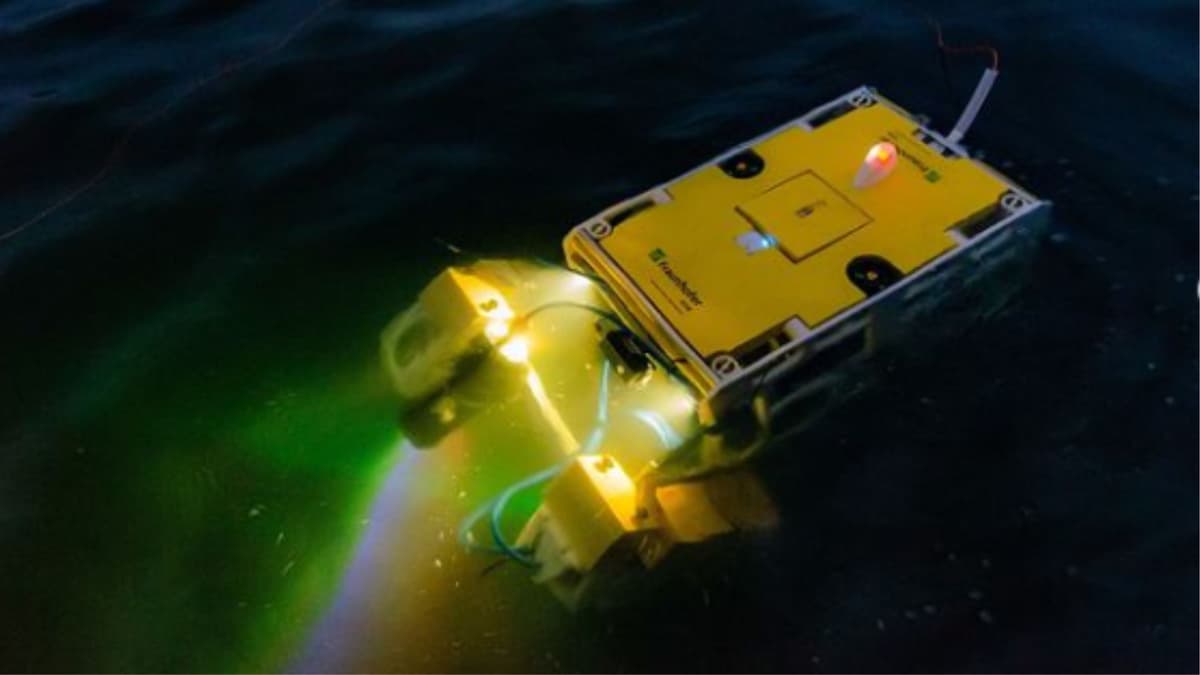

“The acquisition of 3D at Depth builds upon Kraken’s expertise in subsea optical systems, developed through our SeaVision product line, and significantly expands our subsea service offering by adding high-value, high-margin solutions that feature differentiated capabilities,” CEO Greg Reid said. “With 3D at Depth, we are acquiring an industry leader with an established customer base, strong gross margins and gain an expanded presence in the United States, with new offices in Texas and Colorado. This acquisition immediately strengthens our presence in the U.S. Gulf region, complementing our historically strong book of subsea services work in northern Europe. This also provides Kraken with a strategic entry point into the U.S. market. Following completion of the acquisition, Kraken will be able to offer a more comprehensive suite of world-class subsea acoustic and optical imaging technologies and services, reinforcing our SAS, SeaVision and SeaPower capabilities. Additionally, establishing our first U.S.-based facilities enhances our ability to scale manufacturing operations in the U.S. as demand continues to grow.”

Leung says this should work right out of the gate.

“We expect there to be good operational synergies between 3D at Depth and Kraken’s existing (~20M+ revenues per year) services business, which is comprised primarily of its acquired PanGeo Subsea business (high-resolution 3D acoustic imaging solutions for the sub-seabed),” he wrote. “This acquisition also establishes Kraken’s first US-based facilities, which enhances its ability to scale manufacturing operations in the US as demand continues to grow (also helping to mitigate potential tariff concerns).”

In a research update to clients March 24, Leung maintained his “Buy” rating and price target of $3.25 on PNG, implying a return of 25% at the time of publication.

Leung thinks the company will post Adjusted EBITDA of $26.9-million on revenue of $115=6.1-million in fiscal 2025. He expects those numbers will improve to Adjusted EBITDA of $33.4-million on revenue of $129.4-million in fiscal 2026.

“We are maintaining our estimates pending the release of Q4 2024 results (expected mid-April). However, we do view this transaction as being a net positive for Kraken. We maintain our Buy rating and $3.25 target, which is based on 25x CY26e EV/EBITDA,” the analyst added.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.