How are losses settled under a equipment breakdown coverage?

Equipment breakdown coverage is a type of insurance that protects businesses and sometimes homeowners from the financial losses associated with the malfunction or failure of essential equipment. It covers the repair or replacement costs for equipment that suffers a mechanical or electrical breakdown due to specific causes like power surges, motor burnout, operator error, or pressure system failures. This coverage can also extend to the resulting financial impacts, such as lost income or additional expenses incurred during downtime.

For businesses, equipment breakdown coverage typically applies to critical machinery, such as HVAC systems, boilers, refrigeration units, electrical systems, production machinery, and computers. For example, if a manufacturing company’s production line comes to a halt because a key piece of machinery fails, this coverage would help pay for the repair or replacement of the equipment and could also cover lost revenue or extra costs for temporary solutions.

In residential settings, equipment breakdown coverage might be included as an optional endorsement on a homeowner’s policy. It can cover items like home heating systems, air conditioning units, refrigerators, and water heaters. For instance, if a power surge damages a home’s central air conditioning system, the policy would help cover the repair costs, which are often excluded from standard homeowners insurance.

This type of coverage does not typically include routine wear and tear or maintenance issues, as these are considered the responsibility of the owner. Instead, it focuses on unexpected breakdowns due to sudden mechanical or electrical failure. Equipment breakdown coverage is particularly valuable in mitigating the financial risks and disruptions associated with essential equipment failure, making it a popular choice for businesses and homeowners alike.

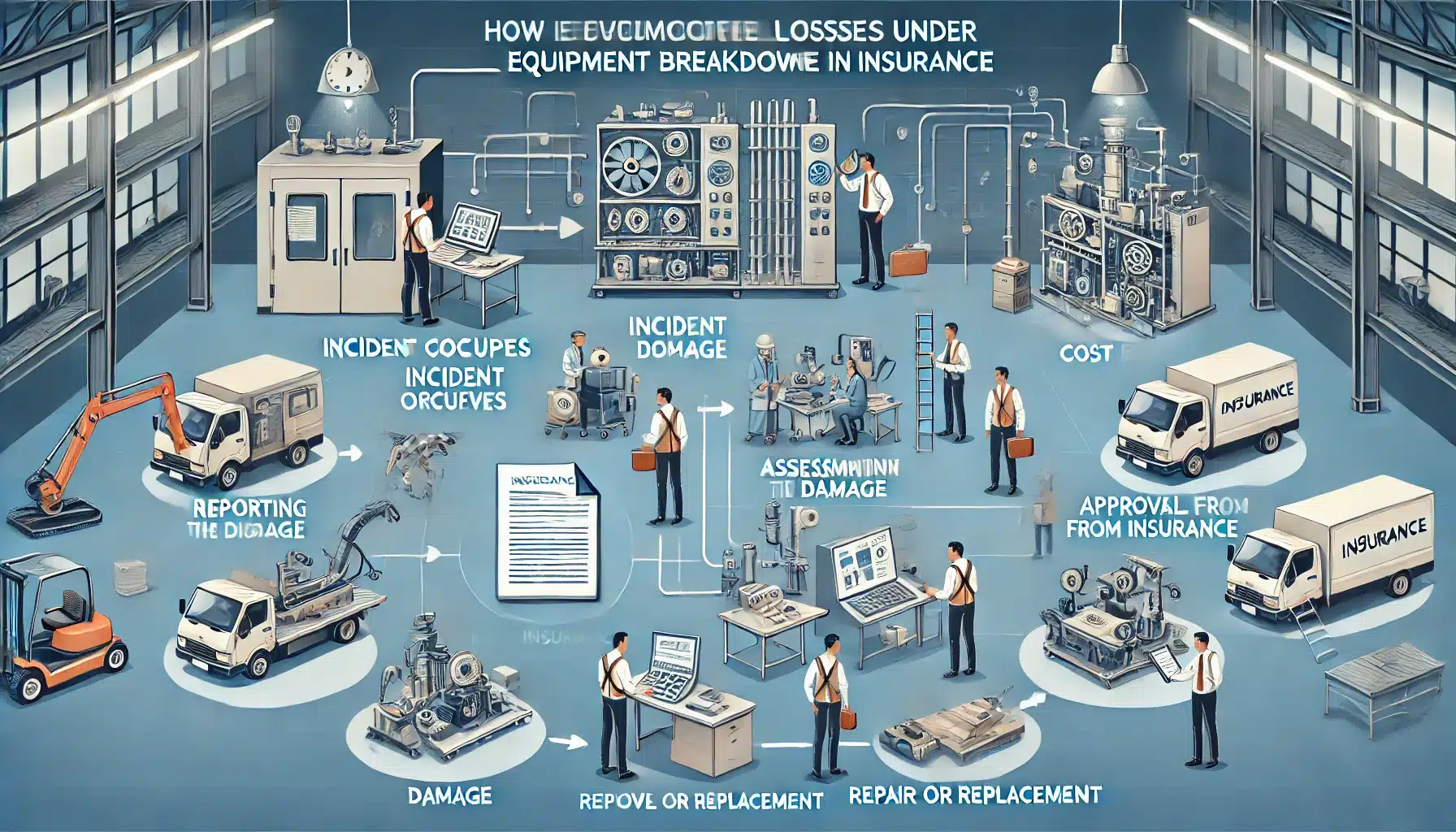

Losses under equipment breakdown coverage are settled by following a structured process that involves assessing the damage, determining coverage eligibility, and calculating the payout based on the policy terms. When a covered piece of equipment breaks down, the first step is for the policyholder to notify the insurer, who will then investigate the cause of the failure. This investigation is crucial because the insurance policy only covers specific perils, such as mechanical breakdowns, electrical surges, boiler explosions, or operator errors that result in sudden and accidental damage. If the failure is determined to be due to an excluded cause, such as normal wear and tear, rust, or lack of proper maintenance, the claim will typically be denied.

Once the insurer confirms that the cause of the loss falls within the policy’s covered risks, they will evaluate the extent of the damage. This may involve sending an adjuster or specialized equipment inspector to examine the affected machinery or system. The adjuster assesses whether the equipment can be repaired or needs to be replaced entirely. The evaluation also includes estimating the costs of repairs or replacement and determining how these align with the policy’s terms.

The valuation of the damaged equipment is a critical factor in determining how losses are settled under an equipment breakdown policy, as it directly impacts the financial outcome for the insured. Most policies clearly outline whether claims will be resolved based on replacement cost or actual cash value, each of which has distinct implications for the policyholder. Replacement cost coverage is designed to pay for the repair or replacement of damaged equipment with new equipment that is of a similar type and quality. This valuation method does not consider depreciation, which means the settlement will reflect the full cost of restoring the equipment to its original operational state as if it were new. This approach is particularly advantageous for businesses that need to resume operations quickly without incurring additional financial burdens for purchasing or installing new equipment. It allows the insured to recover fully from the breakdown and return to normal operations without the added expense of upgrading or accounting for the depreciated value of their previous equipment. The only out-of-pocket costs for the insured, aside from the deductible, are typically limited to the differences in technology or features if they choose to upgrade to newer models.

In contrast, policies that use actual cash value take into account the depreciation of the equipment, meaning the settlement reflects the equipment’s market value at the time of the loss rather than its replacement value. This valuation method factors in the age, condition, and usage of the equipment, resulting in a payout that is often lower than the cost required to purchase new equipment. While this may present a financial challenge for businesses that rely on the equipment for critical operations, it can also reduce the overall cost of the insurance policy, as premiums for actual cash value coverage are generally lower. Businesses may choose this option if they are comfortable with the potential for out-of-pocket expenses to cover the gap between the settlement amount and the cost of new equipment, or if they have alternative means to finance the replacement.

The choice between replacement cost and actual cash value often depends on the needs and priorities of the insured. For businesses with tight operational timelines or high dependency on specific equipment, replacement cost coverage is typically preferred, as it ensures that operations can resume without significant delays or financial strain. On the other hand, businesses with older equipment, less reliance on a single piece of machinery, or the ability to absorb additional costs may opt for actual cash value coverage as a more economical option. Each method provides a different balance of financial security and premium affordability, making it essential for policyholders to assess their specific risks and operational requirements when selecting coverage.

Beyond the direct costs of repairing or replacing the equipment, many equipment breakdown policies provide coverage for associated financial losses. These can include business income loss caused by downtime, extra expenses incurred to maintain operations, or the cost of inventory spoilage resulting from the breakdown. For instance, if a refrigeration unit fails, the policy may cover the repair costs for the unit, the value of any perishable goods that spoiled, and lost income due to the temporary shutdown of operations. This additional coverage helps businesses mitigate the broader financial impact of equipment failures.

The settlement amount is adjusted by the deductible specified in the policy, which is the amount the insured must pay out of pocket before the insurance coverage applies. Deductibles for equipment breakdown coverage can vary and are usually set as a flat dollar amount or, in some cases, as a percentage of the loss. Once the deductible is accounted for, the insurer calculates the final payout and issues payment either directly to the policyholder or to the vendor handling the equipment’s repair or replacement. If the breakdown affects multiple pieces of equipment or involves complex systems, the settlement process may take longer, as the insurer must ensure that all aspects of the claim are accurately documented and resolved.

Throughout the process, the insurer’s goal is to restore the policyholder to their pre-loss condition, ensuring that the necessary repairs or replacements are made and any financial losses are addressed. However, the settlement is always subject to the policy’s terms and limits, which define the maximum amount the insurer will pay for a single loss or over the policy term. These limits may affect the settlement, particularly in cases involving significant equipment failures or extended downtime. For this reason, it is important for policyholders to thoroughly understand their coverage and work closely with the insurer during the claims process to ensure a fair and efficient resolution.

Staff

Writer