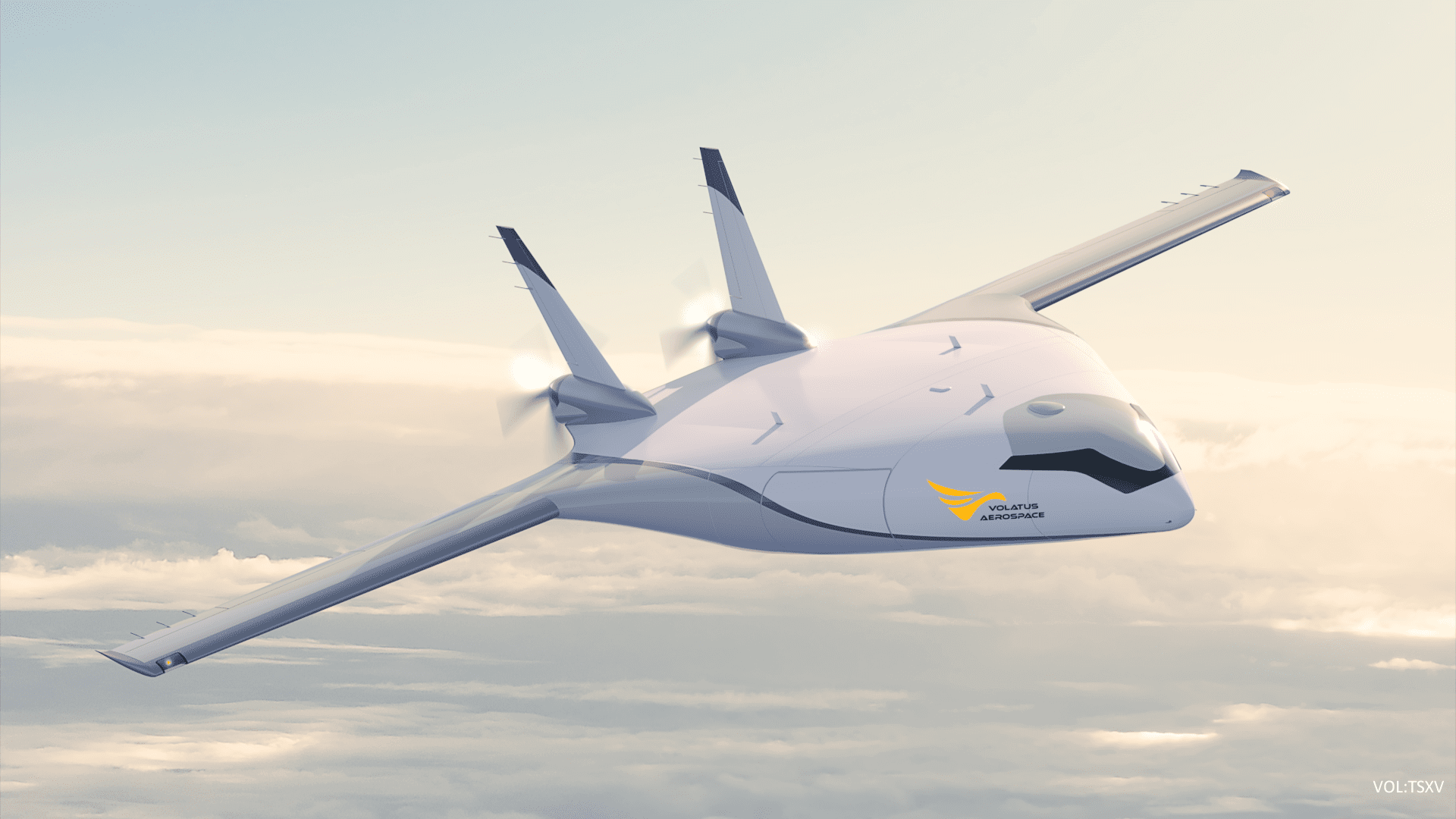

Volatus Aerospace is set to fly, Ventum says

With some new blue chip investors on board, investors should be taking a long look at Volatus Aerospace (Volatus Aerospace Stock Quote, Chart, News, Analysts, Financials TSXV:FLT).

So says Ventum Capital Markets analyst Rob Goff, who in an update to clients October 22 maintained his “Buy” rating and price target of $0.38 on FLT, implying a return of 117.1% at the time of publication.

The analyst says the recent $15-million financing validates the strength of the company’s pipeline.

“Volatus announced that it has secured a $15.0M financing package with $7.5M in convertible debt from Investissement Québec (IQ) and $7.5M in term loan from Export Development Canada (EDC),” Goff wrote. “We look to IQ and EDC as strong, long-term investors who can provide additional growth capital. Volatus looks to leverage every incremental $1M of working capital investment into roughly $3-4M of incremental equipment sales where the gross profit margins are ~25% and incremental operating costs are relatively modest. We look for ~$3-4M of the funding to go directly to purchase working capital as the Company expects it to fund ~ $9-12M in unmet equipment sales demand. We see the long-line inspection revenue profile as a key factor supporting the raise. Volatus released that proceeds will go towards repaying its current outstanding $6M senior loan with a major Canadian bank. The Company also intends to open a new secured line of credit to support anticipated growth. We note that Volatus holds ~$5M of debt related to its fleet financing at ~9.8%.”

The analyst thinks FLT will post EBITDA of negative $2.7-million on revenue of $27.0-million in fiscal 2024. He expects those numbers will improve to EBITDA of positive $5.7-million on a topline of $60.3-million in fiscal 2025.

“We see the new capital supporting the potential for further forecast upgrades,” Goff added. “Where long-line inspection contracts require relatively modest capital, there exists the financial flexibility to seize the significant opportunity to monetize the Company’s portfolio of drones and landing stations as the US moves away from Chinese-manufactured products. We note that Volatus has third-party manufacturing capabilities to significantly ramp its equipment sales where gross margins are targeted at ~25% and incremental operating costs are modest. We look for Volatus to announce further long-line inspection revenues as we progress through 2025. Equipment sales are projected to show significant YoY gains.”

Disclosure: Volatus is an annual sponsor of Cantech Letter

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.