Exro acquisition gets thumbs up at National Bank

A new acquisition by Exro Technologies (Exro Technologies Stock Quote, Chart, News, Analysts, Financials TSX:EXRO) has National Bank Financial analyst Rupert Merer feeling bullish about the stock.

On April 5, EXRO announced it had completed the previously announced merger with SEA Electric.

As reported by the Globe and Mail, the analyst said he likes the deal.

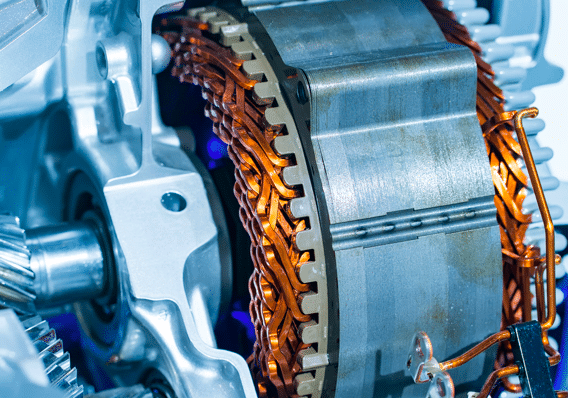

“SEA is a proven EV powertrain technology company focused on commercial vehicles,” Merer said. “The company has deals with Mack (5 years, up to 3,500 units/yr) and Hino (3 years, up to 5,000 units/yr) which could reach $200-million in revenue in ‘24 and more than $300-million in ‘25. SEA’s patented SEA-Drive technology is 25-35 per cent more efficient than competitors according to independent studies. Exro’s coil driver, when added to the systems, could add more than 5-per-cent incremental efficiency in addition to improved performance, charging and lower costs. The acquisition accelerates EXRO’s path to profitability and positions it as an asset light, end to-end solution for electrifying commercial vehicles. With execution on its coil driver contracts and SEA’s backlog, EXRO could reach breakeven EBITDA and FCF in ‘25.”

In a research update to clients April 8, Merer raised his rating on EXRO from “Restricted” to “Outperform”, but cut his price target on the stock from $2.00 to $1.60.

The analyst explained the reasoning behind his new price target.

““Looking at Exro’s peers in energy technology, inverter manufacturers and EV OEM, the EV/sales multiple for the sectors average 1.4-2.3 times (FY2), but typically the stock-specific multiple is well correlated to revenue growth,” he wrote. “Exro has higher revenue growth forecasted than for the peer group, and we believe that warrants a multiple closer to the upper range of peers. With strong partnerships, a proven platform and opportunities for further developments, we like the transaction. Our target moves to $1.60/sh (was $2/sh), which is based on an EV/sales multiple of 2 times (was 2.7 times) on 2025E, in line with the peer group. Our target is also supported by a DCF with a 13.7-per-cent discount rate, though with a lack of visibility past 2025E, we are more confident in a near-term multiple approach to valuing the company. With the shares trading at $0.81/sh, we see good upside potential for the stock, and we are moving to Outperform. The company has some execution risk, and some investors may wait to see evidence of the inflection point in both EXRO and Sea to get more excited, especially considering the challenging industry backdrop in the electric vehicle space.”

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.