Following the company’s fourth quarter results, Leede Jones Gable analyst Doug Loe has maintained his “Buy” rating on Profound Medical (Profound Medical Stock Quote, Chart, News, Analysts, Financials NASDAQ:PROF).

On March 7, PROF reported its Q4 and fiscal 2023 results. In the fourth quarter, the company reported operating expenses of $9.8-million with revenue of approximately $2-million.

“Our preparations continue for the permanent CPT Category 1 codes for Tulsa going into effect at the beginning of 2025, an anticipated inflection point for our business,” said CEO Arun Menawat. “In addition, our next AI-based [artificial intelligence] module, called Contouring Assistant, that enables creation of suggested treatment design based upon the specific prostate anatomy of each patient, is now under U.S. Food and Drug Administration review. Based upon user feedback, we believe this upgrade will not only further increase urologists’ confidence in treating more of their patients with Tulsa but it is also expected to reduce total Tulsa procedure times.”

Loe summarized the quarter.

“ON-based ultrasound tissue ablation device developer Profound Medical reported FQ423 financial data for the December-end quarter that were again stable on topline performance as most recent quarters have been, though still modest in absolute terms,” he said. “This is at least until US reimbursement risk is ultimately mitigated later this year through expected issuance of device/procedure-specific CPT codes for Profound’s flagship FDA-approved MR-guided high-intensity focused ultrasound ablation platform TULSA-PRO. Indeed, because Profound already had preannounced FQ423 revenue (which was US$2.0M in the quarter, and thus US$6.8M for the full year), the firm’s financial update was in our view secondary to strategic commentary provided in parallel on TULSA PRO’s US reimbursement status, ongoing marketing efforts while reimbursement codes are pending, and on TULSA PRO clinical activities that could influence device adoption over time.”

In a research update to clients March 8, Loe maintained his “Buy” rating and one-year price target of (US) $18.00 on PROF, implying a return of 99 per cent at the time of publication.

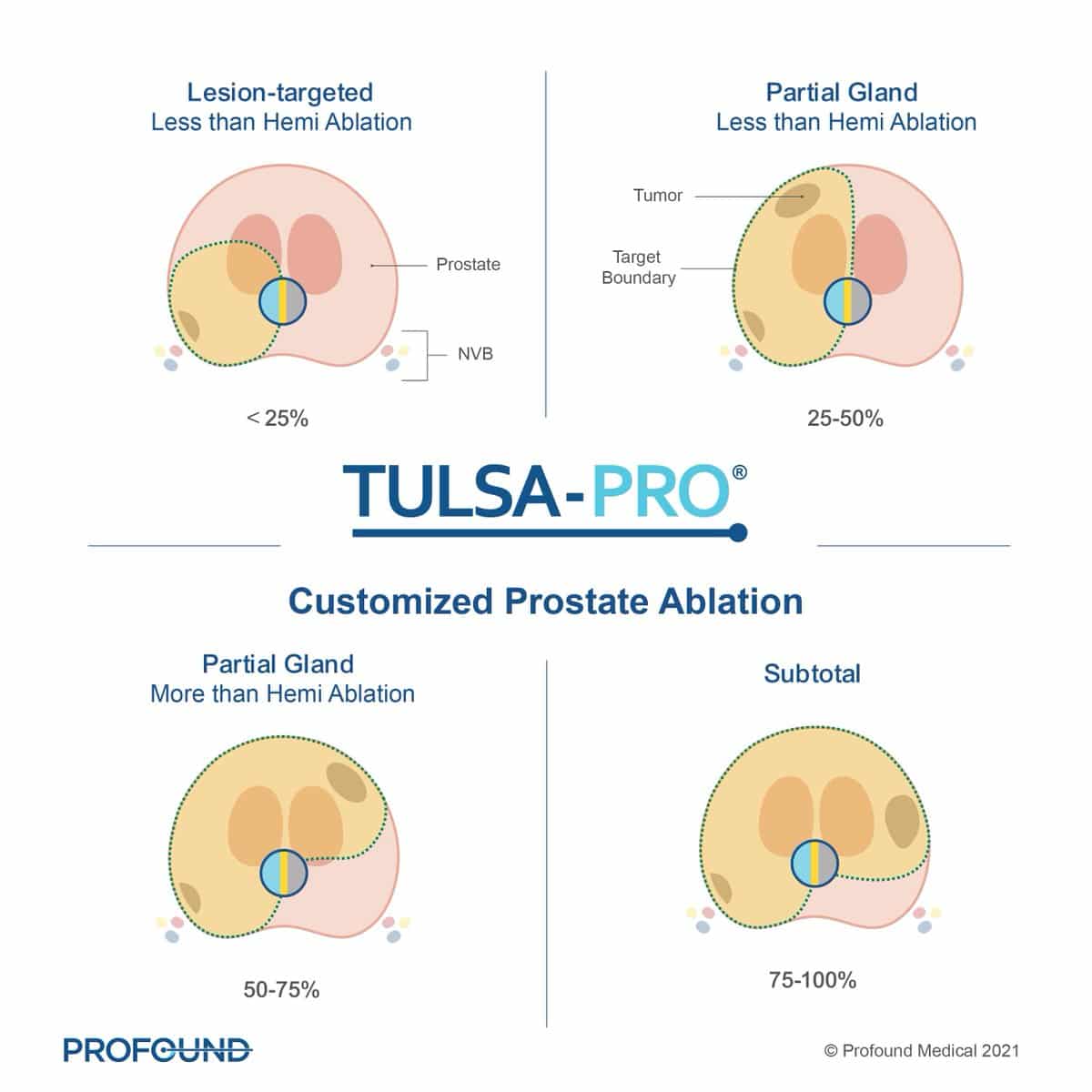

“F2024 should be a transition year for Profound/TULSA PRO just as F2023 was, but we stand by our view that the device itself, and MR-guided ultrasound tissue ablation in general, is well positioned to become a seminal option in treating localized prostate disease,” the analyst added. “Our views are based not just on the pivotal TACT trial on which FDA approval was based, but also on the ever-expanding suite of prostate ablation studies showing that the device can safely eradicate prostate tumors with focused ablation and mitigate benign prostatic hyperplasia symptoms with broader whole-gland ablation. And thus, the device serves as a credible alternative to radical prostatectomy or radiation therapy in the oncology sphere, or to orally active alpha receptor-blocking or 5-alpha reductase-inhibiting small-molecule drugs in the endocrinology sphere.”

Share

Share Tweet

Tweet Share

Share

Comment