More upside to Profound Medical, says Raymond James

The stock has been white hot over the past eight months, but investors thinking there’s little left in the tank for Profound Medical (Profound Medical Stock Quote, Charts, News, Analysts, Financials NASDAQ:PROF) should think again. So says Raymond James analyst Rahul Sarugaser, who reiterated a “Strong Buy” in a Thursday update to clients, saying we can expect another catalyst from PROF shortly.

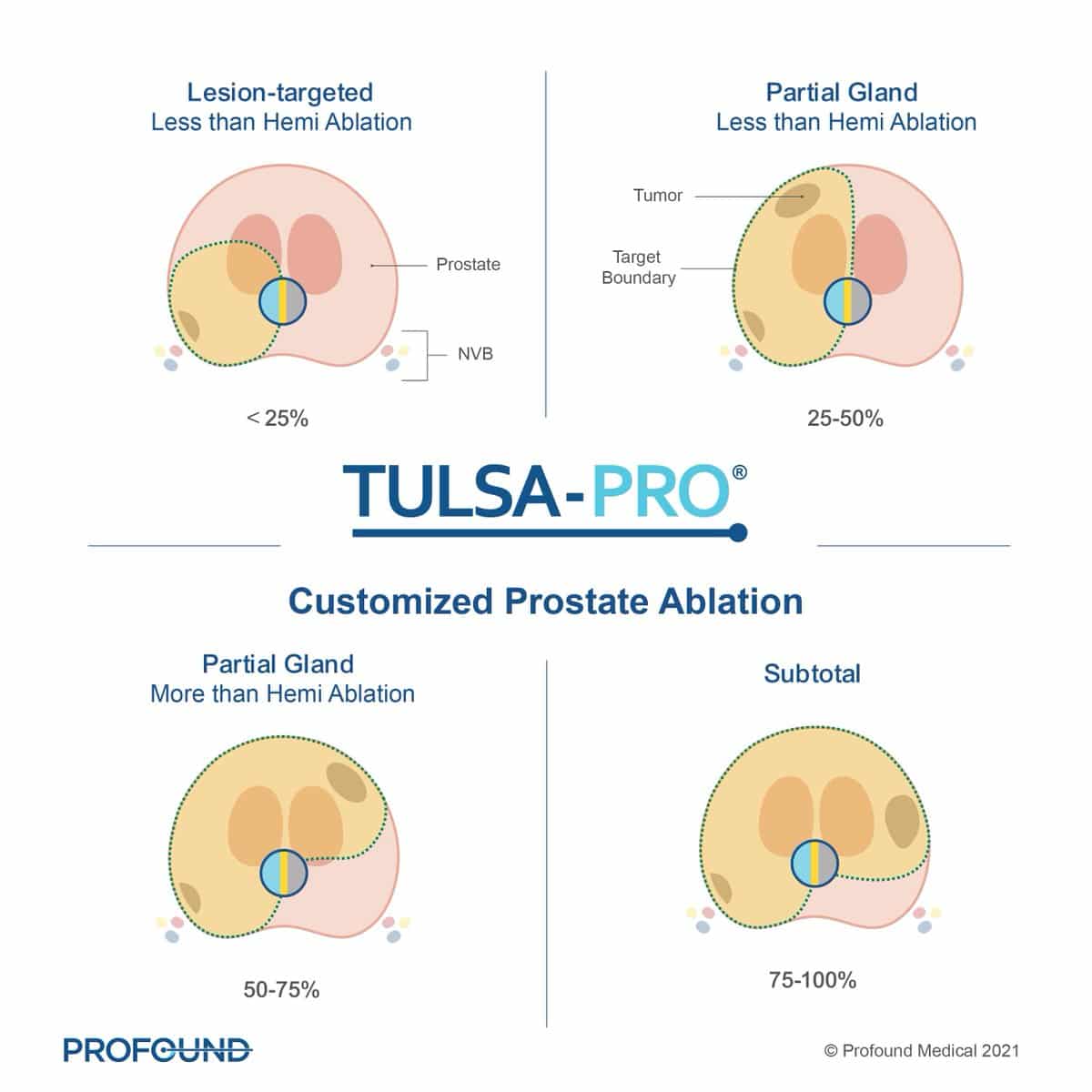

Profound Medical, which is commercializing in the United States its TULSA-PRO technology for the ablation of prostate tissue, saw its share price rise from sub-$4.00 territory last October to above $14.00 earlier this month, although shares have pulled back a bit more recently. (All figures in US dollars.)

In terms of recent catalysts, Profound received earlier in June CPT-1 reimbursement codes from the AMA for the TULSA-PRO and it also announced positive five-year data on its tech.

Sarugaser said investors should now be on the lookout for what he thinks is a likely C-code expansion to ambulatory surgical centres (ASCs) in either July or August, and he said the recent volatility in the stock, which fell about 15 per cent in recent trading sessions, has no basis in fundamentals.

“Given the newly-established CPT codes for TULSA, we anticipate a high likelihood of approval for these C-code expansions. This probable expansion of PROF’s C-code, combined with bullish commentary from 4 key opinion leaders urologists, implies to us that PROF’s revenue inflection will be pulled forward into FY24; we escalate our revenue estimate accordingly,” Sarugaser wrote.

With the update, Sarugaser reiterated a 12-month target price of $20.00 on PROF, which at press time represented a projected return of 50 per cent.

On PROF’s financials, Sarugaser is expecting revenue to go from $7 million in 2022 to $8 million in 2023 and to $16 million in 2024, while EBITDA is expected to go from negative $26 million in 2022 to negative $23 million in 2023 and to negative $18 million in 2024. EBITDA is expected to turn positive in 2026 at $26.6 million and onto $67.4 million in 2027.

“We escalate our revenue estimate and value PROF using a discounted (15 per cent) average of forward revenue multiples—18.0x 2025 revenue, 10.0x 2026 revenue, 7.0x 2027 revenue—deriving an average rNPV of ~$450 million; we further show sensitivity tables with Rev. ± 20 per cent). We further est. PROF requiring $50 million in equity (@ ~US$18/sh. [was US$20/sh.]) at some point during the next 12-18 months; so, including this potential dilution, we calculate a per-share value of $20 (unchanged),” he wrote.

Staff

Writer