MDP price target lowered at Echelon

After a disappointing quarter, Echelon Capital Markets analyst Stefan Quenneville has lowered his price target on Medexus Pharmaceuticals (Medexus Pharmaceuticals Stock Quote, Chart News, Analysts, Financials TSX:MDP).

On February 7, MDP reported its Q3, 2024 results. The company posted Adjusted EBITDA of $3.2-million on revenue of $25.2-million, a topline that was down 12.2 per cent from the same period a year prior.

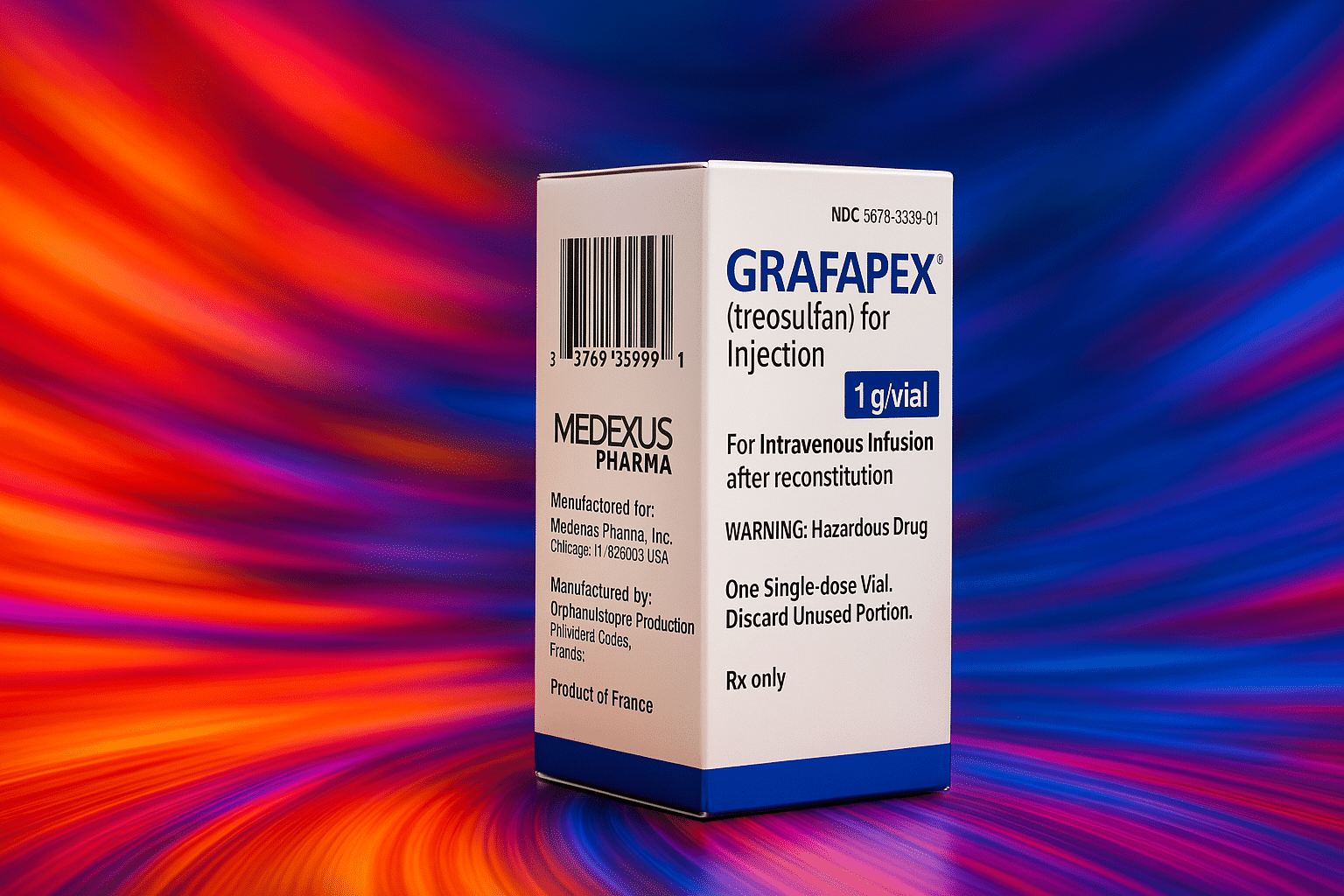

“Our third quarter results reflect yet another quarter of positive operating income and positive adjusted EBITDA,” CEO Ken d’Entremont said. “However, we believe the results also reflect certain changing business conditions affecting our operations, in particular recent adverse trends in Ixinity demand and Rasuvo product-level performance. In response, we have moved quickly to reduce costs, including a reduction in allocation of sales force resources. For Ixinity, we will seek to maintain existing demand but reduce investments in Ixinity’s growth, with the pediatric indication as a tailwind if and when approved. For Rasuvo, we will continue to defend Rasuvo’s strong formulary status. We look forward to increasing our focus on Gleolan, as an institutional sales-based product that we believe will complement our commercialization activities for treosulfan if and when that product is approved.”

Quenneville gave his summary of the quarter and explained why he has cut his price target on the stock.

“Medexus yesterday reported FQ324 (period ending Dec 31, 2023) results that significantly missed expectations due to challenges across its US business, particularly with its IXINITY hemophilia franchise. While the company has quickly responded to the demand and pricing pressure it is seeing in the US by announcing cost cuts of $4-6M, we think that investors will react negatively to management’s admission that IXINITY has limited growth potential going forward. Given the challenging environment Medexus is facing in the US, we are lowering our near-term outlook and as well as our target price to C$3.00/shr (from C$3.30/shr), however we are maintaining our Speculative Buy rating as progress towards the Treosulfan FDA re-submission (CH124) could provide a near-term catalyst that changes today’s negative narrative on the stock.”

The analyst thinks Medexus will post EBITDA of $18.6-million on revenue of $114.0-million in fiscal 2024. He expects those numbers will improve to EBITDA of $23.6-million on a topline of $117.0-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.