After a third quarter that missed expectations, Roth MKM analyst Scott W. Searle is still bullish on Universal Display Corporation (Universal Display Corporation Stock Quote, Chart, News, Analysts, Financials Nasdaq: OLED).

On November 2, OLED reported its Q3, 2023 results. The company posted Net Income of $51.5-million on revenue of $141.1-million, a topline that was down from the $160.6-million it produced in the same period last year.

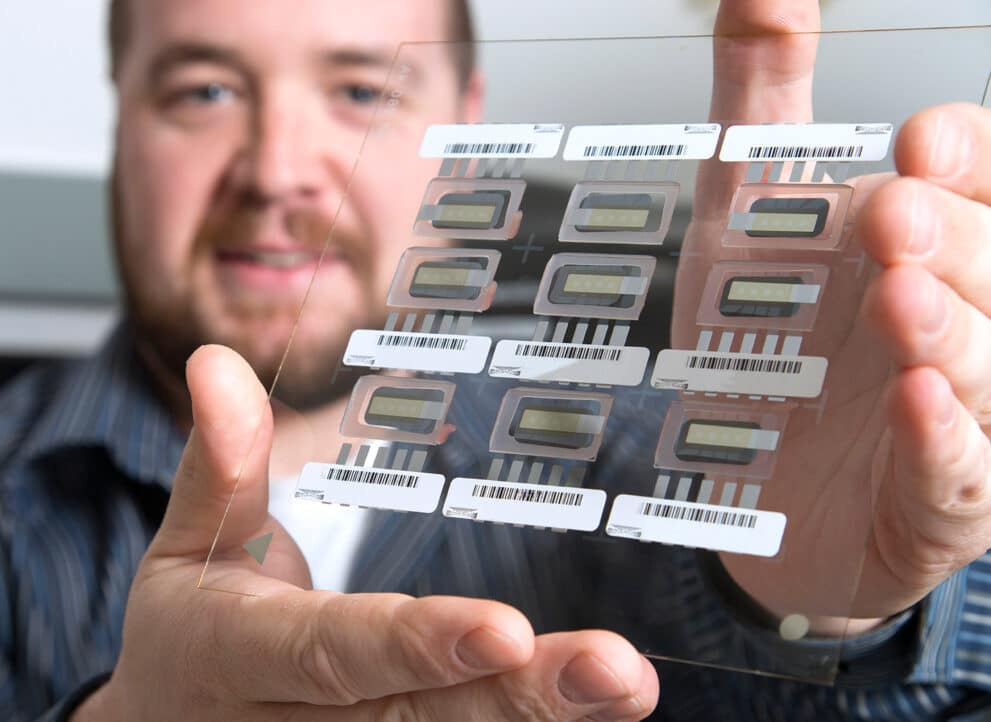

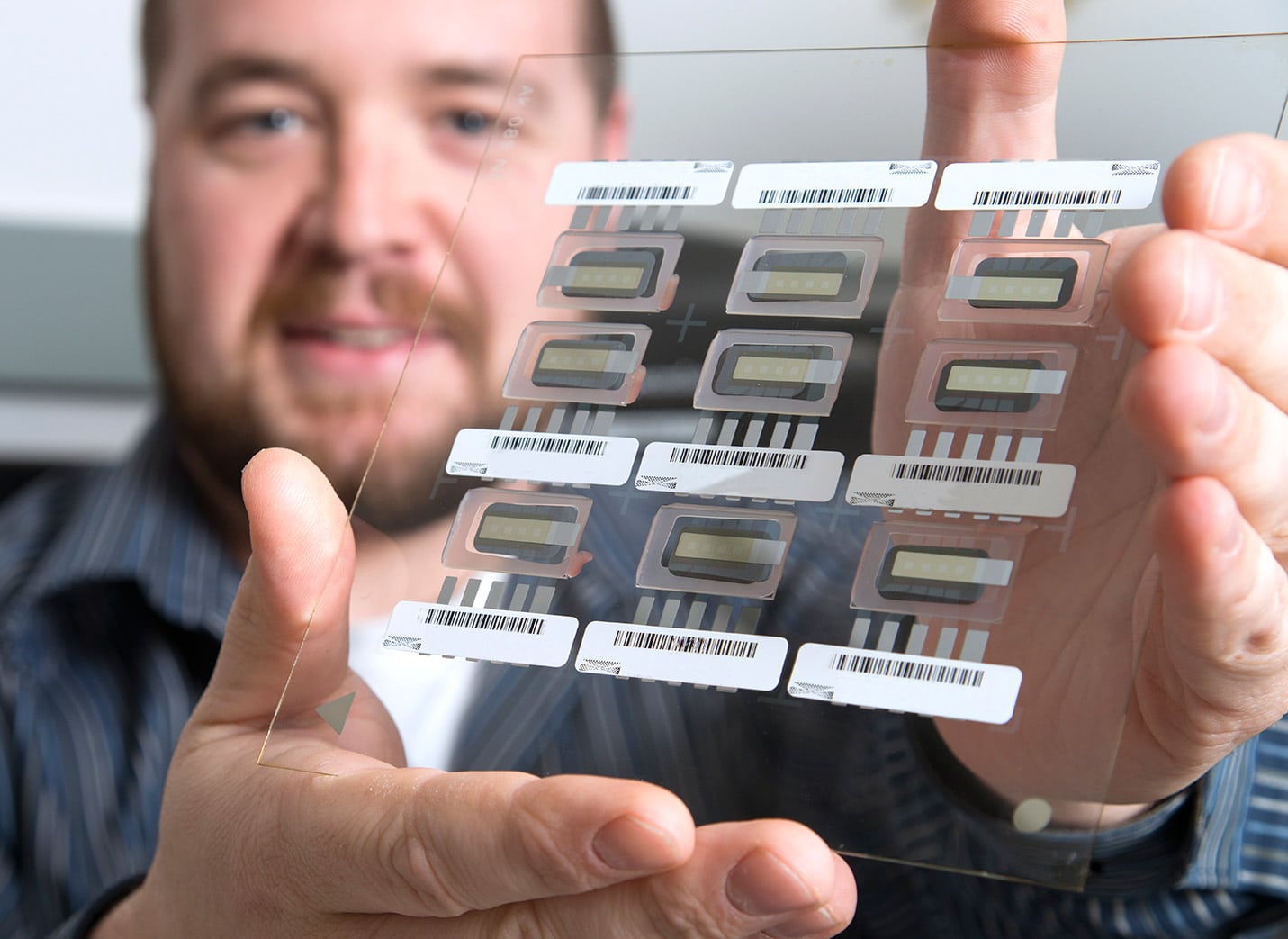

“As we approach the end of 2023, our performance for the year remains on course. Looking ahead, we believe that multiple market verticals are driving the OLED industry’s long-term growth path,” CFO Brian Millard said. “A significant shift in the world of technology is occurring with the introduction of conformable, foldable and rollable consumer electronics, and OLEDs are fueling this form factor revolution. In addition to the expected commencement of a new OLED IT adoption cycle in 2024, we are also seeing the emergence of OLEDs in the automotive market, especially with electric vehicles. As OLED activity continues to expand across the consumer display and lighting landscapes, we remain steadfast in our commitment to advancing our robust OLED materials and technology leadership.”

Searle provided some detail on what happened in the disappointing quarter.

“Universal Display reported sales of $141.1M, down 12% y/y and 4% seq, which was below consensus expectations by ~8M. This is generally in-line with our cautious preview related to concerns around macroeconomic conditions for consumer electronics (CE) which continued to weigh on TV and panel demand (i.e. LG Display), as well as industry research that indicated both near-term excess capacity (DSCC forecasting a 4Q23 slowdown) and delays in new OLED capacity additions. While Materials sales were at record levels ($92.5M, up 10% y/y and 20% seq) the ratio of Materials to Royalty & Licenses Fees diverges from its traditional 1.5:1.0 to 2:1 related to 1). new customers and 2). contract extensions of existing deals, producing the shortfall (this is expected to normalize to 1.5:1.0 in coming quarters). GMs of 73.8% were in-line with expectations (despite the Royalty shortfall) as Materials GMs remained strong at 66%. The net result was reported EPS of $1.08 ($0.07 above consensus) reflecting an $0.18-0.20 benefit from a lower tax rate. OLED ended the quarter with $491M of cash ($792M including LT investments) or ~$16/share.

In a research update to clients November 3, Searle maintained his “Buy” rating but lowered his twelve-month target price on OLED from $196.00 to $176.00.

The analyst thinks the company will post EPS of $4.44 on revenue of $651.3-million in fiscal 2024. He expects those numbers will improve to EPS of $5.29 on a topline of $756.5-million the following year.

“2H24 consumer electronic headwinds are abating, and OLEDs remain in the nascent stages of adoption. We estimate that OLEDs will penetrate < 10% of the available acreage by 2030…It’s still early days. We maintain our Buy rating and are lowering our price target to $176 from our prior $196, on a lower multiple and slightly lower EPS. With the stock trading at ~24x our revised CY24 EPS (net of cash), shares of OLED remain inexpensive relative to the market penetration,” he concluded.

Share

Share Tweet

Tweet Share

Share

Comment