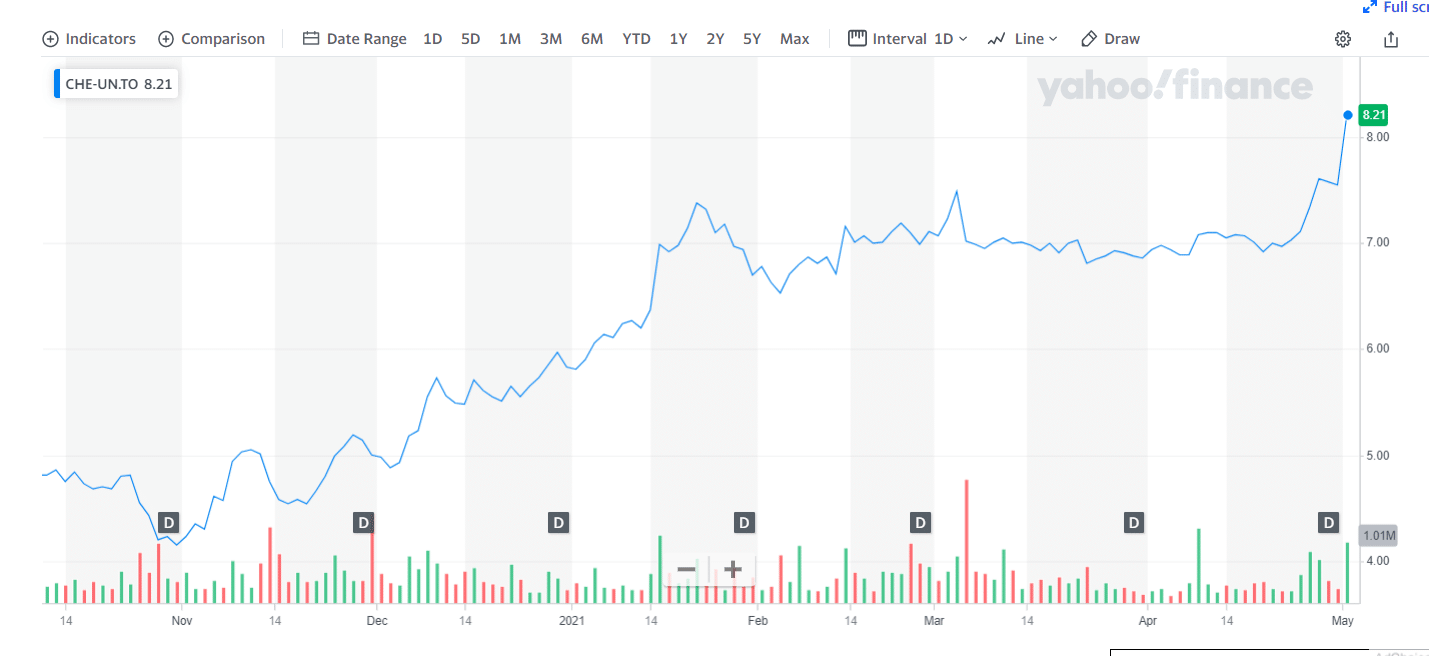

Its third quarter results are in the books and Desjardins analyst Gary Ho still thinks there is double-digit upside to Chemtrade Logistics Income Fund (Chemtrade Logistics Income Fund Stock Quote, Chart, News, Analysts, Financials TSX:CHE.UN).

On November 14, CHE.UN reported its Q3, 2023 results. The company posted Adjusted EBITDA of $142.1-million on revenue of $483.5-million, a topline that was down seven per cent over the same period a year prior.

“The strong performance that we delivered in the third quarter, both financially and operationally, further builds on the solid track-record that we have established in recent years and positions us for a record year in 2023,” CEO Scott Rook said. “While these results reflect strength across a number of products in our diversified portfolio, they are really a testament to the ongoing focus and execution of the entire Chemtrade team. Despite a decline in revenue attributable to lower sulphur and caustic soda prices, the commercial initiatives along with a focus on operating performance were pivotal in driving yet another quarter of growth in Adjusted EBITDA and distributable cash.”

The analyst gave his takeaway on the development.

“CHE delivered a strong 3Q beat, accompanied by a 3.2% EBITDA guidance raise to C $490m+. While 4Q will see some seasonal softness from several chemicals and lower caustic soda pricing, we believe there could be some upside to management’s C $72m+ implied guidance. 2024 will face tough comps in 1H and the North Vancouver turnaround (~C$20m impact), as well as a ~C$6m EBITDA loss from the P2S5 sale,” he wrote.

In a research update to clients November 15, Ho maintained his “Buy” rating and twelve-month price target of $12.00 on CHE.UN, implying a return of 43 per cent at the time of publication.

“Our positive view is based on: (1) multiple chemicals in CHE’s portfolio having relatively recession-resistant attributes; (2) tremendous ultra-pure and hydrogen opportunities; and (3) consistent execution and a repaired balance sheet should restore investor confidence and warrant a valuation re-rate,” the analyst concluded.

Share

Share Tweet

Tweet Share

Share

Comment