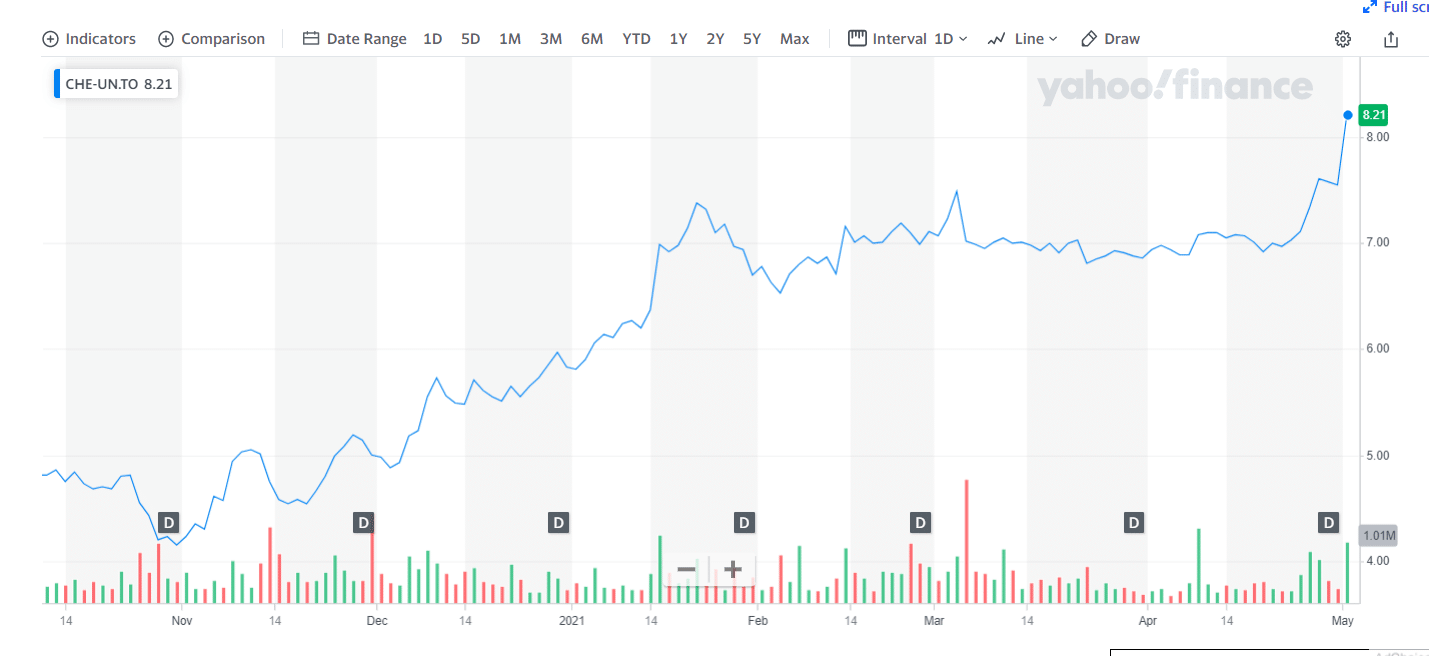

Ahead of quarterly earnings, Desjardins analyst David Newman is staying bullish on Chemtrade Logistics Income Fund (Chemtrade Logistics Income Fund Quote, Chart, News, Analysts, Financials TSX:CHE.UN). In an update to clients on Friday, Newman maintained his “Buy” rating and $12.00 target for CHE, which Newman called an excellent pandemic recovery trade.

Ahead of quarterly earnings, Desjardins analyst David Newman is staying bullish on Chemtrade Logistics Income Fund (Chemtrade Logistics Income Fund Quote, Chart, News, Analysts, Financials TSX:CHE.UN). In an update to clients on Friday, Newman maintained his “Buy” rating and $12.00 target for CHE, which Newman called an excellent pandemic recovery trade.

Industrial chemicals and services company Chemtrade Logistics is one of North America’s largest suppliers of sulphuric acid, inorganic coagulants for water treatment, sodium chlorate, sodium nitrite, sodium hydrosulphite and phosphorus pentasulphide and spent acid processing services, while its industrial services involve processing by-products and waste streams.

The company saw serving CEO Mark Davis retire at the end of February, with Scott Rook taking the helm, a move which puts Chemtrade heading in the right direction, Newman said.

“We believe CHE’s new CEO Scott Rook and the management team are on the right track to grow the business on the back of a far more stable chemicals outlook. Instead of focusing on acquisitions (once every few years), which was CHE’s previous strategy, the company plans to turn its focus inward to improve operational execution, invest in organic growth opportunities, drive cash flows and deleverage,” Newman wrote.

“Management aims to reduce its net debt/EBITDA by more than ~0.25x a year, driven by expected EBITDA growth of at least ~five per cent per year (obviously quicker on a sustained caustic soda and HCl recovery), and targets a ratio of <3.5x in the next two to three years. We forecast net debt/EBITDA of 4.4x in 2021, 3.7x in 2022 and 3.3x in 2023, in line with CHE’s plans, aided by the recent equity offering,” he said. Newman pointed to Rook’s prediction of at least five per cent EBITDA growth, which the company said will be driven by three factors: the market and COVID-19 recovery, organic growth especially in ultra-pure acid related to microchip production, water treatment chemicals and green hydrogen and operational and productivity improvements across the organization. Chemtrade, which has four operating segments in Sulphur Products & Performance Chemicals (SPPC), Water Solutions & Specialty Chemicals (WSSC) and Electrochemicals, is expected to report its first quarter 2021 financials on May 10 after market close. The company reported its fourth quarter 2020 in February where it posted revenue of $319.4 million, down by $35.9 million year-over-year, a net loss of $25.8 million compared to a loss of $12.6 million a year earlier, and EBITDA of $44.2 million compared to $70.3 million a year earlier. Revenue for the 2020 year was $1.4 billion compared to $1.5 billion in 2019 and EBITDA was $265.3 million compared to $295.6 million in 2019. Chemtrade said the 2020 year was a challenge for the company, with Q4 revenues falling due to lower sales volumes and lower selling prices for caustic soda and hydrochloric acid, lower sales volumes of sodium chlorate in its Electrochemicals segment and lower sales volumes for regen acid and merchant sulphuric acid in its SPPC segment. Newman said he’s increasingly bullish on CHE and pointed to data on the recovery in the chemicals markets. “The Chemical Activity Barometer (CAB) rose 0.7 per cent in April on a three-month moving average basis following a 1.1-per-cent increase in March and a 0.9-per-cent gain in February. On a year-over-year basis, the CAB was 12 per cent year-over-year higher,” Newman said. “According to the American Chemistry Council, production-related indicators were positive in April. Trends in construction-related resins and related performance chemistry were solid, indicative of robust gains in this sector. Resins and chemistry used in other durable goods were strong, reflecting growing orders for light vehicles, furniture, capital equipment, consumer electronics and other durable goods. Plastic resins used in packaging and for consumer and institutional applications were positive, a mark of rising consumer spending. Performance chemistry for industry was largely positive, reflecting strength in manufacturing. US exports were positive, while equity prices showed further gains. Product and input prices were positive, as were inventory and other supply chain indicators,” he said. “It would appear a recovery across the industry has taken hold, with most of CHE’s portfolio of chemicals trending higher,” Newman wrote. Chemtrade saw its share price decimated at the start of the pandemic in early 2020 and has yet to fully recover, finishing 2020 down 47 per cent. So far in 2021, the stock is up 29.5 per cent. But Newman sees upside from CHE, where at publication date his $12.00 target represented a projected one-year return of 66.9 per cent. For the upcoming Q1 2021, Newman is calling for Chemtrade to generate adjusted EBITDA by segment of $29 million for SPPC, $24 million for WSSC, $29 million for Electrochemicals and negative $19 million in Corporate for a total EBITDA of $64 million. Newman is expecting $300 million in EBITDA for 2021 and $342 million in 2022.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment