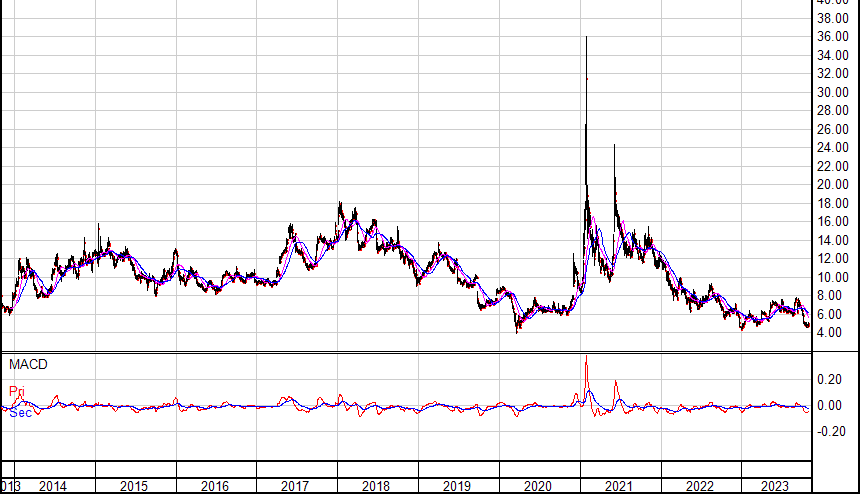

BlackBerry’s stock went nowhere under CEO Chen

Ten years and a day.

The tenure of John Chen is set to end after a decade and BlackBerry (BlackBerry Stock Quote, Chart, News, Analysts, Financials TSX:BB) shareholders seem to be relieved. They moved the stock higher Monday as his departure was announced.

After inheriting what The Globe and Mail’s Sean Silcoff described today as a “hodgepodge of businesses”, Chen spent a decade taking BlackBerry stock from just over six dollars to approximately five dollars.

On October 30, BlackBerry announced that Chen would retire, effective immediately.

“It has been an honour to lead and transform this iconic company over the past decade. I’m proud to have been able to establish BlackBerry’s vision of a trusted, software-defined world and to position the company to unlock value through the separation of our core business units into two separate operating companies,” Chen said. “I want to thank everyone across the BlackBerry community — the board, employees, customers, partners and more — for your support during my tenure and wish the company every success in the future.”

The much hoped for turnaround never happened under Chen. In the most recent quarter under his watch, the company’s Q2 reported September 28, BlackBerry lost $47-million on revenue of $132-million, down 21 per cent from the $168-million it posted in the same period a year prior.

Chen’s ride was a bumpy one with few highlights. A spike in share price in 2021 was due to the company becoming a “meme stock” on Reddit. In June of that year, a report from US-based shareholder advisory firm Glass Lewis gave BlackBerry’s executive pay plan a grade of “F”, saying much of the jump in share price over the period wasn’t caused by anything achieved by management or the company and thus the rewards currently being doled out under the compensation plan’s share performance hurdles were unjustified.

“Based on the company’s share price performance over the past fiscal year — prior to January 2021 the price hovered around $5 and peaked around $8.50 it appears to us that these tranches were earned as a result of the company’s sudden share price increase concurrent with the retail trading phenomenon observed in January 2021, which was characterized by extremely volatile trading patterns of shares in certain publicly traded brands, most famously GameStop,” said the Glass Lewis report.

A year prior, Brian Madden of Goodreid Investment took issue with Chen’s compensation, describing it as “simply egregious”.

Madden had a bone to pick with Chen’s pay structure, which had the CEO making at least $128 million through a five-year contract renewal announced in March 2018. That figure would have ballooned to $400 million if certain metrics were reached.

“You know, the executive compensation is simply egregious,” Madden said. “The CEO collected something like an $85-million signing bonus package, admittedly mostly in stock options, when he joined and collected another hundred and change last year. So, about $200 million has gone out the door and in his pocket since 2014 and the strategy is not working.”

The whispers about Chen’s pay did not start there. In 2018, fund manager Ben Gallander also had a problem with his compensation and pulled no punches in his assessment of it.

““I hate his pay package,” he told BNN Bloomberg. “It’s just greed, complete greed. I think he’s a great operator but it doesn’t make any sense.”

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.