Two pot stocks analysts think are buys in this market

The hype was enormous. Most did not live up to it. In the mid 2010’s, cannabis stocks were everywhere, playing on the promise of impending legalization and comparing the consumption levels of the stuff to alcohol.

Many investments went very wayward for many investors.

But somewhere along the way, a second level of company emerged. These were the ones that put their heads down and focused on revenue and profit. Today, devoid of hype, some of these companies are posting numbers that will make you take notice.

We profile two cannabis stocks that analysts think can make you money in 2023.

Rubicon Organics

Its second quarter numbers are in the books and Haywood analyst Neil Gilmer remains more than bullish on Rubicon Organics (Rubicon Organics Stock Quote, Chart, News, Analysts, Financials TSXV:ROMJ).

On August 16, ROMJ reported its Q2, 2023 results. The company posted Adjusted EBITDA of $1.77-million on revenue of $11.28-million, a topline that was up 28 per cent over the same period last year.

Gilmer summed up the quarter.

“Rubicon reported Q2/23 net revenue of $11.3M, a YoY increase of 28%, above our estimate of $10.6M,” he noted. Adjusted gross profit before fair value adjustments was $4.6M, representing a margin of 40.8% below our expectations for a margin of 41.6%. The Company reported Adjusted EBITDA of $1.8M (15.7% margin) compared to our forecast for EBITDA of $1.5M (14.3% margin). Cash flow from operations was positive $2.4M while free cash flow was positive $1.7M. The Company finished the period with $9.3M in cash and $10.1M in total debt, of which only $0.8M id due in the next 12 months.”

In a research update to clients August 17, Gilmer maintained his “Buy” rating and one-year price target if $1.75 on ROMJ, implying a return of 250 per cent at the time of publication.

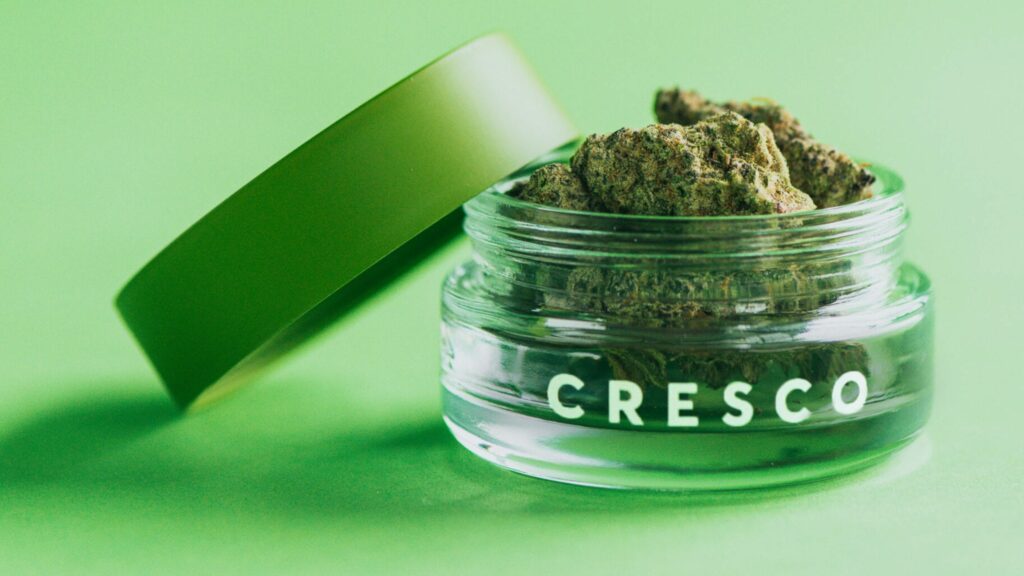

Cresco Labs

A more modest outlook for business in Illinois and New York has Beacon Securities analyst Russell Stanley trimming his price target on Cresco Labs (Cresco Labs Stock Quote, Chart, News, Analysts, Financials CSE:CL) but the analyst is still very bullish on the stock.

On August 16, CL reported its Q2, 2023 results. The company posted Adjusted EBITDA of $40-million on revenue of $198-million. Both numbers bested the street’s expectations and were up significantly over the same period a year prior.

Stanley reviewed the company’s performance.

“Cresco reported Q2/23 revenue/adjusted EBITDA of $198M/$40M v. our forecast of $194M/$28M and consensus at $195M/$31M. Adjusted EBITDA beat even the street-high estimate of $33M,” he said. “Overall revenue was slightly ahead of our forecast and consensus, while being down 9% y/y and up 2% q/q, with sequential growth in retail offsetting a flat top line for wholesale. The adjusted gross margin was 210 bps stronger than expected, and up 111 bps q/q, with management highlighting the exits of margin dilutive operations for the sequential improvement. While the GM outperformance was impressive, the bulk of the EBITDA beat came from OPEX. Raw SG&A expense came in under $71M in the quarter vs. our forecast of $72M, and down from $72M in Q1. Management reported adjusted SG&A of $61M in Q2, down from $68M in Q1 and $71M in Q2/22, with the adjusted SG&A margin improving 405 bps q/q and 150 bps y/y. The resulting adjusted EBITDA margins were 604 bps stronger than we expected, up 538 bps q/q, and reached their highest level since Q2/22. Taking a step back, CL produced 38% q/q adjusted EBITDA growth on a 2% revenue lift. Cresco also produced operating cash flow (CFO) of $18M, beating our forecast for negative $19M and the only other estimate at positive $5M.”

In a research update to clients August 16, Stanley maintained his “Buy” rating on the stock but lowered his one-year price target on Cresco from $5.75 to $4.25, implying a return of 181 per cent at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.