Its second quarter results have been put to bed and Roth MKM analyst Richard K. Baldry still thinks there is money to be made on Salesforce (Salesforce Stock Quote, Chart, News, Analysts, Financials NYSE:CRM).

On August 30, CRM reported its Q2, 2023 results. The company earned $1.28 per share on revenue of $8.60-billion, a topline that was up 11 per cent over the same period last year.

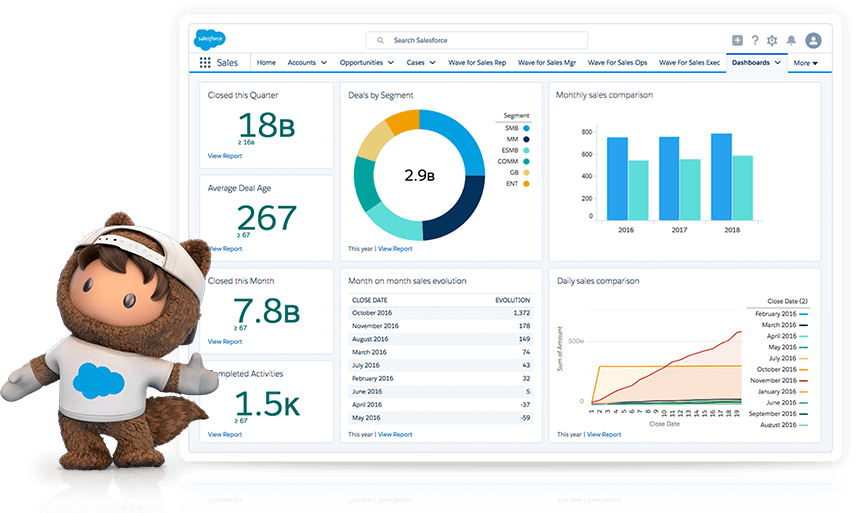

“Our transformation drove our strong second quarter results, delivering revenue of $8.6 billion and record GAAP and non-GAAP operating margins,” CEO Marc Benioff said. “Based on our performance and what we see in the back half of the year, we’re raising our fiscal year ‘24 revenue, operating margin, and operating cash flow growth guidance. As the #1 AI CRM, with industry-leading clouds, Einstein, Data Cloud, MuleSoft, Slack and Tableau, all integrated on one trusted, unified platform, we’re leading our customers into the new AI era.”

Baldry summed up the quarterly results.

“Revenues of $8.60B (up 11% y/y) beat our $8.52B forecast and returned to sequential growth after its unusual 1QF24 sequential revenue decline. Slowed enterprise spending remains a headwind, with revenue growth still far below both its prior long-term 20% target. North America grew 10% again as in 1QF24, but still well under 2HF23’s 15-16% and 1HF23’s 21-22%. While guidance implies stabilized growth in the 11% range for 2HF24, the risk remains that further North American macro deterioration could cause revenue misses as it generated 67% of 2QF24 revenues. As an offset, we now view the rapid emergence of generative AI technologies, and CRM’s ability to already support the technology across most of its offerings, as a potential near-term revenue accelerator to perhaps insulate CRM from recessionary risks.

In a research update to clients August 31, Baldry maintained his “Buy” rating and raised his one-year price target on CRM from $242 to $265.

The analyst thinks Salesforce will post EPS of $8.05 on revenue of $34.8-billion in fiscal 2024. He expects those numbers will improve to EPS of $9.19 on a topline of $38.7-billion in fiscal 2025.

“In May 2022, we upgraded CRM to Buy, viewing its >40% pullback as adequately compensating for its worst operational tendencies, such as steady dilution from expensive acquisitions and exorbitant stock-based compensation,” Baldry added. “With outside activists pushing for reforms, CRM responded by materially cutting costs, an action that saved 1QF24 earnings. Now, with costs essentially flat sequentially, upside 2QF24 revenue growth drove a sharp earnings upside breakout.”

Share

Share Tweet

Tweet Share

Share

Comment