CRM giant Salesforce (Salesforce Stock Quote, Chart, News, Analysts, Financials NYSE:CRM) is projecting healthy growth for the company over the next year, but portfolio manager Ross Healy thinks investors may want to be cautious as the stock and the tech sector in general are both looking overvalued.

CRM giant Salesforce (Salesforce Stock Quote, Chart, News, Analysts, Financials NYSE:CRM) is projecting healthy growth for the company over the next year, but portfolio manager Ross Healy thinks investors may want to be cautious as the stock and the tech sector in general are both looking overvalued.

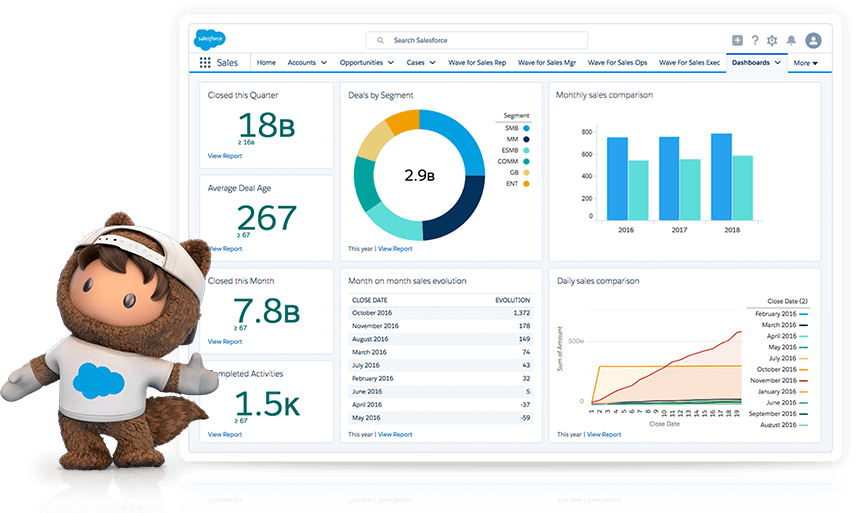

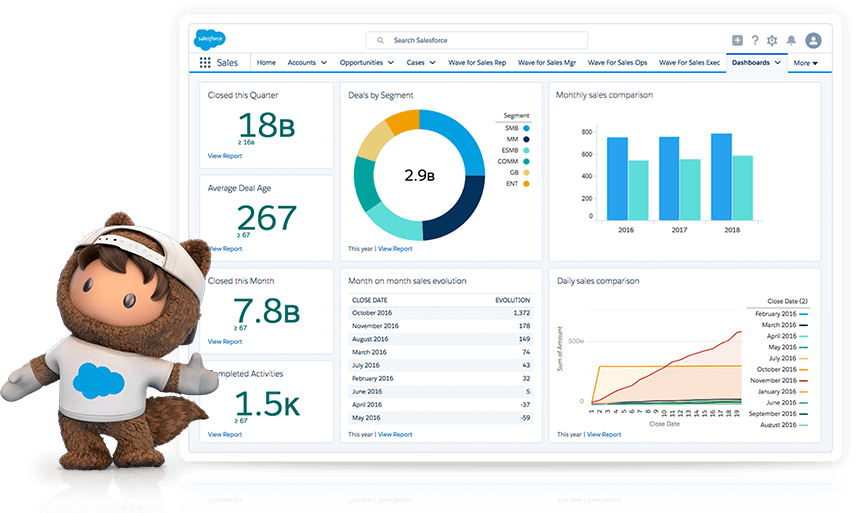

Salesforce surprised to the upside with its latest quarterly results, its fiscal Q1 delivered in late May, with management calling for revenue growth of 22 per cent for the full fiscal year, ended January 2022.

“We had the best first quarter in our company’s history,” said Marc Benioff, Chair and CEO, in a press release. “We believe our Customer 360 platform is proving to be the most relevant technology for companies accelerating out of the pandemic. With incredible momentum throughout our core business, we’re raising our revenue guidance for this fiscal year by $250 million to approximately $26 billion and non-GAAP operating margin to 18 percent. We’re on our path to reach $50 billion in revenue in FY26.”

Salesforce’s fiscal first saw revenue climb 23 per cent year-over-year to $5.96 billion and non-GAAP earnings hit $1.21 per share, as the company said it will benefit from economies waking up from their pandemic-induced slumber. Analysts had called for revenue of $5.89 billion and EPS of $0.88 per share. (All figures in US dollars.)

By segment, Salesforce’s Sales Cloud revenue was up 11 per cent in the quarter to $1.39 billion, while Subscription and Support rose 21 per cent to $5.54 billion and the company’s Professional Services and Other segment rose 47 per cent to $0.43 billion.

“Our performance in the first quarter was strong across all financial metrics,” said Amy Weaver, President and CFO. “We saw record levels of new business and strength across all products, regions, and customer sizes. Our impressive start to this year helps fuel our momentum for the rest of the year as we keep pace toward our goal of $50 billion in revenue in FY26.”

But Healy, chairman of Strategic Analysis Corporation and portfolio manager at MacNicol and Associates, thinks Big Tech has a significant comeuppance to deal with once the decade-long bull market reaches its end.

“When I look at the NASDAQ 100, that is, the growth stocks there, what I find is that they’re trading at almost a 50 per cent premium to their fair market values,” said Healy speaking on BNN Bloomberg on Monday. “This has been going on for a long time and as long as we have bull market conditions I expect that they will probably continue.”

“I would have no argument with [owning] Salesforce, in particular. It’s got nearly a 20-year trend, there’s the growth of the balance sheet and its earnings and fair market value, and it’s just beautifully straight up there,” Healy said. “And there’s no particular reason why that trend will buckle.”

“What may buckle, of course, is if we had a nasty bear market,” Healy said.

Salesforce caught everybody’s attention last summer when it joined the Dow Jones Industrial Average index and delivered a very strong quarterly earnings report, more than doubling the expected EPS and showing revenue growth of 29 per cent.

That drove Salesforce’s share price to a new all-time high of $281 compared to the $190 the stock was at pre-COVID and the $132 per share low it hit last March. But CRM has struggled like many tech names over the past six to nine months and is now pretty much at even since last October.

Healy said investors may be rewarded with Salesforce on a longer timeline but there could be some bumps in the road in getting there, as the company’s business won’t do too well during a tightening economy

“Back in 2008 there was actually quite a fall in CRM, and just as quickly when it was all over it bounced right back again to where it was,” Healy said. “So, if you have the courage of your convictions, even if things turned bad they will turn out okay for you.”

“But I can’t say this late in the bull market that I would be surprised if we if we got that sort of a dip again,” he said. “It depends on your time horizon and how comfortable you are with sitting through those sort of nasty moments.”

It’s unclear whether the market’s preference over the first half of 2021 for cyclical, COVID-recovery-related stocks in sectors like finance and industrials will continue over the second half of the year or whether traditionally growth-associated names in the tech sector will come back into favour.

Barclays recently released a report predicting an end to the cyclical story, saying, “We believe the COVID recovery trade has mostly run its course and, as such, market leadership is likely to change from Cyclical to Secular Growth stocks.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment