Docebo is heading higher, says ATB

Top and bottom line beats look good on Docebo Inc (Docebo Inc Stock Quote, Charts, News, Analysts, Financials TSX:DCBO), according to ATB Capital Markets analyst Martin Toner. Maintaining an “Outperform” rating on the stock in a Thursday update, Toner said investors should see revenue growth reaccelerate for Docebo as early as the current third quarter.

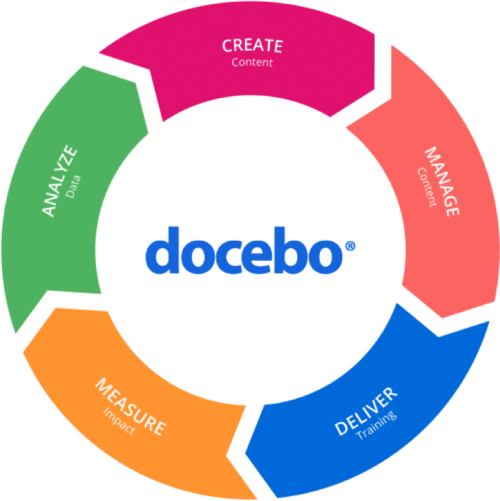

An online learning platform company, Docebo has a SaaS-based Learning Management System that uses AI to generate course content, to track user progress and provide advanced reporting.

The company reported its second quarter 2023 financials on Thursday, showing revenue up 25 per cent year-over-year to $43.6 million and a net loss of $5.7 million or $0.17 per share. Adjusted EBITDA for the quarter was $3.1 million compared to a loss of $0.3 million a year earlier. (All figures in US dollars unless otherwise stated.)

“In the second quarter, we exceeded the upper end of our revenue and profitability guidance by focusing on enterprise accounts across multiple verticals. Despite macroeconomic headwinds, this progress carried into Q3 as we signed a Big 5 US-based global technology leader,” said Claudio Erba, Founder and CEO, in a press release.

The $43.6 million topline was in-line with the consensus call at $43.1 million and better than Toner’s estimate at $42.7 million; meanwhile, the adjusted EBITDA of $3.1 million was a beat of the Street’s forecast at $2.6 million as well as the ATB estimate of $2.3 million.

Toner noted management’s third quarter revenue guidance of $45.9-$46.1 million, which came in above the consensus projection of $45.4 million. The analyst also noted Docebo’s Big 5 US-based global tech leader customer win which came after the end of the Q2, and he said DCBO’s recent government sector customer wins are another potential growth vector for the company.

Docebo shares were early and quick beneficiaries of the COVID impact on businesses, which pivoted to greater digital learning processes, but after rising sharply to as high as $110, DCBO fell hard, landing around $40 and staying there until the start of this year where the stock has been more around the $50 range.

Toner sees more upside from here and maintained a 12-month target of C$85.00, which at the time of publication represented a projected return of 79 per cent.

“The Company continues to execute well despite macro headwinds. We believe as the Company’s investments in the enterprise go-to market approach and the enterprise spending picks up, Docebo’s revenue growth will reaccelerate. Guidance implies that will happen in Q3/23,” Toner wrote.