Medexus Pharma is a “compelling opportunity,” says Echelon

Echelon Capital Markets analyst Stefan Quenneville stayed bullish on Medexus Pharmaceuticals (Medexus Pharmaceuticals Stock Quote, Charts, News, Analysts, Financials TSX:MDP) in a Thursday update to clients. Quenneville maintained a “Speculative Buy” rating on the stock, saying strong year-over-year revenue growth is a great sign for the company.

Specialty pharma company Medexus released on Wednesday preliminary revenue for its fiscal Q1 2024 (ended June 30, 2023), saying they expect $31-$31.5 million in revenue for a year-over-year increase of at least 34.5 per cent. (All figures in US dollars except where noted otherwise.)

The company said strong quarterly results from Rupall were a factor in what would be a record topline.

“This strong revenue performance keeps us on track in our progress toward our previously announced estimate of $20 million of total cash at September 30, 2023,” concluded Marcel Konrad, Chief Financial Officer of Medexus, in a statement.

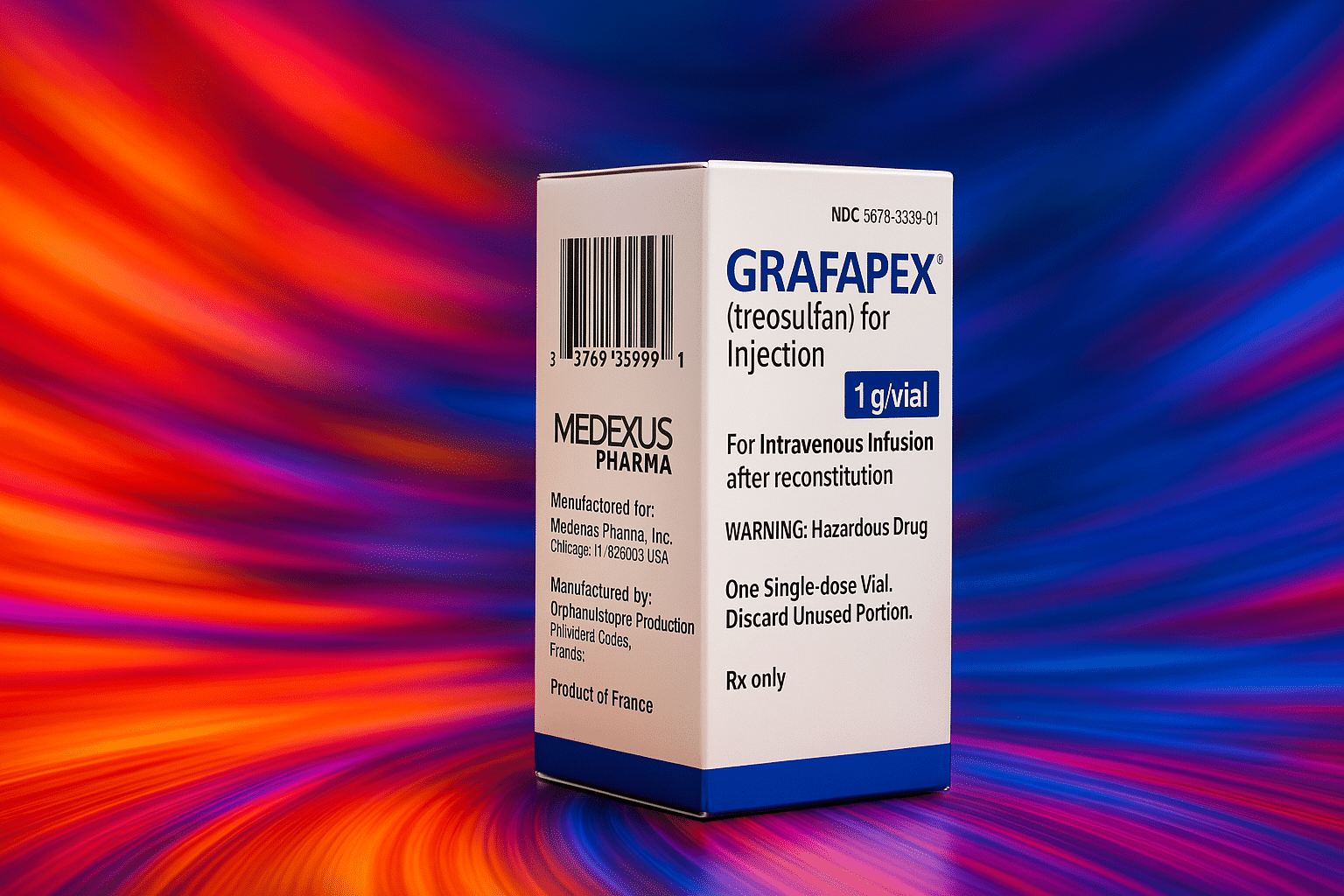

Quenneville said the preliminary Q1 revenue would be ahead of the current consensus at $29.0 million as well as Echelon’s own $28.7 million forecast. The analyst said with the solid beat, Medexus continues to show that despite delays in the potential FDA approval of Treosulfan, the company has been able to successfully leverage its sales force and infrastructure to grow its existing portfolio assets.

Quenneville added that with management also reiterating its guidance of having $20 million in cash by the end of September, and he said that along with the $20 million uncommitted accordion loan from BMO, the funds should help assuage investor concerns about the company’s ability to repay the approx. $40 million of its convertible debt, which matures in October 2023, without meaningful equity dilution.

“We continue to believe that MDP’s top line is poised to meaningfully grow in the coming years via successful product launches and label expansions. As such, we view MDP as a compelling opportunity for investors and reiterate our Speculative Buy rating and C$3.00/shr price target,” Quenneville wrote.

On a comps basis, Quenneville said MDP currently trades at 4.8x his calendar 2023 EV/EBITDA estimate, which is below its Canadian peers at 7.6x and also below the discounted cash flow value of MDP’s portfolio excluding Treosulfan, which the analyst estimated to be C$2.20 per share, while the risk-adjusted value of Treosulfan is estimated to be C$1.00 per share.

At the time of publication, Quenneville maintained C$3.00 target price represented a projected one-year return of 62 per cent.

Staff

Writer