Medexus Pharma is a Buy, says Roth

After reviewing the latest quarterly results from Medexus Pharmaceuticals (Medexus Pharmaceuticals Stock Quote, Charts, News, Analysts, Financials OTCQX:MEDXF), Roth Capital Partners analyst Scott R. Henry is sticking with a bullish call on the stock. Henry delivered a June 30 report to clients where he reiterated a “Buy” rating on Medexus, saying favourable trends appear to be continuing, as the company just posted its sixth straight quarter of positive adjusted EBITDA.

Specialty pharma company Medexus reported its fourth quarter fiscal 2023 (for the period ended March 31, 2023) on June 21, coming in with Q4 revenue of $28.6 per cent, which was good for a year-over-year increase of 41 per cent. The company said strong sales of IXINITY, its intravenous recombinant factor IX therapeutic for patients with hemophilia B, drove the topline ahead.

On earnings, the quarter saw Mexdexus generate $4.8 million in adjusted EBITDA compared to positive $1.1 million a year earlier. For the year, adjusted EBITDA at $16.1 million was a record for the company, one which it attributed to increases in net sales, a reduction in R&D costs and an increase in gross margin.

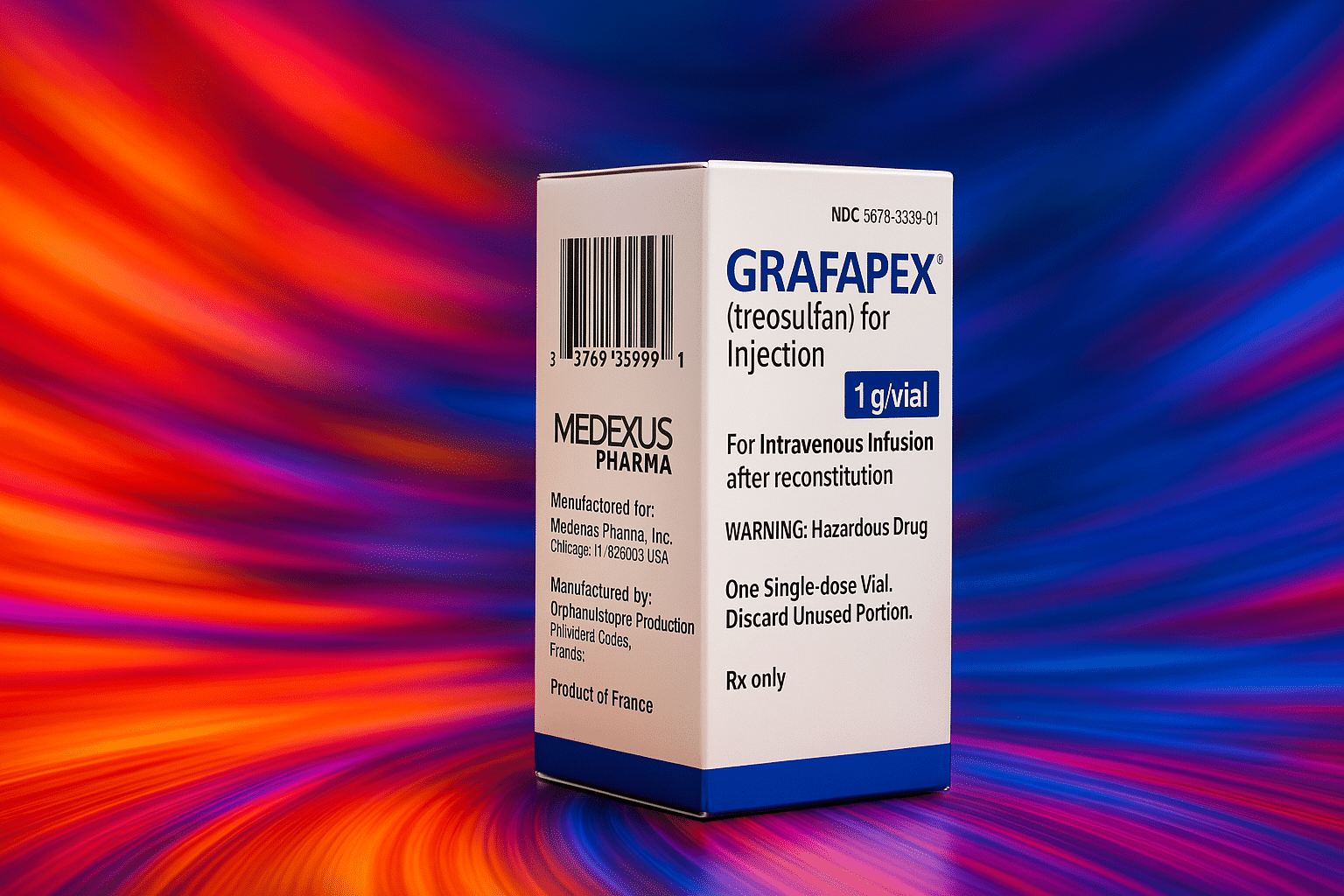

“We are excited about several products in our pipeline that we continue to advance. We recently secured the Canadian rights for terbinafine hydrochloride, a dermatology product, which is an excellent strategic fit with our market leading product Rupall,” said CEO Ken d’Entremont in a press release. “We remain optimistic about treosulfan’s prospects in the United States as our licensing partner works toward a resubmission to the US Food and Drug Administration.”

Henry said the $28.6 million in revenue compared to his forecast at $28.3 million, while Q4 gross margins of 57.4 per cent trailed his target at 62.0 per cent and resulted in gross profit of $15.0 million compared to Henry’s estimate at $15.8 million.

Among his takeaways from the quarterly results, Henry noted how IXINITY continues to drive upside, with by his calculations about $10.7 million in revenue, while Canadian sales were hurt by multiple products, including Medexus’ Metoject and Rupall. As well, Henry remarked that higher performance appears to be a trend with this company, while its debt visibility is improving, according to Henry, where the company has about $40 million in debt due around October 2023.

“The key, in our opinion, is for adjusted EBITDA to remain above ~$3M million per quarter (now three quarters in a row), which suggests a pathway to generate income after paying interest expense,” Henry said. “This near-term Financial risk does make shares more speculative.”

Henry said the in-line results prompted him to retain a 12-month target on the stock of $3.00 per share, which at the time of his publication represented a projected return of 138 per cent.