Shares of MDA Ltd (MDA Ltd Stock Quote, Charts, News, Analysts, Financials TSX:MDA) have been cut down sharply over the past year and a half. But with plenty of tailwinds in the space tech industry and a strong growth profile, investors could see the stock take off.

MDA has a long history as a robotics and space technology company in Canada, having previously been a Canadarm designer as Spar Aerospace and then as MacDonald, Dettweiler & Associates. That company merged with DigitalGlobe in 2017 and moved its headquarters to the United States and rebranded as Maxar Technologies. Maxar then sold off MDA in April 2020 to a Canadian private equity firm and again went public in 2021.

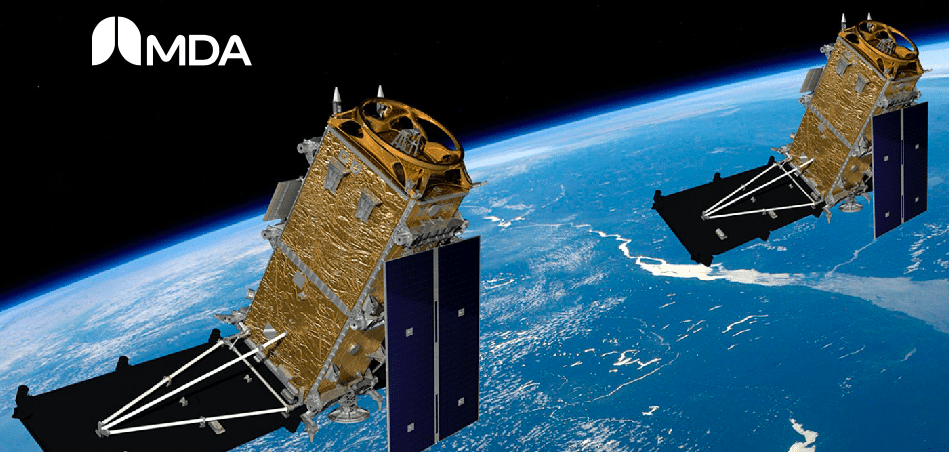

MDA won a contract in 2020 from the Canadian Space Agency to design and develop the Canadarm 3, and the company has been picking up business along the way over the past three years, including last month when it announced a contract from L3Harris to design and build antennas and control electronics for the Space Development Agency’s low Earth Orbit constellation.

“We are very pleased to work with L3Harris on this important space security program as the need for space-based capability increases,” said Mike Greenley, CEO of MDA. “This award from one of the largest U.S. defence industry primes is a strong endorsement of MDA’s best-in-class design and manufacturing capabilities and another example of our strategy in action as we expand MDA’s share of the growing global LEO constellation market.”

MDA’s share price was up around $16 in November 2021 and then got hammered during the tech rout, bringing the stock to as low as $6 before rallying to now in the low-$8 range.

As reported in the Globe and Mail, Scotia Capital analyst Konark Gupta gave a “Sector Outperform” rating last month to MDA and a target price of $12, saying the stock is currently trading at a deep discount to its peer group, as management looks to rebuild credibility after having twice reduced its 2022 guidance and worried investors about its cash burn and capital spending.

But Gupta said MDA has identified a revenue pipeline worth over $15 billion over the next five years, in Satellite Systems, Geointelligence and Robitics; meanwhile, the global space market is expected to growth at a 6.3 per cent CAGR through to 2031.

“The company touches nearly every aspect of the space ecosystem and is benefiting from positive long-term secular tailwinds in the global space market, which has attracted significant public and private capital over the past decade as commercialization increases and investors realize the longterm potential of the industry,” Gupta wrote.

Share

Share Tweet

Tweet Share

Share

Comment