Leede Jones Gable initiated coverage on Monday on ad tech company Gamelancer Media (Gamelancer Media Stock Quote, Charts, News, Analysts, Financials CSE:GMNG), with analyst Greg McLeish saying the company is a leader in the influencer marketing space.

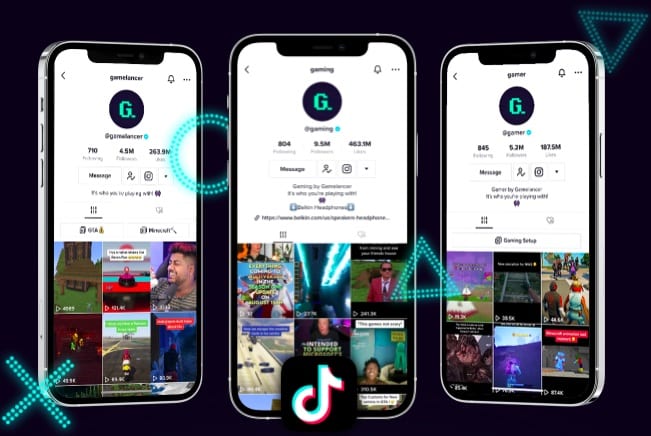

Acquired by Wondr Gaming last spring, Toronto-based Gamelancer produces short-form video content for brands for its owned and operated network of social media channels. The company has 54 channels that collectively have over 40 million followers and subscribers that generate over two billion monthly video views, with its ranks of followers growing by 1.5 million on a monthly basis.

McLeish said it’s Gamelancer’s heft with the Gen Z and millennial cohorts that sets it apart from other companies, as it’s these lucrative demographics that are the focus of many advertisers’ attention.

“Gamelancer is the leading gaming network and the number one social media platform for Gen Z and millennial audiences on TikTok,” McLeish wrote. “With a massive following of over 41 million users and exclusive access to their audience, Gamelancer generates billions of monthly views and controls the content that is distributed on their channels.”

“The company leverages its influencers to produce custom content for promoting brands across its network, resulting in a unique personality and voice that creates memorable and engaging content,” he said.

Moreover, McLeish argues that with the age of the third-party cookie seemingly coming to a close, advertisers the world over will be relying much more heavily on first-party data, i.e., information collected directly from a company’s own channels and consumer interactions.

That’s right up Gamelancer’s alley, as they generate “vast amounts” of first-party data from their channels, McLeish says.

“Gamelancer provides its audience with content pertinent to Gen Z and millennials and offers marketers and brands unparalleled access to these communities. Branded user generated content or original content campaigns are integrated with Gamelancer content, which is curated to perform like its organic content, enabling the company to over-index on industry average key performance indicators (KPIs) on every campaign,” he said.

On its financials, McLeish is expecting Gamelancer’s revenue to go from $10.0 million in 2023 to $22.9 million in 2024 and to $49.3 million in 2025. EBITDA is forecasted to go from negative $184,000 in 2023 to positive $7.3 million in 2024 and to $20.5 million in 2025.

On valuation, McLeish has applied a 15x EV/EBITDA multiple to his 2025 forecasts to arrive at a 12-month target price of $0.40 per share. The analyst said the company’s peers in the influencer marketplace are currently trading at an average of 15.5x.

McLeish issued a “Buy” recommendation on the stock, with his $0.40 target representing at press time a projected return of 300 per cent.

Share

Share Tweet

Tweet Share

Share

Comment