Shares of DIAGNOS Inc (DIAGNOS Inc Stock Quote, Charts, News, Analysts, Financials TSXV:ADK) have shot up recently for a gain of over 30 per cent so far in the month of July alone. But investors should see more upside to come, according to Echelon Capital Markets analyst Stefan Quenneville. In a review on Friday of the company’s latest quarterly results, Quenneville reiterated both a “Speculative Buy” on the stock and a Top Pick rating, saying the back half of 2023 should be catalyst-rich for DIAGNOS.

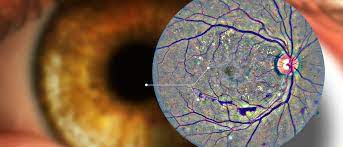

Montreal-based DIAGNOS markets the CARA (Computer Assisted Retinal Analysis) software screening tool as part of its FLAIRE platform for the detection of diabetic retinopathy (DR). CARA is an image enhancement and AI analysis tool that integrates with existing optometry equipment to enable early detection, triage and monitoring of DR, and the company is commercializing its tech through the New Look Vision chain of stores in Quebec and Central America, while the company also has an MOU for commercializing FLAIRE with optician giant EssilorLuxottica.

DIAGNOS released on Wednesday its fiscal fourth quarter 2023 financials for the period ended March 31, with revenue at $68.3K, down 55 per cent from a year earlier, and an EBITDA loss of $556.7K. Both top and bottom numbers were below Quenneville’s estimates at $117.4K and negative $246.5K, respectively. The analyst said a slower than expected New Look rollout was to blame, along with challenges in implementing an updated Electronic Medical Record (EMR) system across New Look’s 400+ store base.

Quenneville said DIAGNOS has set a year-end target of 150 locations with the FLAIRE platform by the end of the year, but the analyst is conservatively modelling 100, given the challenges faced so far.

“While the New Look roll-out has meaningfully lagged our expectation, with only 27 installations to date (versus 17 locations in January), the recent completion of the EMR implementation and public statements from New Look highlighting its eagerness to ramp-up the roll-out provides the needed confidence that the store count will accelerate into the end of the year and beyond,” Quenneville wrote.

At the same time, Quenneville noted that the Quebec government is expected to re-tender an RFP for a multi-year, AI-based diabetic retinopathy screening program in the coming weeks, and he said DIAGNOS remains well-positioned to win the contract. That plus the “potential transformational deal” with EssilorLuxottica still being pursued, DIAGNOS has multiple value-creating opportunities over the second half of the year.

With his “Speculative Buy” rating, Quenneville also reiterated a target price of $1.00 on ADK, representing at press time a projected one-year return of 82 per cent.

“We reiterate our Top Pick rating ahead of what is shaping up to be a catalyst-rich C2023,” Quenneville wrote.

Share

Share Tweet

Tweet Share

Share

Comment