Xponential Fitness is a Buy, says Roth

A short report seems to have investors sweating over fitness brands franchisor Xponential Fitness (Xponential Fitness Stock Quote, Charts, News, Analysts, Financials NYSE:XPOF), but Roth Capital Partners analyst George Kelly thinks the reaction is overblown. In a Tuesday report on XPOF, Kelly said taking advantage of weakness in the stock would at this point be a wise move.

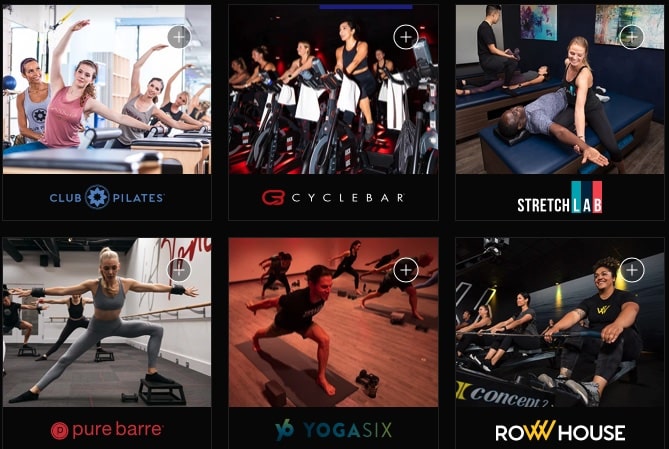

Xponential Fitness, which operates a diversified platform of ten brands in the boutique fitness sector, issued a statement on Wednesday regarding the recent report from Fuzzy Panda Research. The latter makes a number of claims against XPOF, including concerns about brand health, lawsuits against CEO Anthony Geisler and sales of stock by company execs. The initial impact was a more than 35 per cent drop in share price for XPOF.

In response, Xponential said the report “contains inaccurate information” and cautions investors from relying on it. The statement from Xponential also listed a number of points outlining the strengths in the company’s franchise system.

“The Board and Management stand firmly behind the strength of the business and health of its franchisees. As the largest global franchisor of boutique fitness brands, we take great pride in our talented team and strong financial results, illustrated by solid and growing average unit volumes and same store sales. Xponential’s scalable business model, strong free cash flow generation and history of margin expansion position the Company for continued success,” read the statement.

Commenting, Kelly said that while some of the information released in the Fuzzy Panda report “was indeed concerning,” other aspects were misleading and/or inaccurate.

“We disagree with the primary contention that most units are unprofitable and most brands are in distress,” Kelly wrote.

The analyst said the Fuzzy Panda’s report provides franchise average unit volume numbers (AUVs) which misrepresent the state of several of Xponential’s key brands. He said, for instance, that Club Pilates and Pure Barre, which together account for about 55 per cent of Xponential’s total locations, ended the recent fiscal year with run-rate revenue “well ahead” of the AUV’s given in the report. Of XPOF’s top five brands, only Stretch Lab exited the year with a lower run-rate revenue, and Kelly said Stretch Lab is “unique” given its tremendous unit growth over the period.

On the allegations against the CEO, Kelly said much of the report’s content was anecdotal or settled long ago, while on the stock sales, Kelly said CEO Geisler and Chairman Mark Grabowski did recently sell stock but that more context is relevant, in that Geisler bought stock in the open market shortly after the IPO and still owns about 8.2 million shares, while Grabowski’s private equity firm sold in two secondary offerings but still owns about 15 million shares.

At the same time, Kelly agreed with the claim in the report that XPOF’s transition studios approach is “not a productive strategy” and hoped that management allows for more franchise closures, adding that with only 87 transition studios, the issue is not hugely material for the company regardless.

With the update, Kelly maintained a “Buy” rating on Xponential Fitness while lowering his target price to $32, which at press time represented a projected 12-month return of 104 per cent.

“XPOF now trades at 8.8x FY24 EBITDA and with a 10.6 per cent FCF yield, which we believe is compelling. Our PT falls as it may take time for the market to fully digest the report. Our new $32 PT is based on 16.1x FY24 EBITDA,” Kelly wrote.