Lightspeed Commerce keeps Outperform rating with National Bank

National Bank Financial analyst Richard Tse is staying bullish on Canadian e-commerce company Lightspeed Commerce (Lightspeed Commerce Stock Quote, Charts, News, Analysts, Financials NYSE:LSPD), saying in a recent report that investors should applaud management’s new streamlined business plan.

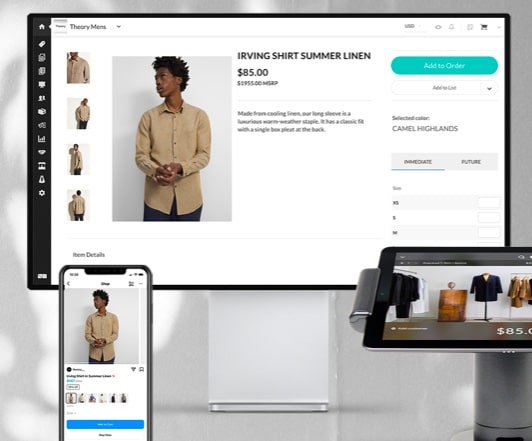

Montreal-headquartered Lightspeed, which offers a cloud-based point-of-sale (POS) system for retailers and restaurants, last month said in an update that it was gunning for profitability through doubling down on its Payments business by requiring that all new merchants use the service. The company has a range of products for clients including inventory, loyalty, sales and analytics solutions, along with order management and POS features specific to both retail and restaurant.

Tse said NBF recently met with with Lightspeed CEO JP Chauvet and Head of Invesetor Relations Gus Papageorgiou, saying the move to cut down on operational complexity is putting the company in a position to take advantage of scaling leverage heading into 2024.

Tse said the market’s reaction to LSPD — the stock went from $120 two years ago to now $15 per share, with no upward movement over the past six months, unlike many other stocks in the tech sector — was partly fuelled by the complexities caused by the company’s nine acquisitions over the space of two years.

At the same time, the analyst said LSPD is currently trading at 1.7x EV/Sales on 2024’s numbers and has $800 million of cash on the balance sheet. That makes the stock “hard to ignore,” according to Tse.

Tse discerned from the meetings that the attempted shift towards becoming profitable has not been easy for Lightspeed.

“What we took away was a Company that’s had to make concessions on growth given the sentiment shift to profitability. From a unit economics standpoint, it believes its LTV:CAC of 3-4x has the potential to double with Payments,” Tse wrote in his June 22 report.

“For investors, the benefit is that Lightspeed should be in a positive EBITDA position next fiscal year. That said, our impression was that Management was frustrated by this profitability constraint based on its view that it’s in a position to capture considerable share in a market that’s ripe for consolidation,” he said.

On the new strategy, where the company is no longer selling its platform without the Payments solution (and is charging a 50-basis points service fee for those businesses that continue to use a non-Lightspeed payment provider), Tse said the prospects look good, as the company has so far been able to convert existing subscribed merchants at a high rate.

Tse related that Lightspeed expects the all-in costs to convert its existing merchant base to a target penetration of over 60 per cent should be just $12 million.

“To us, that means it should be more than reasonable to see the Company drive its existing penetration around ~20 per cent towards 35 per cent next fiscal year and towards 50 per cent the year after. We estimate each 10 per cent in incremental penetration under the trailing 12-month GTV, would drive ~$200 million in gross revenue,” Tse wrote.

With the update, Tse reiterated an “Outperform” rating on LSPD and 12-month target of US$20.00, which at press time represented a projected return of 31.2 per cent.

Staff

Writer