More good news from Eupraxia Pharmaceuticals (Eupraxia Pharmaceuticals Stock Quote, Charts, News, Analysts, Financials TSX:EPRX) has boosted the stock higher, but investors will want to stick around for more upside. That’s according to Raymond James analyst Rahul Sarugaser, who delivered on Monday a report to clients where he reiterated a “Strong Buy” rating on EPRX.

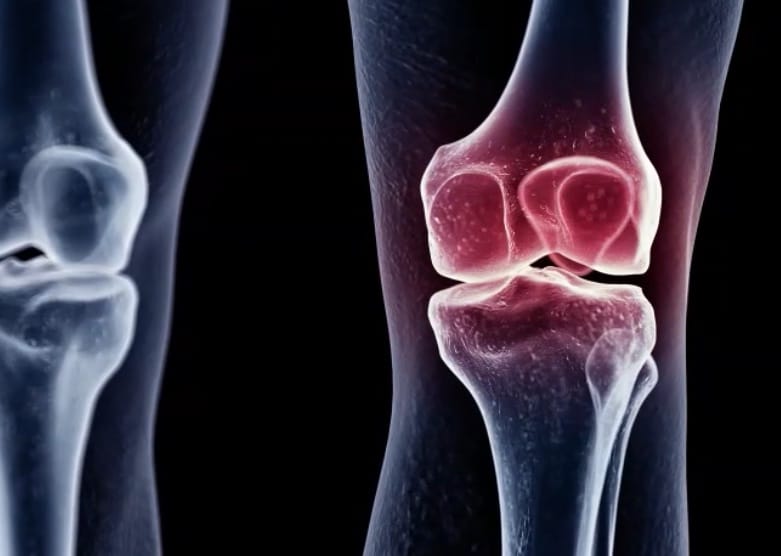

Eupraxia shares went for a 12 per cent gain on Monday after the clinical-stage biotech company released results from its Phase 2b trial of lead candidate EP-104IAR, in development for the treatment of osteoarthritis (OA) of the knee. The company said the trial met its primary endpoint with a clinically meaningful and statistically significant improvement on pain over placebo over a 12-week period. The drug also showed statistically significant improvement in three of four secondary endpoints.

“We believe these Phase 2b results move us closer towards that goal, which could potentially change the OA treatment paradigm,” said CEO Dr. James Helliwell in a press release. “If approved, this represents a significant opportunity to treat millions of underserved patients. In addition, these data provide further validation of our technological platform and the potential for its use in other indications.”

Based on the results, the company said it will now “aggressively pursue” a Phase 3 program, mentioning that the US FDA has granted fast track status to EP-104IAR due to a significant unmet need.

Sarugaser said the Phase 2b results provide a strong basis for repeat and bilateral dosing, for which no other OA drug is currently indicated.

“Eupraxia Pharmaceuticals reported positive top-line results from its Phase 2b clinical trial of EP-104IAR among 318 patients with osteoarthritis (OA), meeting its primary endpoint, three of four secondary endpoints, and all safety criteria, collectively demonstrating clinically meaningful and, importantly, durable pain relief,” Sarugaser wrote.

The analyst noted that the study used Eupraxia’s polymer vehicle as the placebo, whereas competitor Flexion had used saline solution as placebo during its Phase 2 and 3 studies of Zilretta. He said given the higher viscosity and associated potential for short-term OA pain relief in EPRX’s vehicle alone, Sarugaser suggested that the separation of EPRX’s active versus placebo curves could be interpreted as a more impressive result compared to those yielded by Zilretta.

“We are curious to learn more about the absolute duration of pain relief conferred by EP-104IAR in EPRX’s present study,” Sarugaser wrote.

With his “Strong Buy” rating, Sarugaser maintained a 12-month target of $11.00 per share, which at press time represented a projected return of 64 per cent.

Share

Share Tweet

Tweet Share

Share

Comment