Following the announcement of a new financing, Raymond James analyst Rahul Sarugaser has lowered his price target on Eupraxia Pharmaceuticals (Eupraxia Pharmaceuticals Stock Quote, Chart, News, Analysts, Financials TSX:EPRX), although the analyst remains very bullish on the stock.

On March 15, EPRX announced it had raised $33.9-million in an overnight marketed public offering.

In a research update to clients March 18, Saurgaser maintained his “Strong Buy 1” rating on EPRX, but lowered his price target on the stock from $19.00 to $16.50.

The analyst explained the reasoning behind the move.

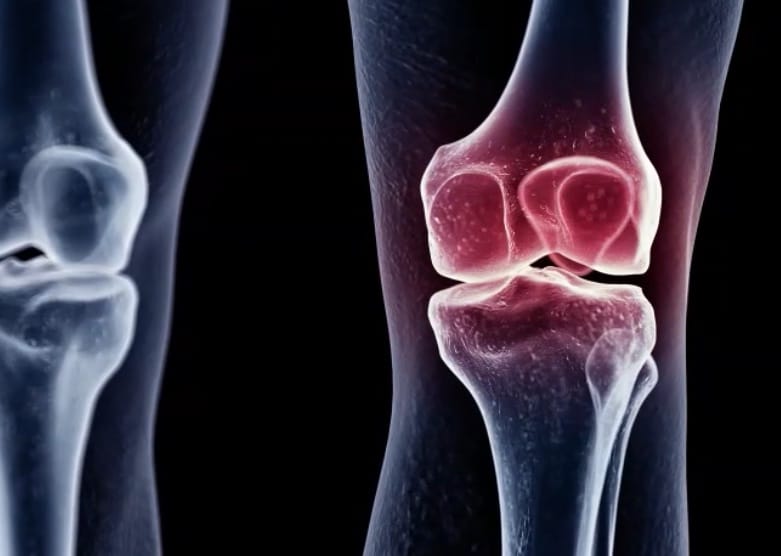

“EPRX closed its public offering of 8.3 mln sh. for total proceeds of C$33.9 mln, which, while 25% dilutive, (and drives our PT to $16.50), pushed Cash to ~$60 mln. We calculate this either partially funds both its ongoing programs—Ph 1b/2a in EoE + Ph 3-ready in OA—or, EPRX could choose to reserve the ~$60 mln to fully fund its EoE program (which we consider its lead asset) through registrational trials to an FDA NDA, while concurrently seeking a partner to co/fund the OA program,” he wrote. “This way, EPRX could bring its EoE program across the finish line (FDA registration), keeping full economics from EoE, while maximizing the market impact of its OA asset by securing a partnership with a mid/large pharma player (giving up some economics, but diluting only the OA asset vs. the entire company). We believe this alternative strategy represents the more accretive (less dilutive) path to maximizing shareholder value.”

Saurgaser broke down his valuation on EPRX, in light of the new financing.

“We value EPRX using a sum of the parts (SOTP) risk-adjusted NPV (rNPV) analysis of its two clinical assets in OA + EoE (Ex. 3). We maintain our est. value of EoE ($493 mln), and, assuming OA would be 50% partnered, reduce its value to $288 mln (was $575 mln) for a SOTP of $781 mln. Adding 8.3 mln sh., we calculated a FD sh. count of 47.0 mln sh., which impels our PT to $16.50 (was $19).” he said.

What does “Eupraxia Pharmaceuticals do (via Raymond James).

“Eupraxia Pharmaceuticals, Inc. is a Victoria, BC-based clinical stage biotechnology company focused on the development of locally delivered, extended-release therapeutic candidates. The company’s lead clinical candidate, EP-104IAR, is in development for the treatment of osteoarthritis (OA) of the knee and for treatment of eosinophilic esophagitis (EoE). Eupraxia’s drug delivery technology is equally relevant for the treatment of other forms of OA (e.g. hip, shoulder), and may be deployed toward a wide range of other indications, delivering drugs that could be improved by an extended-release profile.”

Share

Share Tweet

Tweet Share

Share

Comment