The stock is down by half over the past two years, but Echelon Capital Markets analyst Stefan Quenneville thinks investors will profit from owning Cognetivity Neurosciences (Cognetivity Neurosciences Stock Quote, Charts, News, Analysts, Financials CSE:CGN) over the coming 12 months. In a Tuesday report to clients, Quenneville said a new large-scale contract win, the first of its sort for CGN, gives a boost of confidence to the company’s platform.

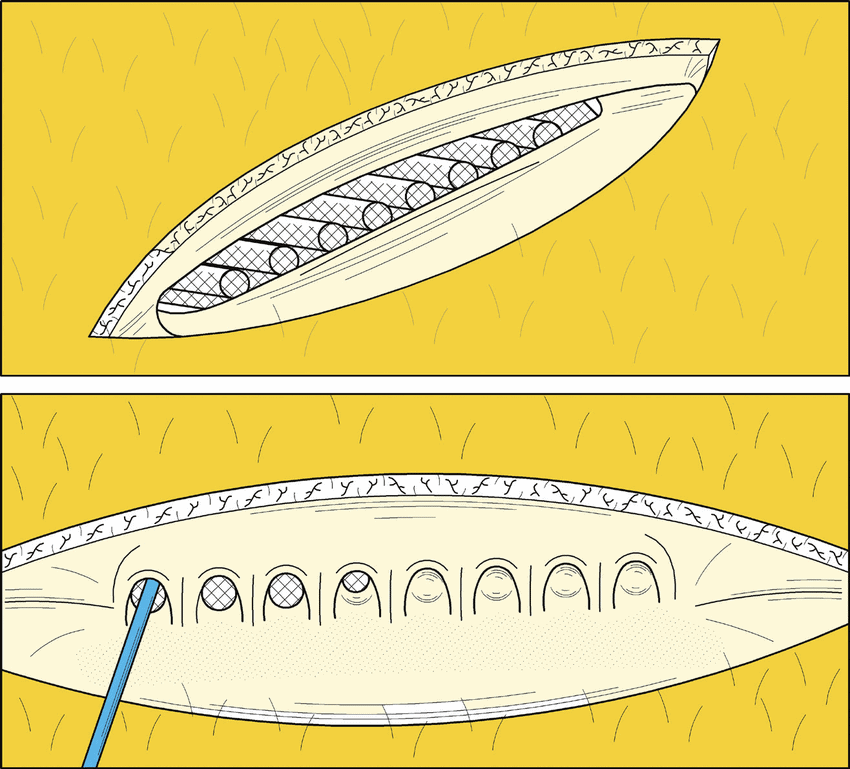

Cognitivity Neurosciences uses AI to enable early detection of cognitive decline in neurodegenerative diseases like Alzheimer’s dementia (AD). The company has an app-based, FDA-cleared Integrated Cognitive Assessment (CognICA) platform that replaces time-consuming pen-and-paper assessments conducted by clinicians.

Vancouver-based CGN announced on Tuesday an agreement signed with Japanese insurance company Mitsui Sumitomo Aioi Insurance (MSA) to provide CognICA tests to MSA’s roughly four million policyholders. CGN said the two companies are also engaging in negotiations to potentially conclude a distribution agreement for undisclosed Asian markets by mid-2023.

CGN said the contract is the first agreement of many it has planned as it rolls out the CognICA platform.

“This agreement demonstrates the growing demand for innovative tools that enable early detection and proactive management of brain health,” said Cognetivity CEO Dr. Sina Habibi in a press release. “We look forward to working with MSA to improve the health of their customers and to set new standards for brain health in the Japanese and APAC markets.”

Commenting on the news, Quenneville says the contract validates the value proposition of CognICA and, if it can successfully close the distribution agreement in the coming months, will provide Cognetivity with a credible commercial partner to spur growth in the Asian markets. He added that the contract comes with potential annual revenue of about US$3.4-US$5 million, with that revenue starting in the second half of the current calendar year.

“We continue to view CGN as meaningfully undervalued given the CognICA platform’s proven efficacy, ease of use and scalability,” Quenneville wrote.

The analyst said his estimates on CGN already included some larger contract wins; nonetheless, this one renews his confidence in his projections while allowing for upside.

Quenneville is estimating full fiscal 2023 (year end January 31) revenue of $0.1 million, followed by $1.8 million for fiscal 2024 and $5.5 million for 2025. On EBITDA, the call is for negative $6.4 million in fiscal 2023, negative $5.6 million in 2024 and positive $1.3 million in fiscal 2025.

With the update, Quenneville reasserted a “Speculative Buy” rating and $0.75 per share target price, which at press time represented a projected one-year return of 134 per cent.

Share

Share Tweet

Tweet Share

Share

Comment