Paradigm Capital analyst Scott McAuley shaved a bit off his target price for Spectral Medical (Spectral Medical Stock Quote, Charts, News, Analysts, Financials TSX:EDT) in a new report on Sunday. McAuley said it’ll likely be a longer wait for trial results for the clinical stage medical device company’s septic shock therapy PMX but that investors will ultimately be rewarded for their patience.

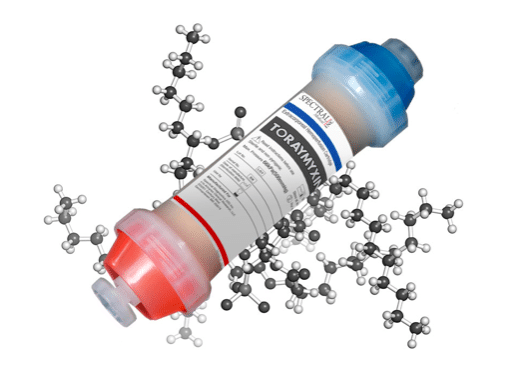

Toronto-based Spectral Medical has in its product portfolio the sepsis diagnostic EAA, dialysis products SAMI and DIMI and PMX or Toraymyxin, which is a device to remove endotoxin from the bloodstream as a treatment for sepsis.

PMX has been approved for use in Japan and Europe, while in July of last year, the US FDA granted Breakthrough Device Designation for PMX for the treatment of endotoxemic septic shock, a condition which has a 50 per cent mortality rate and currently has no FDA-approved treatments.

Spectral is currently recruiting for a Phase 3b study of PMX in endotoxemic septic shock and, with the release of its fourth quarter and full year financials on March 24, announced that it has enrolled 53 patients to date, with an end goal of 150 patients.

The company said once it hits its 90-patient interim milestone, strategic commercial partner Baxter will review the data and provide a second milestone payment to Spectral.

“We have an active pipeline of nine new sites in the clinical trial agreement phase, which should increase our number of sites to a total of 25 sites onboarded by the end of the third quarter of 2023. With a target of 25 sites, we believe we can finalize enrolment for Tigris. We are committed to advancing Tigris and believe PMX, if ultimately approved, will play a major role in reducing the tragic rates of mortality caused by sepsis,” said Spectral Chief Medical Officer Dr. John Kellum in a press release.

In his review, McAuley said Spectral’s financials ($1.7 million in revenue for 2022 and negative EBITDA of $7.1 million) were in line with his forecast, a lack of strong progress in recruiting for the Phase 3b Tigris trial was notable.

At the same time, McAuley said full recruitment will eventually come, although with about $8.4 million in cash at the end of 2022, Spectral will likely need another cash injection to get the trial over the finish line, McAuley said.

“We continue to wait for recruitment to accelerate into the PMX trial; however, we believe that it is a matter of when, not if, the study is eventually successful,” McAuley wrote.

“We have pushed back our expectation for FDA clearance and first revenue from 2024 to 2025, rolled forward our rNPV, and increased the assumed dilution from an additional financing to bridge the gap to the Baxter milestone payments at 90 patients and on FDA clearance. This reduces our target to $1.70 (was $1.90),” he wrote.

With the update, McAuley retained a “Buy” rating on Spectral Medical, while his lowered $1.70 target represented at press time a projected one-year return at the time of publication of 440 per cent.

Share

Share Tweet

Tweet Share

Share

Comment