Roth Capital analyst Craig Irwin likes what he sees from Vancouver-based Nano One Materials Corp. (Nano One Materials Corp.Stock Quote, Chart, News, Analysts, Financials TSX:NANO).

Roth Capital analyst Craig Irwin likes what he sees from Vancouver-based Nano One Materials Corp. (Nano One Materials Corp.Stock Quote, Chart, News, Analysts, Financials TSX:NANO).

In a research report to clients March 13, Irwin initiated coverage of NANO with a “Buy” rating and a one-year price target of $7.00, a figure that implied a return of 100 per cent at the time of publication.

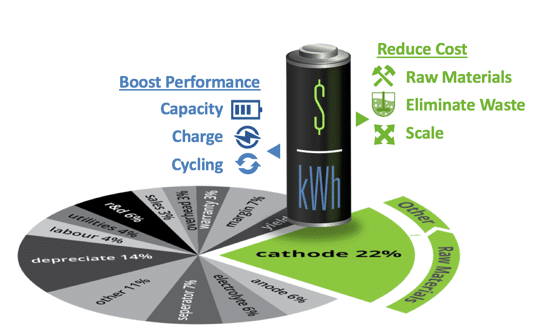

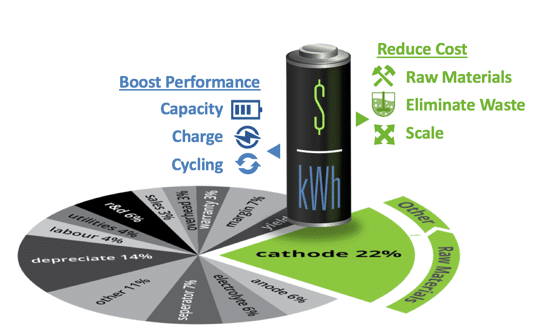

“Nano One is an emerging technology company introducing solutions to produce high-performance cathode materials, with captive production, also pursuing a licensing and royalty revenue model. The company was founded in 2011 and came public through a reverse merger in 2015 and is focused on commercializing its proprietary One-Pot process,” the analyst explained. “Management estimates the One-Pot process can deliver 20% to 40% lower cost cathode materials for lithium-ion batteries, while achieving substantial environmental benefits. Progress at Nano One has been supported by around C$13 million in grants and C$76 million invested capital to date, with progress affirmed by the issuance of 24 patents, plus 47 patents pending globally. Management has attracted an impressive group of nine development partners including Umicore, Saint Gobain, BASF, Volkswagen, two undisclosed automotive OEMs, Rio Tinto, Euro Manganese, and CBMM. The acquisition of Johnson Matthey Battery Materials in November 2022 added a team of 46 experienced technologists, greatly expanding engagement and execution capacity, while providing a path to more rapid production and development.”

Although the analyst cautions that NANO is still in the pre-revenue stage, he says he believes the company could have as many as twenty One-Pot process lines running around the world by 2027. This accomplishment, he estimates, would generate (C) $50 million in untaxed income, which is how the analyst arrives at his valuation.

“Applying a 30x multiple in this earnings scenario for unique technology and an impressive growth outlook, and discounting back at 20% for four years, implies a C$7.00 stock on 105 million shares,” he said.

Share

Share Tweet

Tweet Share

Share

Comment