Helium Evolution is a Buy, says Eight Capital

There’s massive exploration upside to Calgary-based Helium Evolution (Helium Evolution Stock Quote, Charts, News, Analysts, Financials TSXV:HEVI), according to Eight Capital analyst Christopher True, who launched coverage of the stock on Wednesday with a “Buy” rating. True says successful near-term helium well results could produce meaningful upside for the stock and company.

2022 was a record year for helium prices, as global supply was constrained by a number of events including a fire at a Russian gas plant. Together they led to an estimated shortage last year of two bcf/y (billion cubic feet per year), roughly 30 per cent of global demand.

Helium is key to a number of industries, including semiconductor manufacturing, welding, magnetic resonance imaging and a wide array of engineering applications. Earlier this year, the US Geological Survey said it’s seeking public comment on the potential for helium supply risk, even as the US remains the world’s leading helium producer.

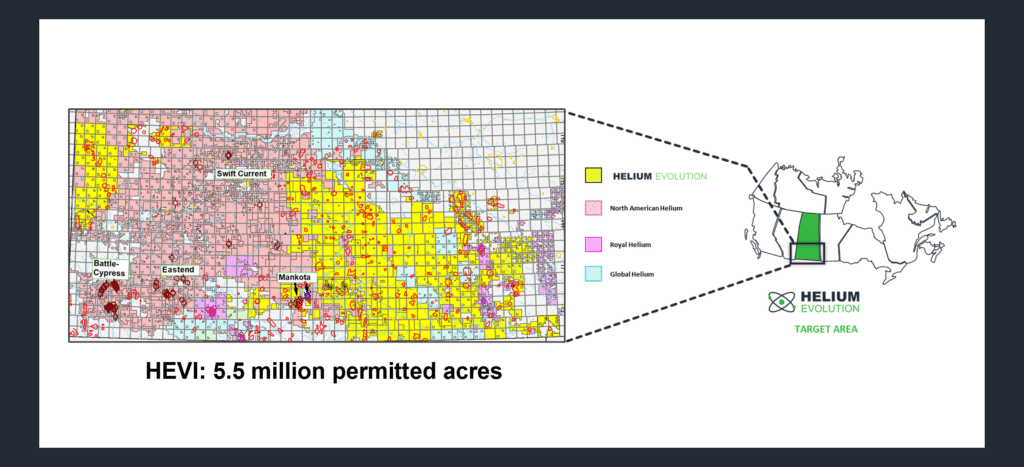

True said Helium Evolution, which currently has 5.5 million acres of permits in land in Southwest Saskatchewan, sports a competitive advantage in the helium industry in the form of an agreement with North American Helium (NAH). Announced in June 2022, the Farmout Agreement will see NAH drill five wells and incur 100 per cent of the drilling expenditures on three predetermined blocks of land. NAH then earns an 80 per cent operating interest in the section of land the well was drilled on, along with nine contiguous sections of land, with Helium Evolution retaining a 20 per cent working interest.

“The Farmout Agreement provides a competitive advantage through sharing knowledge of geological/geophysical data with a preeminent helium producer that HEVI could apply to its own operations. The agreement also provides a runway of near-term catalysts from three remaining Farmout wells and three Seismic Option/Seismic Review wells that can be drilled in the next 12 months,” True wrote.

True said Helium Evolution’s share price has underperformed since it announced its first two operated dry wells and the first unsuccessful Farmout well, while after the second unsuccessful Farmout well, the stock reacted neutrally. The upshot is a stock that has already priced in the negative news flow, according to True.

“We think the company is trading roughly at cash plus land value and believe that any success in the next ten wells that can be drilled over the next 12 months would potentially lead to a re-rate of the stock. This is due to the high-impact nature of helium wells on an NPV15 basis, where a single well plus facility’s NPV15 is ~120 per cent of the company’s current market cap. Additionally, success with NAH could lead to near term cash flows and de-risk HEVI’s land base, which is positive for the stock, in our view,” he said.

With the “Buy” rating, True has started off HEVI with a 12-month target price of C$0.35 per share, which at press time represented a projected return of 133 per cent.