With its Software-as-a-Service platform now hitting its stride and being validated by marquee customers like Apple and Ernst & Young, digital ledger company Boardwalktech Software (Boardwalktech Software Stock Quote, Charts, News, Analysts, Financials TSXV:BWLK) is in the middle of an inflection point, according to Echelon Capital Markets analyst Mike Stevens. In a coverage initiation on Wednesday, Stevens started off BWLK with a “Speculative Buy” rating and C$1.30 per share target price, which at press time represented a projected one-year return of 62.5 per cent.

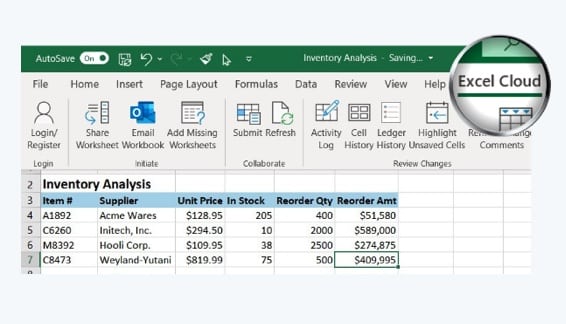

Cupertino, California-based Boardwalktech is an enterprise SaaS provider which has collaborative data management solutions to enhance efficiencies and provide data governance and actionable insights for its customers. The company uses its patented Boardwalk Digital Ledger technology for enterprise workflows, especially those involving Excel spreadsheet applications.

Boardwalktech has seen its revenue drift along from $4.9 million in fiscal 2019 to $4.6 million in 2020 to $4.3 million in 2021 and $4.4 million in 2022, with adjusted EBITDA staying in the negative over those years. (All figures in US dollars except where noted otherwise.)

But Stevens sees better days ahead and is forecasting a full fiscal 2023 (March year end) of $6.6 million in revenue and an adjusted EBITDA loss of $1.5 million. Further down the line, the call is for fiscal 2024 revenue and EBITDA of $9.1 million and negative $620K, respectively, and fiscal 2025 revenue and EBITDA of $12.0 million and positive $845 million, respectively.

That makes for a three-year compound annual growth rate to fiscal 2025 of about 40 per cent for BWLK’s topline. For Stevens, the company’s pivot to a SaaS model starting in calendar 2018 (the year of its public listing) was significant, turning Boardwalktech away from a growth-stifling perpetual license model to now a recurring SaaS business.

On the customer side, Stevens said the company’s innovative technology has received tier one validation by a veritable who’s who of Fortune 500 megacaps.

“With [Boardwalktech’s] clients spanning sectors such as hardware technology, accounting, consumer packaged goods (CPG), clothing retail, semiconductor manufacturing, cosmetics, banking and social media, Boardwalk’s total addressable market (TAM) appears unbounded,” Stevens wrote.

“Further, ever-increasing organizational pressures to prioritize and adhere to environmental, social, and governance (ESG) mandates are providing added tailwinds around supply-chain visibility and traceability, along with the banking sector’s spotlight on data governance. Meanwhile, companies realize that success on these fronts also translates into vast operational improvements,” he said.

Up ahead, Stevens pointed to the company’s stated sales pipeline of $7 million as of its recent fiscal Q3 2023 report released last month, while he said management has spoken of the company moving into two separate $100 million-plus market opportunities over the next 36 to 48 months: in banking and financial services and in supply chain/manufacturing and accounting/tax.

“While we believe these goals are merely loose aspirational targets for Boardwalk, we highlight them to provide context around what the Company believes is reasonably possible with optimal execution and thus, the underlying potential for upside beyond our forecasts – for context, our forecast period exits F2028 with just $22.8 million in total revenues versus Boardwalk’s targeted $200 million-plus,” he said.

Share

Share Tweet

Tweet Share

Share

Comment