There’s a lot on the line over the next few years for Québec-based med tech company OpSens Inc (OpSens Stock Quote, Charts, News, Analysts, Financials TSX:OPS), according to Raymond James analyst Rahul Sarugaser, who provided an update to clients on Tuesday where he reiterated an “Outperform” rating on the stock.

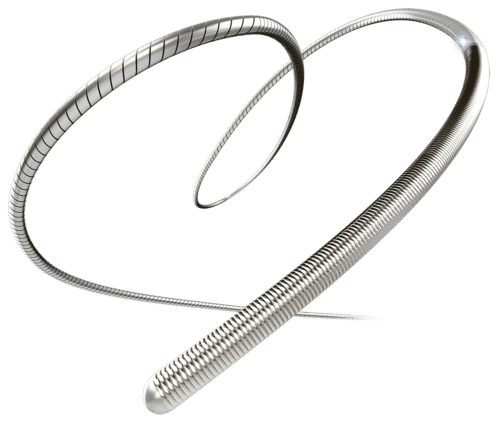

OpSens develops and commercializes cardiology-focused optical devices including the OptoWire, a fibre optic pressure guidewire used in treating coronary artery disease, and the company recently received FDA and Health Canada clearance for the SavvyWire for transcatheter aortic valve replacement (TAVR).

Sarugaser’s report focuses on the TAVR market, which he says is large and has many years left of eight to ten per cent growth. At the same time, Sarugaser said this growth is now at a historically slower pace, while the field remains competitive and there’s a risk of new entrants taking incremental share.

He pointed to Raymond James colleague Jayson Bedford who on Monday downgraded med tech company Edwards Lifesciences (EW) from “Outperform” to “Market Perform,” on concerns over the slowing TAVR market.

For Sarugaser, that makes the next few years more crucial to OpSens as it works to show its value in TAVR, with the analyst asserting that a takeover might be in the cards for OPS.

“With the growing competition in the TAVR market, the big med-tech players will be looking for ways to differentiate their replacement valve product offerings (80 per cent of the market’s value lies in the valves),” Sarugaser wrote.

“Should OPS’ 3-in-1 SavvyWire begin to capture relevant market share from the current workhorse guidewires (ten per cent of market’s value; offered by MDT, BSX, etc.), the larger players may view the acquisition of OPS as an opportunity to create competitive advantage by bundling SavvyWire with their current offerings,” he said.

Sarugaser said in order to position itself within this market dynamic OpSens will need to capture “relevant/significant” market share in the TAVR guidewire space over the next 24 to 36 months.

“Hence, in our view, OPS will need to supercharge its S&M ramp of SavvyWire in order to drive near-term intrinsic (i.e. M&A) value,” he said.

By the numbers, Sarugaser is forecasting OPS to generate full 2023 revenue and EBITDA of $44 million and negative $15 million, respectively, and 2024 revenue and EBITDA of $59 million and negative $12 million, respectively.

With his “Outperform” rating, Sarugaser maintained a 12-month target price of $3.50 per share, representing at the time of publication a projected return of 75 per cent.

Share

Share Tweet

Tweet Share

Share

Comment