Although still fans of the company’s business strategy and tech, Echelon Capital Markets is taking a step back on security and retail analytics name VSBLTY Groupe Technologies (VSBLTY Groupe Technologies Stock Quote, Charts, News, Analysts, Financials CSE:VSBY) on expectations of a slower revenue ramp. Analyst Rob Goff moved VSBLTY from a “Speculative Buy” rating to Echelon’s Watchlist of companies in a Monday update to clients, saying he’ll be looking for key milestones to create more confidence in the name going forward.

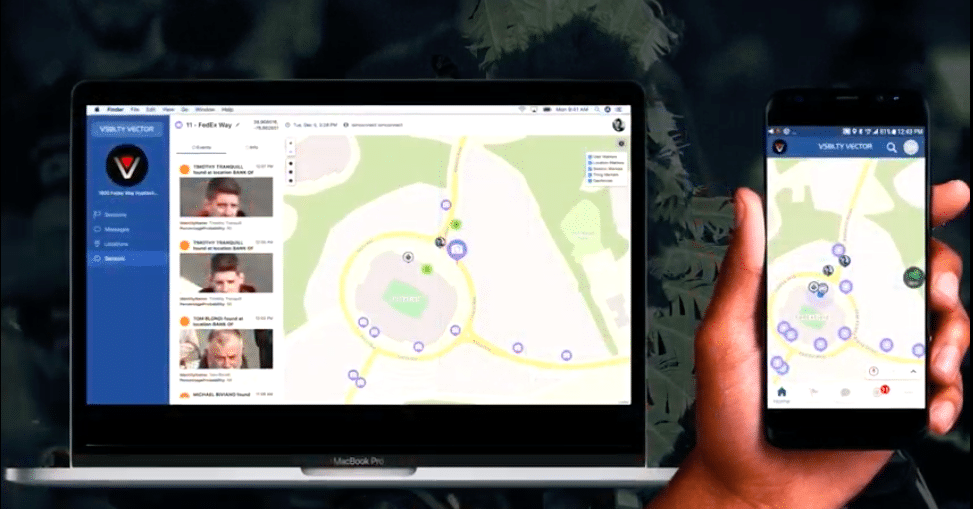

Vancouver-headquartered VSBLTY Groupe has software modules VisionCaptor, a digital signage content management system, DataCaptor, a software module with real-time analytics and audience measurement, and VSBLTY Vector, a facial detection software module.

The company already has strategic partnerships with names like Intel, AB InBev and HCL Technologies. Internationally, VSBLTY announced last year a joint venture with Latin American convenience store media technology company Winkel, while last month, VSBLTY announced a joint venture with a division of Al Jabr Group to bring its security solutions to retail outlets, Oil & Gas and municipalities in five Middle East countries.

For Goff, deployment challenges have been an issue, saying that VSBLTY’s large and powerful partners have “represented both a strength and a weakness,” as project delays and deployment learning curves have surfaced, with the analyst chalking them up to “partnership politics” more than a problem with VSBLTY’s tech.

“The reality of these projects representing only a small fragment of a behemoth partner’s operations versus VSBLTY’s livelihood cannot be ignored. In any event, we are left disappointed with the cadence of both deployment and recognized SaaS/media revenue traction at Winkel’s Latin American 50K-store project, which currently represents the entirety of VSBLTY’s higher-margin revenues,” Goff wrote.

On the sought-after milestones, Goff pointed to scaling up in Winkel’s Latin American store network as a main one, saying that management is expecting Winkel media revenues to push $500,000 in the first quarter 2023 and $1.7 million for the second quarter. That would be a major ramp for VSBLTY, said Goff.

The analyst also said he will be seeking for greater confidence around VSBLTY’s realizing outstanding receivables and payments from both Winkel and RADAR USA of about $2.6 million and $2.0 million, respectively.

“We would gain more conviction around the receivable from Winkel as the JV approaches breakeven, which the Company projects in May 2023, while our confidence in RADAR USA’s payment would be bolstered as the entity secures funding; VSBLTY expects payment in either late Q123 or Q223,” Goff wrote.

Share

Share Tweet

Tweet Share

Share

Comment