Canadian retail software and security stock VSBLTY Groupe Technologies Corp (VSBLTY Groupe Technologies Stock Quote, Charts, News, Analysts, Financials CSE:VSBY) has fallen a long way over the past half-year but Rob Goff of Echelon Capital Markets remains vocal in his support, maintaining a “Speculative Buy” rating and target price of $1.75/share for a projected return of 307 per cent in an update to clients on Friday.

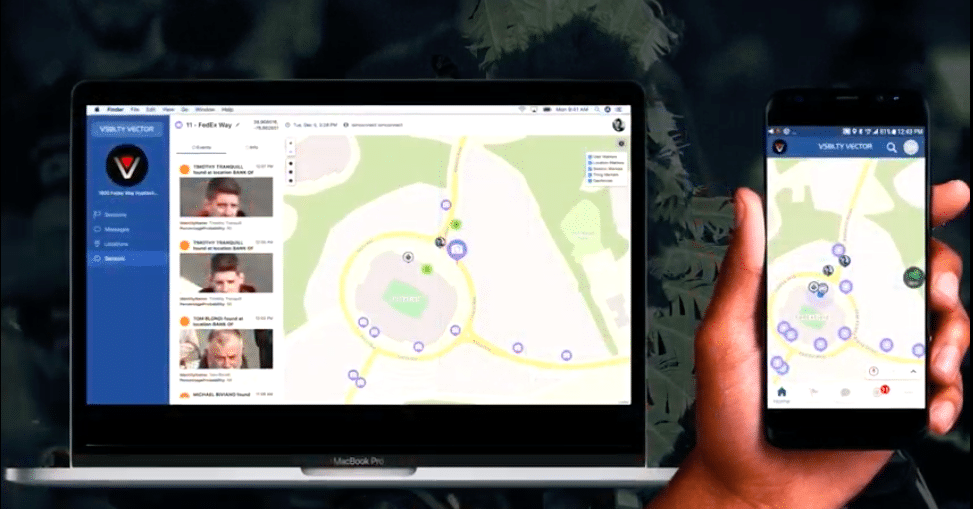

Based in Vancouver, VSBLTY provides software for security and retail analytics technology, including proactive digital displays and place-based media networks with SaaS-based audience measurement and security software that uses artificial intelligence and machine learning.

Goff’s updated analysis comes after VSBLTY announced it had signed an agreement with Wireless Guardian to install security technology funded by a Store-as-a-Medium (SaaM) program, in more than 2,800 Mountain Express Oil (Private) convenience stores and/or truck stops in 19 US states.

“The SaaM program allows retailers to offset the cost to update their security systems using new revenue raised from brand-generated media advertising on cooler doors and screens throughout their stores,” Goff said.

Goff had anticipated a move along these lines following the company’s release of its most recent financial results, noting that the company had expected to announce a North American retail project and store network within the fuel and convenience segment, with Goff being impressed by the timely nature of the announcement.

“The Company has the opportunity to generate revenues in multiple ways within the network, including hardware sales, SaaS licensing fees, and media revenues,” Goff said. “These streams are expected to drive the total contract value, where VSBLTY expects to generate annual gross revenues in the neighbourhood of $30 million once the 2,800 store network is fully deployed.”

According to Goff, VSBLTY expects to initiate a pilot phase deployment of its technology over the next several months before establishing a pace of 500 deployments per quarter, putting the company on pace to potentially fulfill its deployment sometime in 2024; the project is also exclusively a VSBLTY initiative, unlike the joint venture it established with Winkel for its Modelorama project in Latin America.

“We believe the project has the potential to attract significant attention across the broader North American retail space given the infancy of SaaM,” Goff said. “successful execution could represent a strong catalyst for further deals within the category.”

Each deployment among the 2,800 stores is to have two cooler panel displays, along with three 55-inch screens, for a total of five visual displays per store, with Goff estimating the company will bring in between $40 and $50 per screen per month in SaaS/recurring revenues derived from its customer engagement and audience measurement software licenses for VisionCaptor and DataCaptor.

Based on a middle ground estimate of $45 per screen per month, Goff forecasts total SaaS and recurring revenue to be north of $7.5 million once its solutions are fully deployed, paired with anticipated gross margins greater than 60 per cent.

“In partnership with Wireless Guardian, we are delighted to add Mountain Express Oil stores to our ever-growing list of in-store, digital media network customers,” said VSBLTY Co-founder and CEO Jay Hutton in a June 7 press release. “In addition to generating more repeat customers and higher sales, Mountain Express Oil will now benefit from having increased security through new, state-of-the-art technology, funded by a win-win SaaM model.”

Goff is forecasting a vibrant financial future for VSBLTY, as his $8.5 million revenue target for 2022 represents a potential year-over-year increase of 431.3 per cent. Looking ahead to 2023, Goff forecasts another significant jump, with the $23.7 million revenue projection marking a potential year-over-year increase of 178.8 per cent.

In terms of valuation, Goff projects the company’s EV/Revenue multiple to be 8.9x in 2022 before dipping to a projected 3.2x in 2023, which presents a discount to the peer group average projection of 4.5x while significantly outpacing the 13.8x target.

On the margins, Goff forecasts the company’s gross profit to be $3 million in 2022 for an implied margin of 35.3 per cent, which he forecasts to widen to 48.5 per cent in 2023 with gross profit projected at $11.5 million.

Meanwhile, Goff continues to forecast adjusted EBITDA losses for VSBLTY, with projected losses of $7.5 million in 2022 and $2.6 million in 2023.

Despite VSBLTY’s future growth prospects, Goff said he does not want to place undue importance on the company’s relative near-term valuation multiples on account of the company’s relative infancy.

“As VSBLTY executes against its existing deployments and moves closer to profitability, we may have a better opportunity to provide a more relevant comparative valuation analysis,” Goff said.

VSBLTY has seen the value of its stock drop by 64 per cent since the start of 2022, falling gradually after starting the year trading at $1.14/share, dropping to its present low of $0.41/share.

Share

Share Tweet

Tweet Share

Share

Comment