With an attractive valuation, strong organic growth and an acquisitive mindset, Canadian healthcare IT company VitalHub Corp (VitalHub Stock Quote, Charts, News, Analysts, Financials TSX:VHI) merits a “Buy” rating. That’s according to Roth Capital Partners analyst Richard K. Baldry, who initiated coverage on Wednesday, issuing a 12-month target price of $6.00, which at press time represented a projected return of 143 per cent.

Founded in 2012, Toronto-based VitalHub operates as a roll-up strategy, acquiring healthcare IT players in the Canadian, Australian and UK markets. So far, VHI has made over 15 acquisitions.

Baldry said VitalHub’s geographic focus gives it a much less competitive environment in which to work compared to the US market.

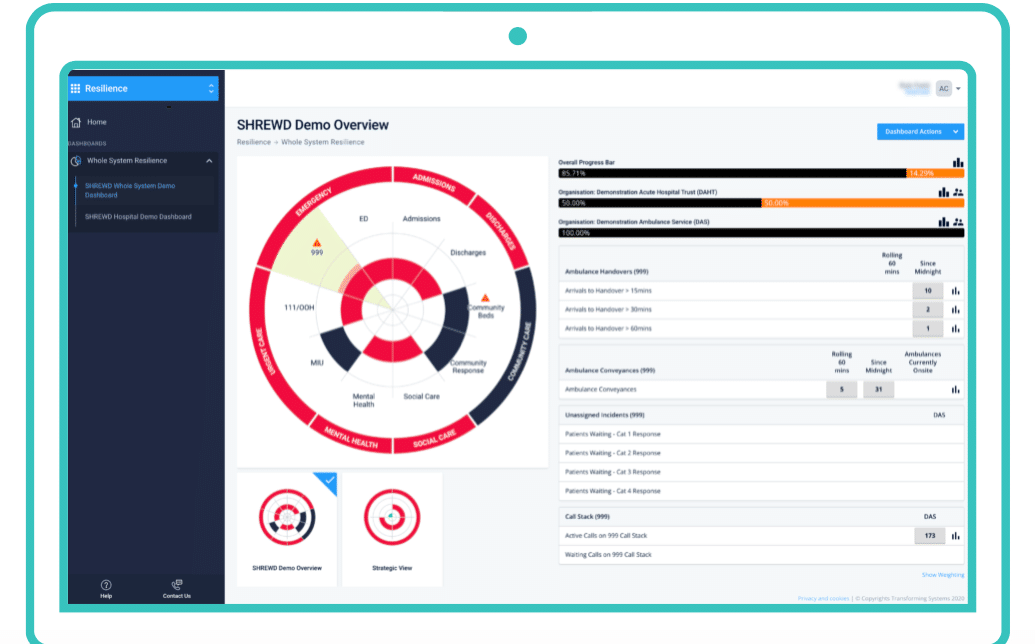

“While VitalHub’s target markets carry their own challenges as they are far more heavily government funded and essentially government operated, we view the benefits of its strategy as outweighing its challenges. With the equivalent of 60,000 hospital beds services by its current installed base, of an estimated 6 million total operated in its addressed geographic markets, VHI appears to be at the early stage of penetration into a large market opportunity (estimated by VHI at $700/bed annually or as much as a $2.1B billion total addressable market),” Baldry wrote.

At the same time, Baldry argued that VitalHub’s organic growth — currently at a trailing 12 months (TTM) rate of 18 per cent — is likely the “most under-valued attribute” to the company.

Baldry said VitalHub will need to show an ability to scale up its top and bottom lines accretively while avoiding a large debt burden, although the company has so far done well at this approach, he said.

“We believe VHI’s strategy to acquire sub-scale Healthcare IT players to create a single well-scaled, profitable and growing Healthcare IT company has merit and has proven successful to date. With a 3Q22 AEBITDA margin of 22 per cent, we believe VHI’s balance of good organic growth (18 per cent TTM) and accretive acquired growth (bolstered by a low-cost, offshore development and service operation) is meaningfully undervalued at current levels,” he said.

Looking ahead, Baldry is expecting VHI to end 2022 with revenue at $39.6 million and EBITDA at $9.8 million. He sees 2023 as generating $45.9 million in revenue and $10.7 million in EBITDA.

On comps, Baldry says VitalHub currently trades at 1.7x run-rate revenues, which is well below the SaaS company average of 4.8x.

“Given VHI has both good organic growth (18 per cent TTM and we assume ten-15 per cent over the next three to five years), its inorganic growth strategy should result in an even faster blended revenue growth rate (likely above 30 per cent annually) and an elevated earnings growth rate as synergies are realized. With adjusted EBITDA also strong versus its peers, coming in at 22 per cent in 3Q22 (we view its SaaS peer group as well-executing if reporting AEBITDA in the double digits while still growing at a 15 per cent pace or better), we believe a sharply higher valuation is well-supported,” Baldry wrote.

Share

Share Tweet

Tweet Share

Share

Comment