Three TSX stocks analysts like in this market

It is always, to one degree or another, a stock picker’s market.

It is always, to one degree or another, a stock picker’s market.

But some are warning that the days of betting on a wide swath of stocks may ending.

“A 10-year ‘secular bear market’ is underway,” Stifel chief equity strategist Barry Bannister wrote recently. “We believe this environment favors the following approach: active (not broad passive) management,” he said.

So what’s an investor to do? Simple. Pick good companies.

At Cantech Letter we highlight three such stocks that analysts recently singled out as good investments.

Beacon Securities analyst Ahmad Shaath said he is staying bullish on good natured Products (good natured Products Stock Quote, Charts, News, Analysts, Financials TSXV:GDNP) in an update to clients on Tuesday. Shaath reiterated a “Buy” rating and $0.70 per share target on GDNP, saying the company is building a solid track record of profitability.

Vancouver-based good natured Products makes and distributes packaging and consumer products primarily made from renewable, plant-based materials, including food packaging, bioplastic rollstock and home & business organizational products.

“Management reiterated that demand for its Packaging products remains strong especially in the key vertical of food packaging,” Shaath wrote. “This should help alleviate the softening in demand from the Industrial segment that the company mentioned with the preliminary results earlier this month. This should also help provide a lift to gross margins, with Q3/FY22 results showcasing the potential improvement in margins as Packaging increases its overall share of the revenue mix,” he said.

At press time, Shaath’s maintained $0.70 per share target price represented a projected 12-month return of 180 per cent.

ATB Capital Markets analyst Martin Toner says Thinkific Labs (Thinkific Labs Stock Quote, Charts, News, Analysts, Financials TSX:THNC) is a company with a competitive advantage and strong international growth potential.

“Relative to other indirectly competitive adjacent solutions, the advantage of a learning platform like Thinkific’s is that it allows Creators to control their pricing and customers. When Creators value controlling the entire process and future- proofing their businesses, Thinkific has a competitive advantage,” Toner wrote.

Toner said management is focusing its path to profitability on increasing gross profit through increased customer traffic, payments penetration and annual revenue per user but also that the company is looking to cut operating expenses, saying that profitability is now a “medium-term” goal.

With this week’s update, Toner maintained an “Outperform” rating on Thinkific Labs and a one-year target price of $6.50 per share, which at the time of publication represented a projected one-year return of 311 per cent.

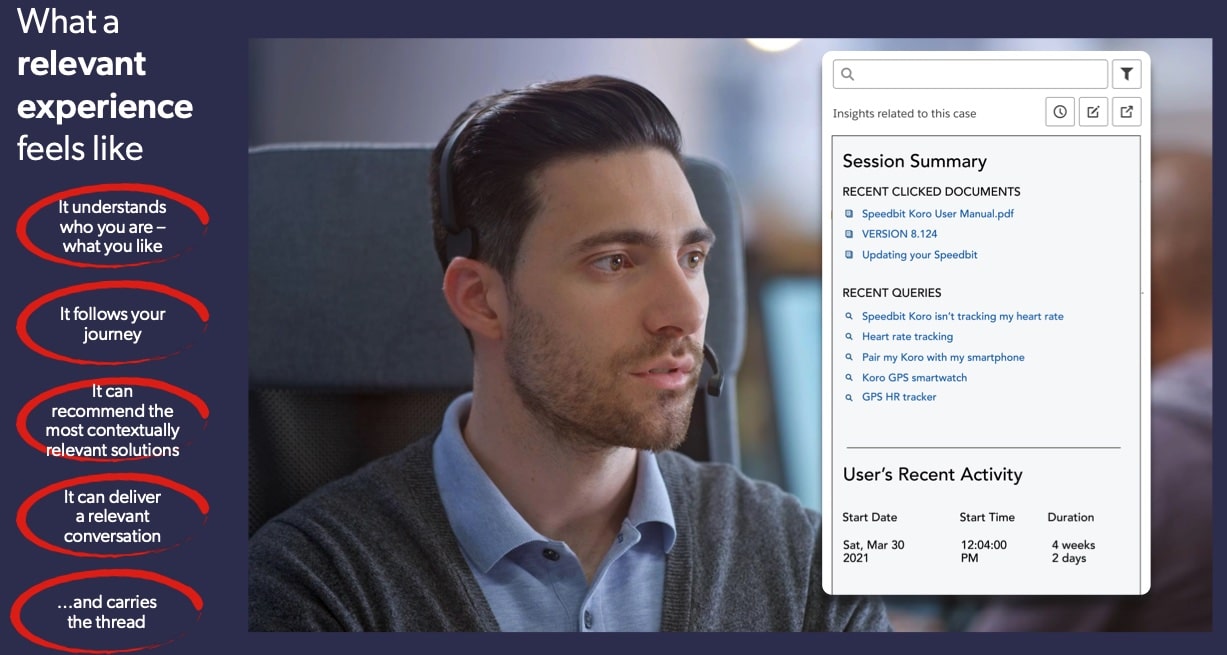

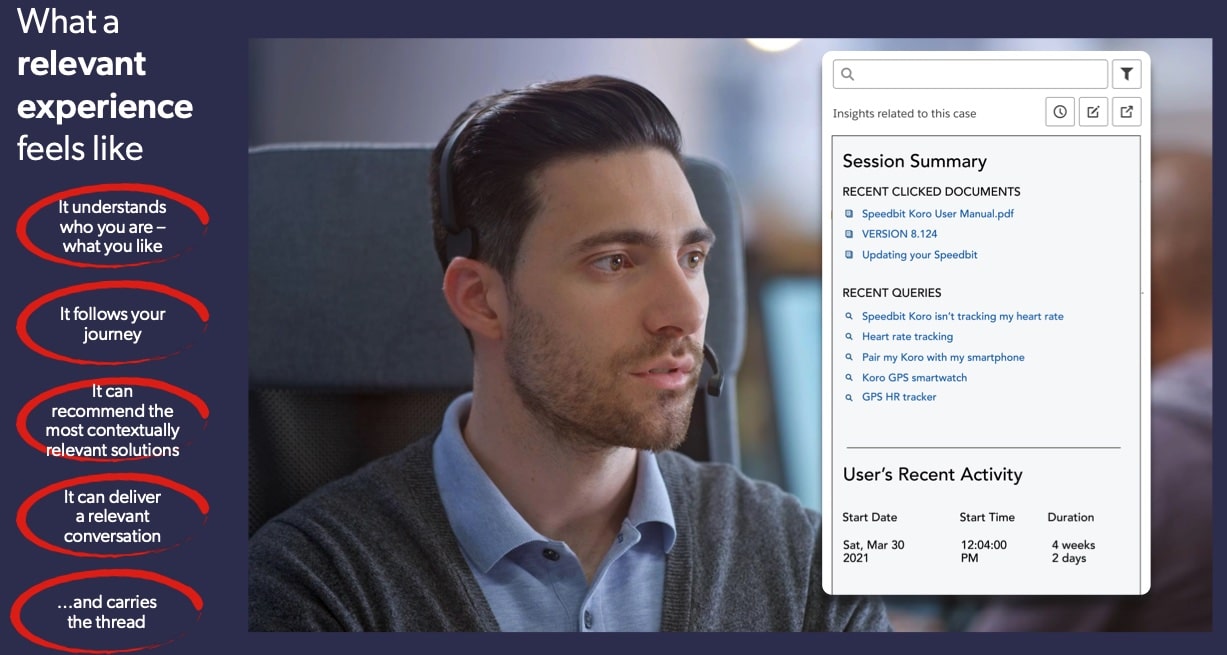

Finally, investors looking for a tech stock that ticks all the boxes should be thinking about Quebec-based artificial intelligence solutions company Coveo Solutions (Coveo Solutions Stock Quote, Charts, News, Analysts, Financials TSX:CVO). That’s the advice from National Bank Financial analyst Richard Tse who reiterated on Thursday an “Outperform” rating on the stock, saying Coveo’s proven technology and multiple avenues for growth are a winning combination.

“We believe Coveo embodies nearly all the attributes we value in growth names from leading (technical) IP corroborated by reputable industry sources, competent (experienced) growth leadership, and product validation (ROI) from a roster of marquee enterprise customers and partners – all defended by high barriers to entry to drive an organic growth rate above 25 per cent,” Tse wrote in a recent report. “And while we recognize valuations for the group have generally been reset across the board for the sector, at 2.7x EV/S, CVO looks compelling,” Tse wrote.

Tse said Coveo appears to have recognized the change in the winds as far as a distaste for tech companies without earnings go, with management now moving to an accelerated path to profitability, driving a 900 bps reduction in adjusted opex in its latest reported quarter, the company’s Q2 fiscal 2023.

Tse is expecting Coveo to generate full fiscal 2023 revenue and adjusted EBITDA of $111.5 million and negative $13.6 million, respectively, and moving to 2024’s revenue and EBITDA of $142.4 million and negative $1.7 million, respectively. (All figures in US dollars except where noted otherwise.)

With his “Outperform” rating, Tse has maintained a 12-month target on CVO of C$11.00 per share, which at the time of publication represented a projected return of 70.5 per cent.

Staff

Writer