Raymond James analyst Rahul Sarugaser likes the new move announced by Opsens (Opsens Stock Quote, Charts, News, Analysts, Financials TSX:OPS) to expand its European market. Sarugaser reported on the latest from Opsens on Thursday, reiterating a “Strong Buy” rating on the stock which has pulled back over the last month.

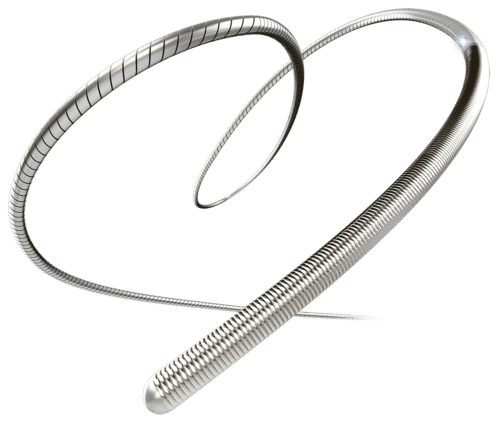

Medical tech company Opsens, which is commercializing a suite of optical devices including the flagship OptoWire fibre optic pressure guidewire for the diagnosis and treatment of coronary artery disease, announced on Wednesday the completion of first cases in a clinical study of its SavvyWire for left ventricular rapid pacing in transcatheter aoritc valve replacement (TAVR) in Europe.

The SavvyWire was recently given FDA clearance and Health Canada approval for commercialization in TAVR, while the new clinical study is meant to help efforts towards getting its CE mark in Europe. The study will in total involve up to nine hospitals and will ultimately enrol 120 patients.

“I am extremely pleased with the performance of the SavvyWire,” said Dr. Regueiro of the Hospital Clínic de Barcelona, who conducted the first procedures as one of the primary investigators of the study, in a press release.

“We successfully used it on three cases today, implanting three different systems, including a Navitor TAVI System from Abbott, an Evolut system from Medtronic, and a SAPIEN 3 valve from Edwards Lifesciences. There is no doubt the SavvyWire allowed us to optimize our efficiency and workflow, while enhancing accuracy and patient safety,” Dr. Regueiro said.

Commenting on the announcement, Sarugaser said Opsens doesn’t require the clinical trial for European marketing approval of the SavvyWire but the company is undertaking the trial to further strengthen its CE mark application and to accumulate more in-human data to drive adoption in the US, Canada and, ultimately, Europe.

“As we calculate it, issuance of a CE mark for SavvyWire would increase SavvyWire’s TAM by >50 per cent (recall, we do not include Europe or ROW in our models until we see imminent clearances in those jurisdictions). And so, we view this relatively rapid progress toward European market penetration—estimating CE mark clearance in late 2023—very positively,” Sarugaser wrote.

With his “Strong Buy” recommendation, Sarugaser has maintained a $6.00 per share target price, which at press time represented a projected one-year return of 160 per cent. Sarugaser thinks Opsens will deliver upcoming fourth quarter revenue of $9 million, making for a full 2022 total of $35 million. EBITDA for the year is expected to be negative $8 million. For 2023, Sarugaser is calling for revenue of $44 million and an EBITDA loss of $9 million.

Share

Share Tweet

Tweet Share

Share

Comment