Sabio is looking attractive, says Paradigm

The path has been a rocky one for the ad tech space recently but there’s substantive value in Canadian name Sabio (Sabio Stock Quote, Charts, News, Analysts, Financials TSXV:SBIO), according to Paradigm Capital analyst Daniel Rosenberg, who provided clients with an update on the advertising technology sector on Wednesday. Rosenberg reiterated a “Buy” rating on SBIO, saying Sabio’s focus on connected TV (CTV) and streaming are right in line with prevailing digital ad trends.

Rosenberg spoke of the evolution in advertising where social media has opened up new channels to reach customers, while the rise of the mobile device has established new platforms and approaches for advertisers. At the same time, Rosenberg said 2022 has brought more than its share of challenges to companies in the space, where budgets for advertising are being tightened amid economic turmoil and recessionary pressures. Public companies have felt the pain, with Ad Tech stocks now down on average 46 per cent year-to-date.

But according to Rosenberg, not only are valuations now more attractive in the space but the sector should be in for a strong end to the year, as the US midterm elections are promising to bring with them big time ad spend. Rosenberg quoted two estimates for 2022’s political ad spending at $9.7 billion and $7.8 billion, respectively, either of which would be double or more the amount ($4.0 billion) spent on the 2018 midterm election and compare well with that spent on the 2020 presidential election at $9.0 billion. (All figures in US dollars except where noted otherwise.)

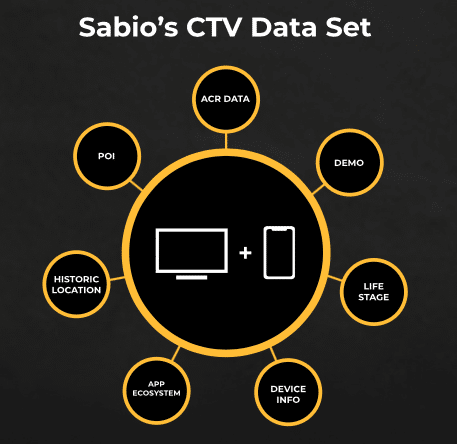

Moreover, Sabio, with its products supporting advertisers in the CTV and over-the-top (OTT) categories and helping them to execute programmatic ad campaigns backed by Sabio’s analytics platform, should do well in the current climate, as CTV is positioned to take in a disproportionate share of ad dollars, according to Rosenberg.

“Within digital advertising, dollars are migrating toward connected TV/streaming (CTV),” Rosenberg wrote. “Several factors are contributing to the shift. First, the decline of linear cable TV subscribers with cord shavers and cord cutters has resulted in viewers shifting their gaze toward streaming platforms. Ad dollars are following suit. At the same time, restrictive privacy changes from Apple (which continue to roll out in every update, see its most recent iOS 16 update) have decreased the effectiveness of application-based distribution channels.”

Specifically referencing the mid-terms, Rosenberg quoted Kantor/CMAG, an advertising expenditure monitoring company, which has predicted CTV and streaming will get $1.2 billion of a projected $7.8 billion in political advertising this year, while eMarketer is estimating $1.5 billion in political spending to flow through CTV and streaming devices.

Rosenberg said Sabio is particularly well positioned to take advantage of the current trends.

“[Sabio] is one of the only publicly listed companies with substantial exposure to the CTV market, with CTV revenue representing about 44 per cent of total revenue and growing. We think the strength of CTV trends should overshadow any general slowdown in ad spending,” he wrote.

“In Q2, management indicated that it expects to continue to capture market share and deliver strong organic revenue growth for the balance of 2022 on the back of a strong sales pipeline. Recall in Q2 Sabio delivered a 70 per cent increase in revenue and a 106 per cent increase in CTV revenue, while many AdTech peers reported challenging results in the same Q2 period,” Rosenberg said.

Sabio reported its second quarter in late August, coming in with revenue of $7.2 million compared to $4.2 million a year earlier and an adjusted EBITDA loss of $1.4 compared to breakeven a year earlier. The company said its average deal size increased by 48 per cent year-over-year, with larger CTV campaigns featuring prominently.

Rosenberg said with its growth investments largely complete, positive adjusted EBITDA should come by the fourth quarter this year with further improvement into 2023.

“We find it notable for an AdTech company of Sabio’s size to attract marketing dollars from enterprise-grade customers and do so while maintaining relatively attractive profitability levels — something we have only seen at peers with much greater scale. We believe it speaks to the value and differentiation of its CTV offering and data analytics capabilities,” he said.

From the Canadian perspective, Rosenberg said valuations in the Ad Tech space appear to be stabilizing and bouncing off lows after a period of contraction. The analyst has Sabio to be trading at 1.8x 2022 EV/Revenue compared to its peer group average at 4.4x and at 1.4x for 2023 estimates compared to its peers at 3.6x. That’s an attractive valuation, Rosenberg said.

“We think there’s substantial room for the gap to narrow given Sabio’s leading growth rates, integrated tech stack and differentiated offering,” he said.

With his Buy rating, Rosenberg has reiterated a C$3.00 target price on SBIO, which at the time of publication represented a projected one-year return of 233 per cent.

Disclosure: Sabio is an annual sponsor of Cantech Letter.