NowVertical has a 122 per cent upside, says Echelon

Echelon Capital Markets analyst Rob Goff is calling big data company NowVertical Group (NowVertical Group Stock Quote, Charts, News, Analysts, Financials TSXV:NOW) a compelling investment opportunity with lots of room for organic and inorganic growth. Goff reviewed the company’s latest news in a recent report to clients where he reiterated a “Speculative Buy” rating and C$1.60 per share target price, which at the time of publication represented a projected one-year return of 122 per cent.

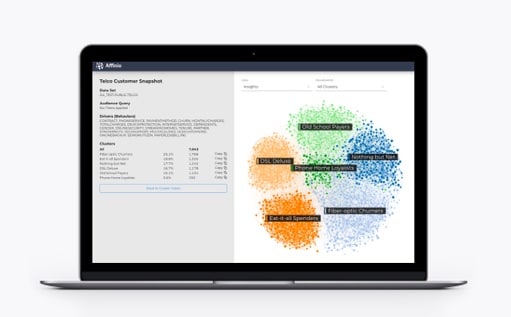

NowVertical, which has a suite of products for vertical-specific intelligence and analytics for enterprise customers. The company has three business segments in NOW Origins for the core technology software stack, NOW Solutions for vertical-specific analytics and Affinio for marketing analytics in the Snowflake data cloud environment.

Last week, NowVertical gave an update on its operations in Latin America, featuring a new contract with a large-scale retail and manufacturing provider in Mexico. The company also said it has added new customer contracts in a number of sectors such as financial services, retail, pharma and healthcare. NowVertical has hired 50 new personnel to support its expanding LATAM operations through CoreBI, its solutions provider for the region.

“The Big Data analytics market is growing incredibly fast, and we are keeping pace with entry into new regions; Mexico currently represents more than a quarter of LATAM’s demand for Big Data and Analytics services and provides a great opportunity for us,” said Daren Trousdell, Chairman and CEO of NOW, in a September 14 press release.

“We are very excited with the progress we are making in establishing a solid global presence, which is highlighted by our ability to attract some of the biggest and most respected brands operating today,” he said.

Commenting on the news, Goff said CoreBI’s growth is a strong case study of NOW’s ability to acquire high-growth assets and invest in said asset to unlock additional upside.

“We await the repetition of this accretive technique with additional existing business units and future acquisitions. Strong organic growth and the ability to make accretive acquisitions with cross selling are cornerstones of our positive revaluation thesis where we look for an [Enterprise Value] of $100 million+. We note the technique of copy/paste/accrete, repeat has historically served Converge Technology Solutions well to reach scale where its size could be leveraged across the global mid-market,” Goff wrote in his September 16 report.

Goff said NowVertical looks poised to hit that $100 million revenue run rate within six to nine months, with positive EBITDA potentially coming as early as the fourth quarter 2022.

The company reported its Q2 2022 last month, where pro forma adjusted revenue was $7.9 million, up 862 per cent from a year earlier, and adjusted EBITDA was negative $0.6 million compared to negative $0.2 million a year earlier. Over the quarter, NOW had acquired US-based guided solutions analytics firm Resonant Analytics, while the company also launched its NOW Affinio platform. NowVertical ended the quarter with cash and equivalents of $6 million.

Commenting on NOW’s M&A prospects, Goff said the company’s current pipeline of Letters-of-Intent is likely to need about $12-14 million, which is likely to be financed with a combination of debt and a modest equity raise.

Goff said complex data intelligence solutions are a high-growth, high-margin area for investors.

“We view NOW as a compelling investment opportunity where a baseline organic growth rate of 20 per cent+ contributes to an ~$40 million run rate exiting 2022. Beyond organic growth, we look for the successful completion of strategic, accretive acquisitions from its pipeline to support a target run rate of $100 million exiting 2023,” he wrote.

Goff said NOW’s brand of mid-market-focused fusion analytics has larger companies like Palantir and C3.ai as its ambassadors and the field has already been endorsed by marquee clients like General Motors, the US Department of Defense and Netflix.

On his estimates for NowVertical, Goff is calling for full 2022 revenue of $30.2 million, good for an 847 per cent growth rate, and adjusted EBITDA of $1.7 million. For 2023, he is forecasting $59.5 million in revenue and $2.8 million in adjusted EBITDA.

On valuation, Goff estimates NOW’s EV/Revenue as 20.4x in 2021, 2.8x for 2022 and 0.8x for 2023, while the EV/EBITDA multiple is estimates at 16.5x for 2023.

“With demonstrated organic and inorganic growth, advancing scale and profitability, we look for an aggressive revaluation of the shares. We believe the prospective returns linked to a scale-driven revaluation of its shares represent a strong return profile against the associated execution risks where NOW’s track record and synergies warrant confidence that it will be successful,” Goff said.