Dialogue Health is heading to $7.50, says Desjardins

Desjardins Capital Markets analyst Jerome Dubreuil is staying bullish on Canadian digital healthcare stock Dialogue Health Technologies (Dialogue Health Technologies Stock Quote, Charts, News, Analysts, Financials TSX:CARE), saying in a Tuesday report that the recent loss of a major customer is not as serious as it sounds.

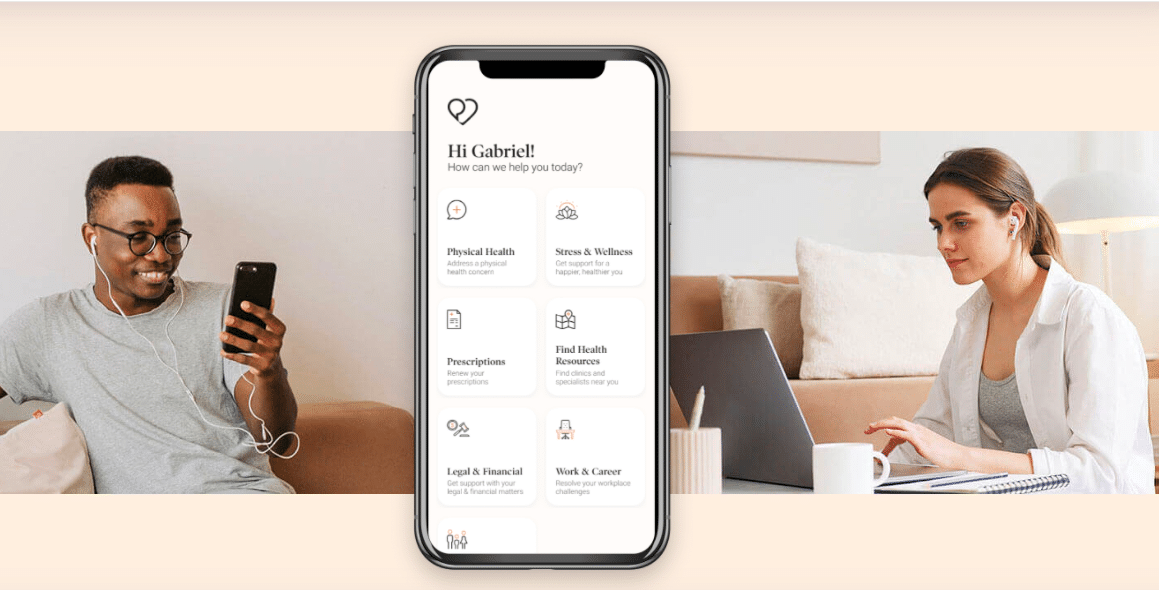

Dialogue, which offers a health and wellness platform as a one-stop, 24-hr employee and family access portal for virtual healthcare, provided a business update on Tuesday after market close. Dialogue said that Optima Global Health — a Canadian provider of Employee Assistance Programs (EAPs), vocational rehab and disability management services, in October, 2020 — recently lost one of its largest customers. Dialogue said the customer chose to not renew its agreement, which had represented about $4.6 million in annual business for CARE.

“While disappointed to lose a customer, we stand by our strategy to focus on higher margin, tech-enabled services that deliver superior outcomes,” said CFO Navaid Mansuri in a press release. “The churn at Optima represents lower margin revenue that varies based on utilization and that we expect to replace with more stable recurring revenue on our Integrated Health Platform.”

“When combined with operating expense savings, we anticipate that the impact on adjusted EBITDA will be limited. The net result will be a higher gross margin profile for our business. We remain committed to breakeven EBITDA by the end of 2023, and are well-capitalized to achieve our growth and profitability objectives,” he said.

With the update, Dialogue said it recently added over $5.2 million in new annual recurring revenue, and management provided third quarter guidance, saying total revenue should be between $23.2 and $23.5 million, gross profit margin should be 49.0-50.0 per cent and adjusted EBITDA should be between negative $4.7 and negative $4.5 million.

Reviewing the business update, Dubreuil called the Desjardins takeaway on it “mixed.” On the one hand, he noted the customer revenue was not insignificant at about $4.6 million compared to Dialogue’s current EAP revenue run rate at $27 million, but at the same time the customer was being served at a lower margin through Optima’s legacy EAP and thus not in keeping with Dialogue’s higher margin outlook.

“We do not believe this decision by the client and CARE is due to any recent change in the competitive landscape but rather to the client’s preference for the legacy, lower-margin model, which is not consistent with CARE’s strategy. We see minimal risk of additional significant churn at Optima over the next several quarters,” Dubreuil wrote.

“It is disappointing to see CARE lose a customer but the lower margins generated in legacy EAP and the savings this generates should limit the EBITDA impact. Importantly, management recommitted to attaining breakeven adjusted EBITDA by the end of 2023,” he said.

Dubreuil also noted Dialogue’s announcement that its Mental Health service and EAP are now available through Canada Life’s Consult+ app throughout all of Canada for plan sponsors. The analyst said the expansion is a positive for CARE as it further validates its recent offerings and should support further revenue growth.

On the offered guidance, Dubreuil noted that the revenue line at $23.2-$23.5 million is lower than the consensus estimate, while the anticipated gross profit margin and adjusted EBITDA were broadly in line with expectations.

Dialogue last reported its quarterly financials in mid-August where its second quarter revenue increased by 38.3 per cent year-over-year to $23.0 million and the company increased its plan members to 2.4 million, up 65.1 per cent year-over-year. Gross margin went from 41.5 per cent a year ago to 49.7 per cent and the adjusted EBITDA loss was $4.8 million compared to a loss of $5.7 million a year ago.

Dialogue, which IPO’d in March of 2021, has lost a ton of ground since its debut, going from a high of $19.49 in April of last year to now between $2 and $4 per share. Dubreuil sees lots of upside from here, however, and with his update has reiterated a “Buy” rating on the stock with an “Above-average” risk rating and $7.50 target price. At press time, his target represented a projected one-year return of 160 per cent.

Subsequent to Dialogue’s second quarter, the company reported that Sun Life had added CARE’s Mental Health service to its Lumino Health Virtual Care platform, giving clients of Dialogue’s largest insurance partner access to Dialogue’s full suite of services including Primary Care, EAP and iCBT.

“Every day, we hear from customers and members who appreciate the responsiveness, convenience, and effectiveness of our modern approach,” said Dialogue CEO Cherif Habib in the September 20 press release.

“Our ability to consult with patients within 24 hours, compared to several weeks for legacy EAPs, as well as our commitment to provide strong continuity of care, have reduced employee leaves of absence in a meaningful way and generated a clear return on investment for customers. Demand for our modern EAP is robust and our pipeline for that service continues to grow,” he said.

Staff

Writer