Neo Performance Materials is undervalued, says Paradigm

Off by about half from its late-2021 highs, J. Marvin Wolff of Paradigm Capital Markets likes what he sees from Neo Performance Materials (Neo Performance Materials Inc. Stock Quote, Chart, News, Analysts, Financials TSX:NEO), maintaining a “Buy” rating and C$31/share target price for a projected return of 162 per cent in a recent update to clients.

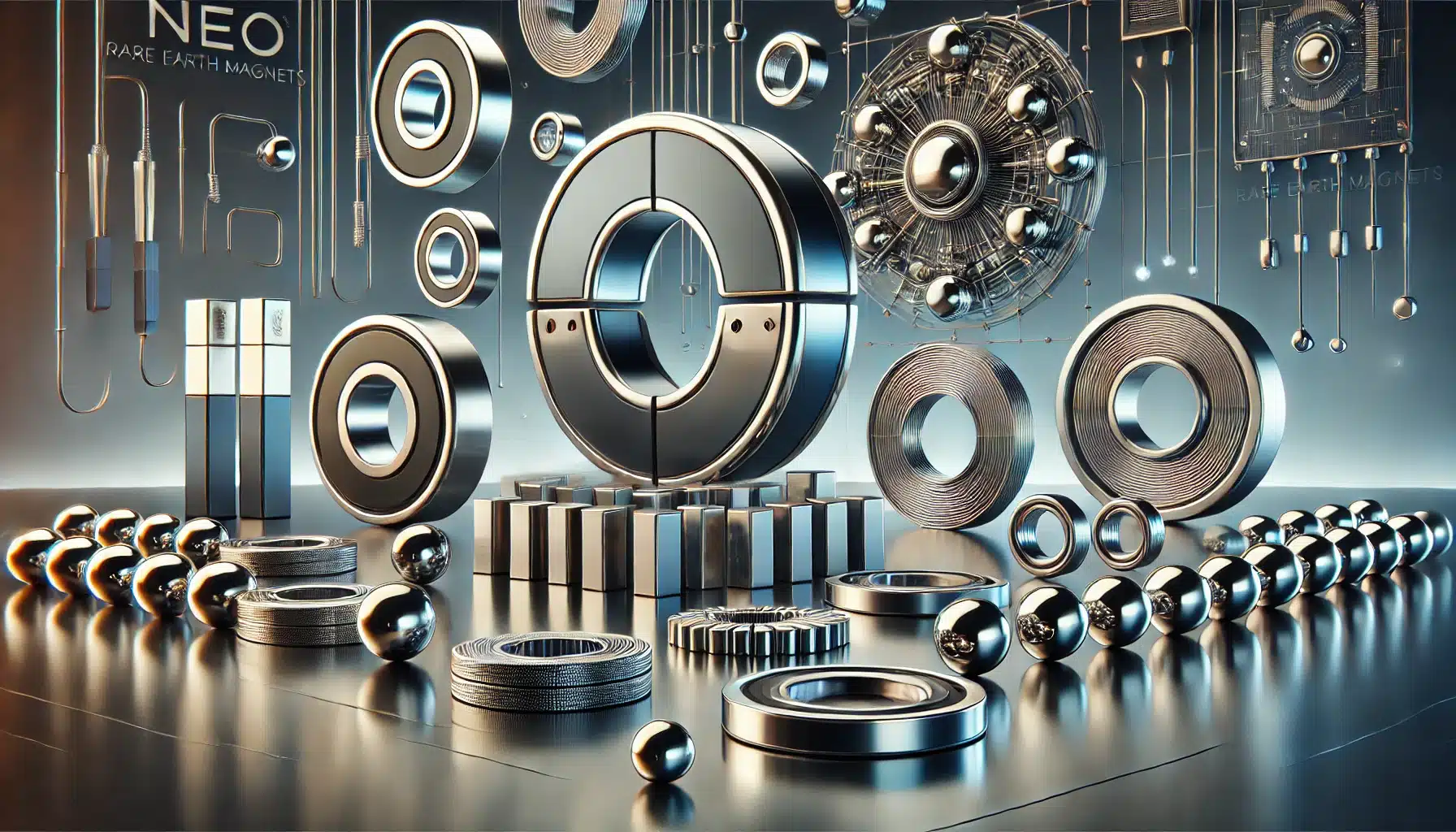

Toronto-based Neo Performance Materials manufactures and sells rare earth, magnetic powders, magnets and rare metal-based functional materials in Canada and internationally.

Wolff’s latest review serves as a follow-up to recent meetings Neo conducted with Paradigm clients, which further solidified Wolff’s view that the stock is undervalued.

“While NEO has been a profitable but quiet stock, we believe the growth trajectory warrants our valuation,” Wolff said in his June 23 report. “In our view, the shares are undervalued and current stock market conditions provide for a rewarding entry point.”

In particular, Wolff cites the company’s transition from being an operator of its Silmet plant in Estonia to producing traction motor magnets as reason for optimism, particularly in light of the European Union’s goal to have a significant proportion of EV auto parts sourced outside of China by 2025, with a number of EV OEMs aiming to have half of its e-axle components sourced in Europe in the same timeframe.

A key feature of Neo’s potential is the two-phase plant transition plan; the first phase will consist of a minimum of 1,200 tpa of sintered magnets, which are are produced by taking magnetic NdFeB rare earth powders and applying heat to just below the melting point while exposed to a magnetic field and then cooled, for EV traction motors. Phase 1 comes at a capex of $50 million (all figures outside of share prices are in US dollars), with an aim toward having shovels in the ground this winter, and producing the magnets by 2024.

Meanwhile, the second phase is projected to be a significant step up, as production is to ramp up to a minimum of 5,000 tpa of sintered magnets, accompanied by capex of $150 million. According to Wolff, the plan is to break ground in late 2023 and be producing magnets by 2025.

“In general, the North American auto industry (with the exception of Tesla) is about 2–3 years behind the EV curve,” Wolff said. “As North American OEMs rush to build EV capacity, we fully expect opportunities not dissimilar to Europe will develop.”

Wolff forecasts progression in the company’s revenue in 2022 at a projected $628.4 million (16.5 per cent year-over-year increase), though he then forecasts a 19.7 per cent drop to $505 million in revenue for 2023. (All figures in US dollars except where noted otherwise.)

Wolff also believes the pivot could generate potential EBITDA of between $75 million and $80 million per year without any additional growth; at present, Wolff forecasts $108.6 million in EBITDA and a 3.1x EV/EBITDA multiple for 2022, with shifts to $85.3 million and a 3.9x EV/EBITDA multiple in place for 2023, with the multiples already providing a significant discount to the peer group averages of 8.8x in 2022 and 8x in 2023.

Neo Performance Materials has seen its share price drop by about 37 per cent in the first half of 2022, consistently falling off after starting the year trading at C$19.84/share, and dropping as low as C$10.64/share on May 12.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter